Part 1 – Fourteen Years for Thirty Seconds

The funny thing about betrayal is that it never comes from strangers.

It comes from people you’ve given your time, your trust, and—if you’re like me—fourteen years of your life. People you’ve shielded from disaster and cheered for in their victories. People who, when the knife finally slides in, don’t even bother to look you in the eye.

My name is Michael Grayson, and until three days ago, I was the Director of Operations and Strategy at Blue Peak Technologies, a midsized software company in Boston, Massachusetts.

For fourteen years, I arrived earlier than anyone, left later than everyone, and built the processes, systems, and relationships that took Blue Peak from a scrappy 10-employee startup in a cramped loft to a 200-person operation humming across three floors of glass and steel.

And the man who fired me—Robert Sterling—knew exactly how much I’d done for the company. That was the part that stung the most.

What nobody at Blue Peak knew was that I never needed the job in the first place.

Not a single day of it.

I’m the son of Richard Grayson, a billionaire whose financial empire stretches across continents, controlling investments in everything from tech to shipping to luxury hotels. My last name—if I’d ever chosen to use it—could open almost any door in the corporate world.

When I graduated from Harvard Business School, my father offered me a senior role at his firm. I turned it down.

I didn’t want to be Richard Grayson’s son who got handed a corner office. I wanted to know that my career was built on my own merit, that I could stand in any room without leaning on my last name.

So I cut financial ties with my family, took an entry-level job at Blue Peak, and started from zero. To my father’s credit, he didn’t try to stop me. He just said, “If you’re going to prove yourself, prove it completely.”

At Blue Peak, I became Michael the operations guy. I wasn’t flashy. I didn’t give TED Talks or show up in glossy business magazines. I solved problems quietly, optimized systems, and made the gears turn smoothly behind the scenes.

Most importantly, I looked out for the people who actually built the company day after day—the developers, the QA testers, the analysts, the field sales teams. I believed in treating them with dignity, not as expendable resources.

But my low profile—what I considered a virtue—made me invisible to people who only value a shining résumé and loud self-promotion.

And that invisibility is exactly what almost cost me everything.

The New Regime

Six months ago, Blue Peak hired a new CEO. Robert Sterling, fifty years old, famous for his aggressive restructurings, and proud of the nickname “The Hatchet” in corporate circles.

From day one, I knew there would be trouble.

Sterling believed in two things:

Mass layoffs to “streamline efficiency.”

Partnerships designed for short-term profit, no matter the long-term cost.

I tried—God knows I tried—to work with him. I presented reports proving that our culture was our greatest asset. Employee loyalty directly correlated with productivity, client retention, and our ability to innovate.

He looked at me the way a wolf looks at an old sheepdog—like I was a relic from another era.

To him, I represented everything that needed to be purged.

Within months, longtime employees were being walked out without warning. Projects we’d invested years into were scrapped because they wouldn’t pay off fast enough to pad his quarterly numbers. Departments stopped cooperating; everyone fought over shrinking budgets like starving dogs over scraps.

I started documenting everything:

Which clients left and why.

Which employees were let go and how it impacted delivery.

Which financial decisions seemed to dance right on the edge of legality.

And I saw the pattern. Sterling was driving the company toward a cliff.

But in the end, none of that mattered.

The Friday Before the Fourth

It was the last Friday in June, three days before the July 4th holiday.

Sterling called me into his office. He didn’t offer me a chair. Didn’t look up from the papers in front of him until he’d finished signing whatever it was that clearly mattered more than the man standing in his doorway.

Finally, he said:

“Michael, as part of our restructuring, your position is being eliminated. We no longer need your type of old-school experience here.”

That was it. Fourteen years, gone in thirty seconds.

There was a flicker of something in his eyes—not regret, but satisfaction. He’d wanted me out from the moment he arrived, and now he’d finally cleared his board.

The Calm Before the Storm

I didn’t shout.

I didn’t slam my fist on his desk.

An ice-cold calm settled over me—the kind that only comes when you realize you’re no longer bound by the rules of the game you’ve been playing.

