Fox News Repositions Itself as a Broadcast-Scale Player in the Streaming Era

For years, the battles in American media have been familiar: Pepsi vs. Coke, Verizon vs. T-Mobile, and Fox News vs. CNN and MSNBC.

Lately, however, Fox Corporation is trying to move its high-profile cable news channel onto a different playing field.

Executives at Fox are pitching top media buying agencies with a bold claim: in the era of streaming, Fox News Channel offers the kind of large, live audiences that advertisers used to find on CBS, NBC, and ABC—viewership that’s no longer guaranteed now that audiences watch on-demand. The pitch is being made in the run-up to the “upfronts,” when U.S. TV networks sell most of their ad inventory for the upcoming programming season. Unlike last year, Fox doesn’t have a Super Bowl broadcast to anchor its offerings, and like other media companies, it faces uncertainty amid ongoing trade tensions under the Trump administration.

“Fox News rates are lower than prime-time broadcast, but we deliver the same scale, the same reach, and a high overlap with those audiences,” said Trey Gargano, EVP of Advertising Sales at Fox News, in a recent interview. “I don’t think there’s anything else like it in the market.”

“Fox News rates are lower than prime-time broadcast, but we deliver the same scale, the same reach, and a high overlap with those audiences,” said Trey Gargano, EVP of Advertising Sales at Fox News, in a recent interview. “I don’t think there’s anything else like it in the market.”

The strategy comes as advertisers are taking a fresh look at news programming. Historically, the news genre hasn’t always appealed to big brands—especially given its potential to polarize viewers. Instead, the space has typically been dominated by pharmaceutical, automotive, and financial service advertisers, while large consumer goods companies have stayed away.

But that may be changing. “There’s definitely a more nuanced approach today,” said Suzanne Irving, President of Integrated Investment & Client Solutions at media agency OMD. “It used to be a hard rule—just avoid news. Now, advertisers are more willing to explore.”

As audiences migrate to streaming, live news is gaining value for marketers who want to reach viewers in real time. NBCUniversal, for example, has presented data showing news viewers are more likely to make purchases. Many news outlets are embracing programmatic ad sales to help advertisers avoid content that could be seen as controversial. CNN is expected to highlight upcoming digital initiatives, while MSNBC may showcase a reshaped schedule featuring figures like former Biden White House advisor Jen Psaki.

Yet Fox News stands out with a significant post-election ratings boost. In the first quarter of 2024, Fox News’ total day viewership rose 48%, with a 58% jump among the key 25–54 demographic, according to Nielsen. Meanwhile, broadcast networks are trying to attract younger viewers (ages 18–49) by positioning their news content as less divisive than cable offerings.

Wall Street is taking notice. “Fox News is capturing a historically high share of cable news ratings, has added over 100 new blue-chip advertisers, and appears to be permanently gaining market share from general entertainment cable channels,” wrote Alan Gould of Loop Capital in a recent research note.

This kind of pitch isn’t new. Fox has previously framed Greg Gutfeld’s late-night show as a rival to network stars like Jimmy Fallon and Stephen Colbert, and positioned Harris Faulkner’s afternoon segments against shows like The View.

Now, Fox is going broader. CEO Lachlan Murdoch recently referred to Fox News Channel as a “fifth broadcast network.” The network has likened its top-rated roundtable show The Five to American Idol, Survivor, or The Neighborhood. Bret Baier’s Special Report has at times outperformed CBS Evening News in select markets, and America’s Newsroom is being compared to mid-morning broadcast staples.

Fox News, long judged primarily by its prime-time opinion shows, is emphasizing its full-day schedule. “We’re not just selling prime time—we’re selling the entire network, which delivers prime ratings throughout the day,” said Gargano.

Other networks have tried similar “broadcast replacement” strategies before. A decade ago, Time Warner pitched TNT and TBS as comparable to the Big Four, and Discovery tried to curate a pseudo-broadcast schedule across channels like Food Network and TLC.

What makes Fox News’ effort unique is its focus on unscripted, real-time content—a growing advantage in the streaming world.

Since selling off much of its studio and cable portfolio to Disney in 2019, Fox Corporation has doubled down on live-viewing content. The Trump era helped elevate Fox News, which has strong connections to the former administration and consistently lands top newsmakers—from White House insiders to figures like Elon Musk and astronauts Suni Williams and Butch Wilmore.

“They do have a compelling story,” one media buyer said. “Heading into the election, it was clear where the viewership was shifting.”

Still, Fox News’ success in the marketplace will depend on broader economic factors and how it prices its inventory relative to competitors.

All three major cable news networks—Fox News, CNN, and MSNBC—are navigating the challenge of viewers moving from traditional TV to streaming platforms. According to data from Kagan (S&P Global Intelligence), Fox News is expected to bring in $1.19 billion in ad revenue in 2025, slightly down from $1.23 billion in 2024. CNN is forecast to fall to $587.2 million (from $663.4 million), while MSNBC is projected to bring in $699.2 million (down from $752.4 million).

One outlet likely unaffected by Fox News’ new strategy? The Fox broadcast network, which operates separately from the cable news channel. Gargano emphasized the two brands are “collaborative” when it comes to sponsor partnerships, but they don’t share programming.

News

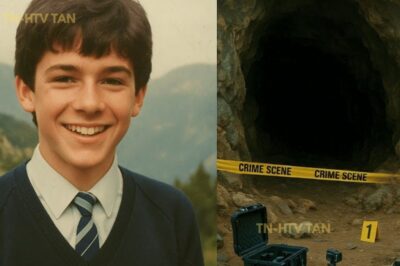

Husband and pregnant wife disappeared while camping, 11 years later this is found…

📖 Desert of Shadows Part I — The Disappearance (2011) Chapter 1 — The Last Photo The last message arrived with…

After my husband’s funeral, my son took me to the edge of town and said, “This is where you get off.” But he didn’t know the secret I already had inside me.😲

After my husband’s funeral, my son said, “Get down,” but he had no idea what he had already done. You…

When Elisa got off that train, she thought she would find a husband, but what she found was much bigger…

When Elisa got off that train she thought she would find a husband but what she found was much bigger…

Couple disappeared in Chihuahua Desert — in 2007, tourists found body trapped in a cactus…

March 1994. A couple disappears in the Mexican desert during a special trip. She was pregnant. He was 54 years…

She disappeared during a school trip in 1983… The truth took 35 years to come to light.

On March 15, 1983, 32 seventh-grade students from San Miguel High School boarded the yellow bus that would take them…

— No, no! I’m going after Dad! I’m going to help him! He cures everyone in the village. He just couldn’t cure Mom!

Larisa could barely keep her eyes open, her body so weak that every step she took was like wading through…

End of content

No more pages to load