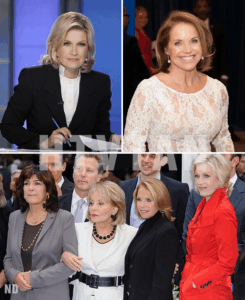

Kayleigh McEnany, Trump’s former press secretary, was on Fox speaking today as viewers noticed they were missing their usual DOW ticker (Image: Fox News)

Kayleigh McEnany, Trump’s former press secretary, was on Fox speaking today as viewers noticed they were missing their usual DOW ticker (Image: Fox News)

In a stunning moment that has left viewers questioning Fox News’ approach to reporting financial news, the network was seen removing its Dow ticker during a significant market downturn. The removal came as President Donald Trump’s latest tariff announcement caused stocks to plummet, leading to a wave of speculation and mockery on social media.

The Controversial Moment: Fox News Removes Dow Ticker Mid-Crash

On April 16, 2025, as the Dow Jones Industrial Average plummeted by 1,228 points following Trump’s announcement of sweeping new tariffs, the usual ticker showing the real-time stock market performance mysteriously disappeared from the screen. Fox News anchor Kayleigh McEnany, the former White House press secretary, was speaking live during the segment as the market dive unfolded.

While McEnany discussed the tariff changes, which included substantial hikes on imports from China, the European Union, and several other countries, viewers were quick to notice the conspicuous absence of the Dow ticker. A clip shared on X (formerly Twitter) showed the moment, sparking widespread criticism. Users began jokingly speculating that Fox News had removed the ticker to avoid drawing attention to the market’s sharp decline.

One user wrote, “Fox News logic is if the ticker’s gone, the crash didn’t happen,” while another added, “Good thing I developed object permanence when I was a baby.” These comments pointed to the growing belief that the conservative news network was attempting to downplay the negative effects of Trump’s economic policies on American workers and markets.

Tariff Announcement Leads to Market Turmoil

The day’s financial meltdown came after Trump’s announcement that he would be increasing tariffs across nearly all U.S. trading partners. The new measures include a 34% tariff on imports from China—bringing the total tariff on Chinese products to 54%—and additional taxes on products from the European Union, Vietnam, and Taiwan. The tariff hikes are expected to disrupt global trade, raise costs for U.S. consumers, and strain international relations, according to experts.

The stock market responded quickly to the announcement, with the S&P 500 falling 3.7%, marking its worst day since the early days of the COVID-19 pandemic in 2020. The Dow Jones, the benchmark for U.S. stocks, dropped by over 1,200 points, or nearly 3%, while the Nasdaq composite sank by 4.8%. Smaller U.S. companies were hit particularly hard, with the Russell 2000 index falling more than 5.5%.

The drop in the stock market impacted everything from oil prices to Big Tech stocks, and even gold—typically seen as a safe haven for investors—dropped in value. These widespread losses are seen as a direct consequence of the tariffs, which have raised concerns about inflation and the potential for an economic slowdown.

Fox News’ Response: Dismissing the Backlash

While the removal of the Dow ticker during a major market crash did not go unnoticed, Fox News has yet to offer an official explanation for the decision. However, some have speculated that the move was meant to prevent the visual display of a market collapse that could further damage Trump’s standing with conservative viewers.

The network’s handling of the situation raised eyebrows, especially since similar actions had been taken in the past. A previous incident in August 2024 saw the network remove the ticker during another market dip linked to Trump’s economic policies. This pattern has led critics to accuse Fox News of intentionally shielding viewers from the negative effects of the president’s decisions.

Trump’s Tariffs: A Risky Economic Gamble

The tariffs imposed by President Trump are part of his broader “America First” economic agenda, which prioritizes U.S. industries and seeks to reduce reliance on foreign imports. While Trump and his supporters argue that these policies will bring jobs back to America and level the playing field with trading partners, many economists and business leaders believe the tariffs will lead to higher prices for American consumers and disruptions to global supply chains.

The controversial decision to increase tariffs on such a wide array of goods has sparked a backlash, with critics arguing that the move could harm American businesses and consumers, especially in industries that rely on imported materials. Some experts warn that the tariffs could push the U.S. economy into a recession, with the current market drop seen as a harbinger of what’s to come.

Musk’s Alleged Influence and Media Gaslighting

In addition to the economic fallout, Elon Musk has become involved in the debate over the tariffs and their impact on U.S. businesses. Musk has expressed concerns about the damage to the global economy and the long-term consequences of Trump’s trade policies, particularly the impact on tech companies that rely on imports.

As Musk becomes more vocal about his stance on U.S. economic policy, his relationship with the media has become more contentious. His accusations of being gaslit by legacy media outlets have gained traction, as some believe the media has downplayed the negative effects of Trump’s tariffs while simultaneously amplifying criticism of his policies.

The Fallout for Fox News: A Pattern of Political Bias?

The removal of the Dow ticker during a financial crisis and the ongoing handling of negative news related to Trump’s policies have raised concerns about Fox News’ editorial decisions. While some believe the network is trying to shield its audience from the harsh reality of economic consequences, others see it as a reflection of the network’s broader political agenda—one that consistently defends Trump’s policies while downplaying their potential harms.

This incident has sparked broader questions about the role of the media in shaping public opinion during times of political and economic uncertainty. As Fox News continues to face criticism for its handling of Trump’s policies, the question remains: will the network ever confront the financial fallout of these decisions, or will it continue to focus on shaping the narrative to fit its political ideology?

Conclusion: What’s Next for Trump’s Economic Legacy?

The controversy surrounding Fox News and the market’s response to Trump’s tariffs has only just begun to unfold. As the impact of these policies becomes more apparent, both in the U.S. and abroad, it remains to be seen how the media will respond and whether Trump’s economic policies will continue to dominate the national conversation.

For now, the network’s decision to remove the Dow ticker during a market crash serves as a reminder that the intersection of politics, media, and economics is a volatile one. The real question is whether the American public will continue to buy into the narrative presented by Fox News, or whether they will demand a more honest reckoning with the consequences of Trump’s decisions.

News

EXPLOSIVE REVEAL: Elon Musk’s SHOCKING Plan to Buy ABC—Tucker Carlson as CEO and “Ending the Woke Agenda”

In a move that has shaken the foundations of the American media industry, Elon Musk is reportedly preparing to make…

SHOCKING REVEAL: Susanna Reid Admits Fear of Breast Cancer Screening Left Her in Denial—A Powerful Moment on Good Morning Britain

In an emotional segment on Good Morning Britain, television presenter Susanna Reid opened up about her struggles with health anxiety,…

SHOCKING NEWS: Keanu Reeves REFUSES to Present Lifetime Achievement Award to Whoopi Goldberg—”She’s Not a Good Person”

In an unexpected and highly controversial move, actor Keanu Reeves has reportedly refused to present the Lifetime Achievement Award to…

SHOCKING REUNION: Days of Our Lives Stars Matthew Ashford & Melissa Reeves Return—And It Feels Like NO TIME Has Passed!

In a heartwarming turn of events, Days of Our Lives fans were treated to the return of iconic couple Jack…

SHOCKING EXCLUSIVE: HGTV’s Jennie Garth, 46, Reveals Her Kids Expelled from School—The Heartbreaking TRUTH Behind Hollywood’s Perfect Family Image

In a surprising and emotional revelation, HGTV star Jennie Garth, 46, opened up about her children being expelled from school,…

End of content

No more pages to load