Sterling had made the worst mistake a predator can make.

He’d underestimated his prey.

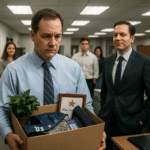

I took my box of personal belongings, said goodbye to the few colleagues who hadn’t been forced out already, and walked out with my head high.

He had no idea what he’d just unleashed.

That night, for the first time in fifteen years, I called my father.

“Michael,” Richard Grayson said, answering on the second ring. His deep voice sounded exactly as it had when I was a kid and had to confess breaking a window. “From your tone, I imagine this isn’t just to wish me a happy Independence Day.”

I explained the situation. Every detail.

When I finished, he asked only one question:

“What do you need?”

“Access to Grayson Holdings,” I said. “And total discretion.”

“You have it,” he replied without hesitation. “Fifteen years of independence proved your point. Now it’s time to use the tools you’ve always had.”

The following Monday, while Sterling probably pictured me sulking in my apartment, I was in Manhattan, sitting in a private conference room at Grayson Holdings, surrounded by the best corporate lawyers and financial strategists in the country.

I had a plan.

And if it worked, Blue Peak Technologies would belong to me before Sterling even knew I was coming.

Part 2 – Building the Trap

If there’s one thing I learned growing up in the Grayson family, it’s this:

Power isn’t about who talks the loudest.

It’s about who holds the quietest leverage.

I wasn’t going to storm back into Blue Peak with lawyers in tow. I wasn’t going to blast my grievances on LinkedIn or leak dirt to the press. That’s how amateurs play.

I was going to own the company before Sterling realized he’d handed me the perfect opening.

The Leverage Play

Blue Peak Technologies was publicly traded, but it wasn’t a Wall Street darling. The stock was thinly traded—meaning you could quietly buy significant amounts without the price spiking or anyone noticing… if you knew how to do it right.

That was where Grayson Holdings came in.

On paper, Grayson Holdings is an investment management firm with a long list of subsidiaries, shell companies, and quiet partnerships. In reality, it’s an intricate web designed to move enormous sums of money through dozens of channels without leaving a single obvious trail.

We deployed the network.

Each week, different entities began buying Blue Peak stock—always keeping purchases below the disclosure threshold that would trigger SEC filings. We alternated buying through New York, London, and Singapore brokerages. We even had small-cap funds in Canada and Switzerland take minor positions to further muddy the waters.

From the outside, it looked like a handful of unrelated investors had suddenly taken an interest in an under-the-radar tech company.

From the inside?

I was pulling every string.

By the end of the third week, we controlled 23% of Blue Peak.

Two weeks later, that number hit 35%.

By the sixth week after my firing, we owned exactly 40%.

Sterling had no idea.

Watching the Collapse

While my team bought shares, I kept tabs on what was happening inside.

It wasn’t hard—years of building trust meant I still had plenty of loyal friends at Blue Peak.

Sarah Chen, my former assistant turned project manager, called me one night after midnight.

“Michael, the company’s falling apart. Sterling fired three senior developers this week, and now the rest of the team is working 70-hour weeks just to meet deadlines we can’t hit. People are breaking.”

“Be patient,” I told her. “Things will sort themselves out soon.”

Marcus Torres, head of sales, was next.

“Clients are asking about you. TechFlow Industries just canceled a $2 million contract because they don’t trust our delivery anymore. MediaSync is shopping for a new vendor.”

“Keep doing your job,” I said. “Document everything.”

Neither of them knew I was documenting everything too—every client lost, every delay, every resignation, every cost Sterling’s so-called “efficiency” had actually created.

The Dossier

My legal team compiled a dossier thick enough to make a filing cabinet groan. It included:

12 separate contract violations with major clients.

Three questionable HR practices that brushed against state labor laws.

Evidence of manipulated financial reports in Sterling’s internal updates to shareholders.

It wasn’t just enough to get him fired.

It was enough to make sure no legitimate company would ever hire him again.

The Bait

The turning point came when Sterling announced an extraordinary shareholders meeting for August 15th.

