Leavitt’s Shocking Allegations Against Pelosi: A Closer Look at Stock Trading Scandal

In a stunning revelation on Fox News, Republican strategist and commentator Karoline Leavitt raised serious concerns about House Speaker Nancy Pelosi’s financial dealings, alleging that her personal wealth has grown at an extraordinary rate, far beyond the scope of her public service salary. Leavitt’s comments come as part of a larger conversation about stock trading bans for members of Congress, a topic that has gained significant attention in recent months due to the controversial trading activities of lawmakers, particularly Pelosi.

Leavitt, who has been an outspoken critic of the current political establishment, made the connection between the push for a ban on stock trading for Congress and Pelosi’s impressive—yet highly questionable—investment success. According to Leavitt, Pelosi’s stock portfolio experienced a jaw-dropping 70% growth in 2024, a year in which it reportedly outperformed major hedge funds and even doubled the returns of famed investor Warren Buffett’s Berkshire Hathaway. This sharp increase in wealth, despite Pelosi’s official salary of $174,000 per year, has led many to question whether the Speaker’s financial success is a result of insider knowledge and influence, or simple luck.

Pelosi’s Portfolio: The Numbers That Don’t Add Up

The numbers surrounding Pelosi’s stock portfolio are certainly eye-catching. In 2024, her portfolio reportedly saw an astonishing 70% increase, a figure that far outpaces the returns of some of the most successful investors in the world. According to Leavitt, this growth in Pelosi’s assets has raised alarms, especially when comparing her returns to the performance of large hedge funds and investment giants like Warren Buffett.

“The President does not want to see people like Pelosi enriching themselves while they are in public service,” Leavitt said, referencing the President’s recent remarks on the issue of stock trading bans for members of Congress. Leavitt’s accusations are not just about Pelosi’s financial success, but also about the implications of such wealth accumulation while serving in a role meant to represent the interests of the American people.

For years, Pelosi’s investments have been a subject of scrutiny. Critics argue that the Speaker’s ability to consistently make highly profitable investments, particularly in tech stocks, raises questions about whether she is using her position to gain financial advantages through insider information. While there is no definitive evidence proving any wrongdoing, the timing and magnitude of Pelosi’s investment successes have certainly fueled suspicions.

The Stock Trading Ban Debate: A National Concern

The debate over banning stock trading for members of Congress has been a hot-button issue for some time. Leavitt’s comments echo those of many who believe that lawmakers should not be allowed to trade stocks while in office, especially considering the potential for conflicts of interest. The argument is simple: if lawmakers are able to influence policies that affect the stock market, they should not be allowed to benefit financially from that knowledge.

Pelosi, as one of the most powerful figures in Congress, has long been under scrutiny for her stock trades. Critics claim that her financial success, particularly in the tech sector, raises questions about her access to information that the general public does not have. In light of these concerns, many lawmakers, including President Biden, have voiced support for a ban on stock trading for members of Congress. Biden, who has spoken publicly about the need for greater transparency and accountability in government, has expressed his support for measures that would ensure public servants cannot enrich themselves through insider knowledge.

Leavitt’s remarks about Pelosi come at a time when the discussion about stock trading bans is gaining momentum. With several lawmakers, including Senator Josh Hawley, calling for increased restrictions on congressional stock trading, the issue is likely to continue to make headlines in the coming months.

Pelosi’s Defense: What She Says About Her Investments

Pelosi, of course, has not remained silent on the issue of her stock portfolio. Over the years, she has defended her financial dealings, insisting that she and her husband make their investment decisions based on publicly available information, not insider knowledge. Despite these claims, Pelosi’s opponents have continued to question the timing of her trades, particularly in high-growth sectors like technology.

In interviews and public statements, Pelosi has stated that her investments are handled by her husband, Paul Pelosi, and that she has no involvement in the day-to-day management of their portfolio. However, this defense has not satisfied her critics, who argue that the Speaker’s position of power gives her an undeniable advantage in making decisions that could impact the market.

While there is no concrete evidence linking Pelosi’s stock trades to insider information, the sheer success of her investments, particularly during her time as Speaker, has continued to raise eyebrows. The 70% growth in her portfolio in 2024 is just the latest example of how her financial success has far outpaced that of many other public servants.

The Larger Issue: A System That Rewards the Well-Connected

Leavitt’s criticism of Pelosi’s stock trading practices ties into a broader concern about the financial advantages that public servants, particularly those in high-ranking positions, can gain through their access to information and political influence. The issue of stock trading bans for Congress is not just about Pelosi; it’s about the entire system that allows those in power to use their positions for personal gain.

In recent years, there have been increasing calls for greater transparency in government, particularly when it comes to the financial dealings of elected officials. As Leavitt points out, it is not just about the wealth of individuals like Pelosi, but about the larger system that enables politicians to amass wealth while in office. “We need to have a system that prevents people from enriching themselves while they’re supposed to be working for the American people,” Leavitt stated.