His goal?

Show off his “excellent” first-half results.

Get approval for another round of deep cuts—25% of the remaining workforce.

To him, it was the moment he’d consolidate power.

To me, it was the perfect stage for my reveal.

I spent the next two weeks preparing. I knew every number he was going to present. I knew which lies he’d tell to make those numbers shine. And I knew exactly how to dismantle him in front of an audience he couldn’t control.

I even bought a new suit—navy Armani, tailored perfectly.

The kind of suit that says: I’m not here to fight for my job. I’m here to end yours.

The Morning of August 15th

The day dawned hot and bright in Boston. The meeting was set for 10:00 a.m. in Blue Peak’s main auditorium.

I arrived at 9:30, thirty minutes early.

The room was already filling with shareholders, board members, and—at Sterling’s invitation—employees. He wanted them to witness his “triumph.” I recognized dozens of faces from my years there: Sarah in the third row, Marcus leaning against the back wall, even Jennifer Walsh, the CFO, who had somehow survived the purge.

I sat in the fifth row on the left, close enough for everyone to see me when the moment came.

In my briefcase were two sets of documents:

Proof that I controlled 40% of Blue Peak’s shares.

The dossier that would burn Sterling’s empire to the ground.

When Sterling walked in at exactly 10:00, he was all swagger—expensive gray suit, polished cufflinks, that smug half-smile I’d come to know too well. He worked the room like a politician, greeting big shareholders, tossing condescending nods toward employees.

He had no idea the stage was already set.

Part 3 – The Public Execution

Sterling took the stage with the confidence of a man who believed the room belonged to him.

“Ladies and gentlemen—shareholders, valued employees—today is a historic day for Blue Peak Technologies,” he began, his voice echoing in the auditorium. “In just six months under new leadership, we’ve transformed a bloated and inefficient operation into a lean, results-driven machine.”

A click of the remote, and the first slide filled the screen behind him:

30% reduction in operational costs. 15% increase in gross margin. Workforce optimization.

At a glance, it looked impressive. To someone without context, it looked heroic.

I knew better. Every number on that screen was a half-truth at best, a fabrication at worst.

Sterling paced the stage, feeding the audience line after line of corporate jargon.

“We eliminated redundancies, cut unnecessary expenses, and focused on what truly matters: results for our shareholders. The old culture of ‘corporate family’ has been replaced by a professional mindset driven by metrics.”

I saw Sarah Chen’s expression tighten. Marcus Torres leaned forward in his seat. Around the room, employees shifted uncomfortably—because they knew exactly what that “old culture” phrase meant. It was an insult to everything we’d built.

Then came the dagger.

“This transformation,” Sterling said, “required some difficult decisions. We had to part ways with employees who clung to outdated ways of thinking, who resisted change, and who prioritized the status quo over innovation.”

He didn’t say my name, but I could feel every eye in the room flick toward me.

I kept my expression neutral, my hands folded neatly over my briefcase.

Sterling spent another twenty minutes spinning his vision: international expansion, strategic acquisitions, his fantasy of turning Blue Peak into a billion-dollar “unicorn.”

Finally, he arrived at the real reason for the meeting.

“Therefore, I am requesting shareholder approval for the second phase of restructuring—which will include an additional 25% reduction in workforce and reallocation of resources to high-impact areas.”

He paused for applause.

None came.

“Now,” Sterling said with forced cheer, “I’d like to open the floor for questions from shareholders—bearing in mind that only those with a stake greater than 5% may speak.”

That was my cue.

I rose slowly, buttoned my navy Armani jacket, and walked to the microphone in the center aisle. Every step drew more eyes toward me.

“Excuse me,” I began, my voice calm and clear, “I have a few questions for Mr. Sterling.”

Sterling’s smile faltered for just a second.

“Well, well… Michael Grayson. What a surprise to see you here. But as you know, this meeting is for qualified shareholders only. You no longer work at Blue Peak.”

“You’re correct,” I replied evenly. “I no longer work here. But I am a qualified shareholder. In fact…” I let the words hang for a beat. “…I represent exactly 40% of this company’s shares.”

The room went still.

Sterling blinked. Once. Twice. As if I’d just spoken a foreign language.

“That’s impossible,” he said finally, his voice pitching higher than before. “I have records of all major shareholders.”

I opened my briefcase and withdrew the first set of documents, holding them up for the nearest board member to take.

“Over the past eight weeks,” I said, “through Grayson Holdings and its subsidiaries, I’ve acquired a 40% stake in Blue Peak Technologies. All transactions were properly filed with the SEC and are available for verification.”

Murmurs erupted across the room. Board members whispered urgently. Employees stared at me like they were watching a movie twist they didn’t see coming.

Sterling’s jaw tightened. “Even if that’s true—”

“It is,” I said, not raising my voice but cutting him off cleanly. “And as a major shareholder, I have a right to review the accuracy of the financial data you presented today. Which is where my next set of documents comes in.”

I pulled the thick dossier from my briefcase and set it on the podium.

“In the past two months, I’ve conducted an independent audit of Blue Peak’s operations,” I continued. “The results… differ substantially from your presentation.”

I began reading:

“Blue Peak has lost 23% of its long-term clients.”

“Projects worth $4.2 million have been canceled due to delays and quality failures.”

“Employee turnover has increased by 340%.”

“Recruitment and training costs have erased any savings from the layoffs.”

Sterling stepped toward the edge of the stage. “These are unfounded accusations from a resentful ex-employee—”

“I’m not a resentful ex-employee,” I said, my tone sharpening. “I’m Michael Grayson. Son of Richard Grayson. Of Grayson Holdings.”

Gasps swept the room. A few smaller shareholders straightened in their seats—they knew exactly what that meant.

“I spent fifteen years building my career without my family’s name or money,” I went on. “Fourteen of those years were here, building this company on a foundation of respect, integrity, and operational excellence. You destroyed that foundation in less than six months.”

From the corner of my eye, I saw CFO Jennifer Walsh stand.

“Everything Michael has said is accurate,” she said, her voice steady. “I have the same numbers in my reports. Mr. Sterling ordered me to exclude them from the official presentation.”

The auditorium erupted—shareholders demanding answers, employees speaking over each other about their own experiences under Sterling’s leadership.

Sterling tried shouting over the noise. “This meeting is not a circus!”

I waited for the noise to die just enough, then delivered the final blow.

“As majority shareholder, I call for an immediate vote of no confidence in the current executive management.”

It took less than ten minutes.

The vote was unanimous.

Robert Sterling was removed as CEO on the spot.

Security escorted him from the building while he muttered threats about lawsuits and regret.

“Mr. Sterling,” I called after him, “I’d advise talking to your lawyers before making threats. We have enough evidence of mismanagement and possible fraud to keep them busy for years.”

He didn’t reply.

What came next… even I didn’t see coming.

art 4 – The Aftermath

The moment Sterling disappeared through the auditorium doors, the atmosphere shifted.

It wasn’t relief—not yet—but it was as if the tension that had been choking the air for months had finally loosened its grip. People were talking in quick bursts, some still whispering to each other like they couldn’t quite believe what they’d seen.

The board members were the first to move. Three of them—faces flushed, ties slightly loosened—made their way to me.

One of them, Alan Reeves, the longest-tenured director, extended his hand.

“Michael… or should I say Mr. Grayson,” he said with a half-smile. “You’ve just saved this company from a slow death. And I think I speak for all of us when I say—what now?”

Before I could answer, Jennifer Walsh stepped closer, her expression steady but expectant. “The company needs leadership,” she said. “Right now. Investors, employees, clients—they’ll all be looking for reassurance. Someone has to take the reins.”

The Offer

Alan cleared his throat. “Michael, we want you to take over as CEO.”

The words hung in the air.

It would have been so easy to say yes. To slide into the seat Sterling had just been dragged from, to have the final, perfect piece of revenge. I had the shares. I had the authority. I had the proof that I could do the job better than anyone.