The conversation about stock trading bans for Congress is one that is not likely to go away anytime soon. As more people become aware of the potential for conflicts of interest and the vast wealth accumulation of certain lawmakers, there is growing pressure for reform.

The Role of the Media: How the Narrative is Shaped

The media’s handling of Pelosi’s financial dealings has also been a topic of discussion. While some outlets have given her a pass on the issue, others have raised concerns about the potential for corruption. Leavitt’s comments reflect a broader frustration with the mainstream media’s reluctance to investigate the financial dealings of powerful political figures, particularly those on the left.

In her criticism, Leavitt pointed out how the media often pushes a particular narrative, depending on the political affiliation of the figure involved. While some outlets are quick to scrutinize conservative figures for their financial dealings, others tend to downplay or ignore similar concerns when it comes to liberal politicians like Pelosi. This selective reporting, according to Leavitt, only further fuels distrust in the media and in government institutions.

Conclusion: The Need for Accountability in Congress

Karoline Leavitt’s remarks about Nancy Pelosi’s stock trading activities and the broader issue of financial accountability in Congress serve as a reminder of the need for transparency and reform in American politics. While Pelosi has defended her financial dealings, the growing scrutiny surrounding her investments highlights the need for stricter rules to prevent public officials from exploiting their positions for personal gain.

As the debate over stock trading bans for Congress continues, it is clear that the American people are increasingly demanding greater accountability from their elected officials. Whether or not the current administration, or future lawmakers, will take action to address these concerns remains to be seen. But one thing is certain: the issue of financial transparency in government is not going away anytime soon, and as more revelations come to light, the pressure for reform will only grow stronger.

News

“‘Nice Try, But No Chance,’ Kaitlan Collins TRIES to Corner Tulsi Gabbard on Live TV — But Her Question BACKFIRES, Leaving Viewers Stunned!” In a jaw-dropping moment on The Lead, CNN’s Kaitlan Collins tried to trap Tulsi Gabbard with a tough question about her involvement in the release of classified documents. But Gabbard, now more aligned with conservative views, expertly flipped the script, leaving Collins flustered and unable to recover. The stunning back-and-forth quickly went viral, with viewers watching in disbelief as Gabbard dominated the exchange. Watch the explosive moment unfold below 👇👇 Hỏi ChatGPT

CNN Reporter Humiliated as Question Backfires in Front of Tulsi Gabbard In a moment that left many viewers in disbelief,…

“SHOCKING BACKLASH: CNN’s Erin Burnett Faces FIRED After On-Air Lying Exposed in Controversial New York City Shooting Broadcast!”

Will CNN Host Be Fired After Outrage Over Her On-Air Lying Explodes? In a shocking incident that has ignited widespread…

“‘This is Why They Hate You’: Bill Maher Shuts Down Al Gore Live on TV, Leaving the Studio in Stunned Silence!” In an unforgettable moment on live TV, Bill Maher didn’t hold back as he confronted Al Gore with a brutal remark: “This is why they hate you.” Maher’s sharp words left the studio in complete silence, as Gore was caught off guard and visibly taken aback. The tension in the room was palpable as Maher put Gore firmly in his place. Watch the shocking exchange below 👇👇

Bill Maher Stuns the ‘Real Time’ Crowd by Putting Al Gore in His Place In a recent episode of Real…

“‘That Sounds Like a Mistake’: Bill Maher Left Stunned by Whitney Cummings’ Brutal Honesty About Her Personal Transformation!”

Whitney Cummings’ Brutal Honesty on Being an Ex-Liberal Stuns Bill Maher: A Journey Toward Conservatism In a moment that left…

“FINAL CONVERSATION REVEALED: ‘I Can’t See You, We’re Going Down…’: Black Hawk Pilot’s Last Words to Instructor Seconds Before Crashing into American Airlines Plane, Killing 67”

Family members broke down in tears as they learned more about the tragedy during a congressional hearing on Thursday Two…

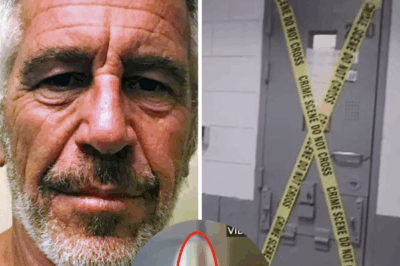

“SHOCKING DISCOVERY: CCTV Captures Mysterious Orange Figure Near Epstein’s Cell the Night Before His Death – Police Video Expert Drops Bombshell Theory!”

Forensic experts disagree with the official government explanation for the figure Mystery orange figure is seen near Epstein’s cell…

End of content

No more pages to load