But as I looked around—at Sarah Chen’s hopeful face, at Marcus in the back, at the other employees watching me like I was about to announce the weather for the rest of their careers—I realized something.

I didn’t want it.

For fourteen years, I had been the architect behind the curtain. I knew exactly what kind of energy the CEO’s role demanded—and I knew it wasn’t mine. I was a builder, not a figurehead.

“Thank you,” I said finally. “But I’m not accepting the position.”

The murmurs started instantly—confusion, disbelief.

“Instead,” I continued, “I’d like to nominate Jennifer Walsh as interim CEO.”

Jennifer blinked, clearly not expecting it.

“She knows the company’s real financial situation better than anyone,” I said. “She has the trust of the people in this room. And she’s proven she’ll tell the truth, even when it’s not convenient.”

Alan looked at her, then back at me, then nodded slowly. “If Jennifer’s willing, I think that’s an excellent choice.”

Jennifer hesitated for only a moment before squaring her shoulders. “I’ll do it,” she said.

The Rebuild

The weeks that followed were some of the busiest of my life—though I wasn’t officially in charge, Jennifer and I worked side by side to stabilize the company.

We reversed Sterling’s worst decisions first:

Rehired key employees who had been unfairly terminated.

Restored long-term projects Sterling had scrapped.

Launched a client outreach campaign to repair relationships and bring back lost contracts.

Within three months, we’d recovered several million in revenue and brought turnover rates back to pre-Sterling levels. The office, once silent and tense, was beginning to sound like itself again—phones ringing, quiet laughter in hallways, the hum of a company with its heart beating again.

Sterling’s Fall

I didn’t have to lift a finger for the next part.

The business press got wind of Sterling’s removal, and journalists started digging. It didn’t take long for three former employers to file lawsuits alleging mismanagement. His “success stories” from past roles crumbled under scrutiny.

By the end of the year, Sterling couldn’t get a meeting with a legitimate company. His LinkedIn went dark. He’d become exactly what he turned me into—unemployed and unwanted.

The irony didn’t escape me.

A Conversation with My Father

One evening, a few months into the rebuild, I visited my father in his Manhattan penthouse.

He poured two glasses of scotch and handed me one. “You could have taken that CEO seat,” he said. “Why didn’t you?”

I sipped, letting the smoky warmth settle before answering. “Because power for its own sake doesn’t interest me. Building something worth keeping—that does.”

A slow smile spread across his face. “Your mother would have liked that answer.”

By the year’s end, Jennifer was officially confirmed as CEO with full board approval. My 40% stake gave me significant influence, but I kept my role advisory. I didn’t need my name on the letterhead. I had what I came for.

Blue Peak was steady. Sterling was finished. And I had proven—to myself most of all—that I could win on my own terms.

Part 5 – One Year Later

It was almost exactly a year to the day since Sterling had called me into his office and dismissed me with thirty seconds of corporate coldness.

I stood now in the same building, in the same hallway outside the executive suite—but the air felt different. Lighter. The tension that had weighed on every conversation during his reign was gone, replaced by the quiet, steady hum of people who enjoyed their work again.

Blue Peak was thriving.

The Numbers That Mattered

Under Jennifer’s leadership, we’d:

Rebuilt our client base to 110% of pre-Sterling levels.

Expanded into two new markets—but only with contracts we knew we could deliver on.

Increased employee retention to an all-time high.

It wasn’t about quarterly fireworks; it was about sustainable growth.

The best part?

Walking through the office and seeing people smile again.

Hearing laughter in the break room.

Knowing the developers weren’t being pushed to exhaustion just to feed an investor deck.

Sterling’s Ghost

Sterling’s name still floated in the business press from time to time, but always in the context of lawsuits, unpaid debts, or failed ventures. He’d gone from a “turnaround specialist” to a cautionary tale in less than eighteen months.

I never spoke to him again.

And I never needed to.

My revenge wasn’t about hearing him admit I’d beaten him—it was watching him lose everything he thought made him untouchable.

The Quiet Role

Owning 40% of Blue Peak meant my influence was undeniable, but I stayed in the shadows by choice. I attended board meetings, reviewed major decisions, and advised Jennifer, but my day-to-day life was mine again.

I was free to work on the kind of projects that actually made me curious—startups building something real, not just dressing up numbers for investors. Some of those projects, I funded directly. Others, I simply mentored.

For the first time in years, I felt… balanced.

A Visit from Sarah

One afternoon, Sarah Chen stopped by my office—well, my smaller, tucked-away office on the top floor that overlooked the Charles River.

She set a coffee on my desk. “You know,” she said, “people still talk about that meeting last August. They call it the day the curtain dropped.”

I smiled. “That’s generous. It was just timing.”

“No,” she said firmly, “it was more than timing. You taught this whole company that it’s possible to stand up to people like him—and win.”

I didn’t know what to say to that. So I just nodded, feeling a quiet satisfaction settle in my chest.

Dinner in Manhattan

A few weeks later, I was back in New York, having dinner with my father. We were at his usual table at the top of a Midtown skyscraper, the city spread out like a living map below us.

“You played it well,” he said between bites of steak. “Sterling never saw you coming. That’s the Grayson blood.”

I chuckled. “I’m not sure that’s a compliment.”

“It is,” he said. “But more importantly—you didn’t let it make you bitter. You finished it, then walked away. Most people in your position would have taken the CEO role just to grind him into dust.”

“That would’ve made it about him,” I said. “This was always about Blue Peak.”

He studied me for a long moment. “You know, I think you’ve proven whatever you set out to prove when you walked away from this family fifteen years ago.”

I thought about that. And for the first time, I believed him.

A Different Kind of Independence Day

On July 4th, exactly a year after that firing, I stood on the balcony of my Boston apartment, watching the fireworks bloom over the harbor.

My phone buzzed—Jennifer sending me a picture of the company picnic. Kids chasing each other across the grass. Employees laughing around grills. The kind of simple, human joy that no profit chart can measure.

I put the phone down and let the fireworks light the sky.

Independence Day, indeed.

This time last year, I’d been underestimated, cast aside, and assumed defeated.

Now?

I was the quiet owner of the company that had tried to discard me.

The man who’d torn it apart was out of the game for good.

And the people who really built Blue Peak had their dignity back.

Not bad for thirty seconds’ worth of dismissal.

The End

News

CEO’s Paralyzed Daughter Sat Alone at Her Birthday Cake—Until a Single Dad Said ‘Can We Join You’

Part 1 – The Lonely Birthday The afternoon sun painted lazy golden streaks through the lace curtains of Sweet Memories…

I Built $45M Business, Supported My Family Then Dad Said ‘Leave You Lowlife’ So I Moved To…

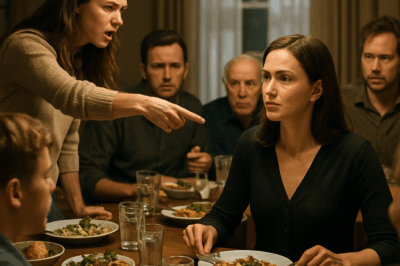

Part 1 – The Dinner Table Ambush It was supposed to be just dinner. A casual check-in, a “how’s everything…

HE SIGNED THE SALE PAPERS. HER FAMILY’S EMPIRE COLLAPSED.

PART ONE – The Toast The first crack didn’t sound like glass breaking.It sounded like a laugh. A breathy, performative…

My Sister-In-Law Exposed My “Affairs” At Dinner — Then I Revealed Who Those Men Really Were…

PART ONE: The Set-Up If you’ve never had someone try to ruin your life in front of a table full…

They Told Me to Eat in the Car… So I Left Them a Gift Under the Plate and Walked Away

PART ONE: The Seat That Wasn’t There You ever walk into a room and know before you even sit down…

At My Sister’s Wedding, She Publicly Mocked Me — Then Her Groom Silenced the Whole Room

PART ONE: The Invitation I Almost Declined I was standing in my kitchen rinsing out a coffee mug when the…

End of content

No more pages to load