Part One

When they fired me, it wasn’t behind closed doors. It wasn’t a quiet conversation in HR with tissues and fake compassion.

It was at the all-hands meeting.

Forty-six faces on folding chairs, fluorescent lighting humming overhead, the smell of cake someone had sliced for “another successful quarter.”

And then there was Kenzie—our CEO’s daughter, parachuted into the role of Chief Culture Officer—standing under the projector light with a smug smile and a voice that could peel paint.

“Enjoy the company hoodie and gift card,” she cooed, her tone nasal, brittle. The Botox in her forehead hadn’t settled right, so her attempt at sincerity looked more like constipation.

That’s how I knew it was happening.

I’d seen plenty of bad terminations in my career, but this was performance art.

No warning.

No write-up.

No “can we chat in private?”

Just a public beheading, sandwiched between a “new kombucha flavor launch” announcement and a slide about Q3 burn rate.

“Samantha has been a valued member of the Vyron family,” she recited, her eyes never leaving the script she definitely didn’t write. “But due to performance misalignment and shifting culture priorities, we’ve decided to part ways.”

My name was scrawled on a hoodie tag in Sharpie like a thrift store item. Inside, a $50 gift card to a juice bar that didn’t even exist in my zip code.

And to twist the knife, she added, “Unfortunately, your Q4 bonus didn’t meet the updated KPI rubric, so it won’t be awarded.”

Updated KPI rubric.

Lady—I wrote the original KPI rubric.

The silence in the room was suffocating. Sales guys tugged at their collars. Interns stared at their phones like they’d just received breaking news about Taylor Swift. The CFO avoided eye contact, clearly calculating boat payments in his head.

I didn’t crack. I smiled. That same calm smile HR people fear—the “don’t worry, I won’t sue” smile.

I held the hoodie up like it was radioactive polyester. “Thanks for the memories,” I said evenly.

Not because I wasn’t furious. But because fury is for amateurs.

And I’m a professional.

I walked out without slamming a door. No meltdown, no theatrics. Just the quiet click of heels and the faint smell of vanilla air freshener covering the rot of corporate hypocrisy.

That’s when I noticed the slip.

HR hadn’t made me sign a single thing.

No exit packet.

No NDA reminder.

No acknowledgement of “fair termination.”

Just a perky pre-written email saying my company login would deactivate by 3:00 p.m.

Which told me everything.

They knew.

Someone in that room knew this wasn’t clean.

Because here’s what Kenzie didn’t realize when she handed me that hoodie:

Three weeks earlier, I had quietly insured myself. Not with lawyers, not with money—

With a clause.

Clause 12.7B.

The quiet bomb buried in Vyron’s vendor contracts.

And the moment she fired me without due process, she had pulled the trigger.

Part Two

Three weeks before the hoodie hit my desk like a funeral favor, I was sitting in a dive bar that smelled like stale fries and old secrets.

My laptop glowed between a glass of pinot and a stack of napkins scrawled with half-baked ideas. Across from me sat Shelley, my attorney. Forty-two, cynical, pearls around her neck like brass knuckles.

She leaned over my screen, eyebrows climbing higher as she read. Then she whistled through her teeth.

“You sure you want to do this, Sam?”

I sipped my wine. “They’ve been treating me like an employee, but I’ve been acting like an owner. It’s time I got some insurance.”

The “insurance” in question: a licensing clause buried so deep in our vendor consolidation contract it might as well have worn camouflage.

See, while everyone at Vyron was busy flexing about UX updates and investor roadmaps, I was doing the unglamorous work: cleaning up spaghetti code, duct-taped integrations, half-broken vendor APIs.

Our so-called “proprietary” backend was a Frankenstein stitched together with hope and caffeine.

So I built something new.

Clean. Secure. Scalable.

And here’s the kicker: I didn’t build it for Vyron.

I built it through my own LLC.

We’d had “Ray’s Integrated Systems” on the vendor ledger for years, filed under ops architecture and platform integration. Nobody noticed when the invoice descriptions shifted slightly. Nobody read the fine print when I slipped in a statement of work that routed licensing rights back to me, not the company.

And absolutely nobody read the subclause that spelled out what would happen if I was ever terminated without formal review or documented cause.

It was one paragraph, written in plain English:

Upon improper dismissal of key personnel, all perpetual licenses shall self-revoke, effective immediately.

No lawsuit. No arbitration. No negotiation.

Just lights out.

It slid through legal like a lukewarm fart in a meeting. Rubber-stamped, filed, forgotten.

Shelley shook her head as she closed my laptop. “It’s elegant,” she admitted. “Petty, but elegant. Just promise me you won’t use it unless you absolutely have to.”

I smiled. “Of course not. It’s just… insurance.”

But deep down, I already knew.

Kenzie was going to give me a reason.

Kenzie floated into Vyron six months earlier like she’d been airlifted from an Instagram influencer’s mood board. Pastel blazers, designer tote, a job title—Chief Culture Officer—that had authority without accountability.

No résumé. No track record. Just a press release announcing her as “a visionary voice for the future of work.”

Within a week, she’d replaced our ops playbooks with framed quotes about radical alignment. She billed $18,000 in “wellness experiences” that suspiciously aligned with her Palm Springs bachelorette. She called layoffs “emotional recalibrations” and suggested succulents as morale boosters.

And me?

I was a problem.

Because competence makes insecure people itch.

I didn’t roll my eyes when she called budget fraud a “creative reallocation.” I documented it. Color-coded folders, timestamped screenshots, backed up to cloud drives under fake project names.

Every deleted Slack thread. Every “oops” payment to her yoga friends rebranded as consultants.

Every petty theft of credit for work she didn’t do.

I smiled through it all. Never escalated. Just let the pile grow.

Because I knew the sword was coming.

The hoodie. The gift card. The fake tears.

She thought she’d humiliated me.

But in reality, she’d detonated her father’s company.

And the clause was already ticking.

Part Three

The funny thing about traps is that they don’t go off with fireworks. They don’t announce themselves.

Clause 12.7B was silent.

The moment Kenzie handed me that polyester hoodie, the license clock started ticking. No one in that all-hands noticed. Not the CFO calculating yacht payments. Not the engineers nervously glancing at Slack. Not even Kenzie herself, who strutted like she’d scored a standing ovation.

But behind the scenes? Vyron was bleeding out, and they didn’t even know it yet.

It began with a hiccup.

Three days after my “termination,” finance pushed out corrected Q4 revenue projections. They were off by $1.3 million. Officially, the explanation was QuickBooks API delays. The truth?

The automated reconciliation system I’d built—through my LLC—had revoked their access.

No reconciliation. No validation. No safety net.

They were balancing books blindfolded, and the cracks were showing.

Then came the tech unraveling.

Three of our microservices collapsed within 48 hours. The DevOps contractor—Kenzie’s hire, a guy who listed “vision boarding” on his résumé—couldn’t troubleshoot because the backend schema used my naming conventions. Documentation? Sure. But it lived in my repo, not Vyron’s. Clause 12.7B had made sure of that.

Without the license, they had no legal right to touch my systems. Every attempt to patch was, technically, IP theft.

But Kenzie wasn’t worried.

She was on Slack calling it “a growth recalibration phase.”

That’s corporate for: We’re drowning, but we put scented candles on the raft.

She even held a town hall where she wore a sweatshirt that said #DoTheWork, claiming “resistance to culture” was the real reason deadlines were slipping.

I nearly snorted coffee through my nose.

Meanwhile, Monolith Capital had begun due diligence for the $50 million Series B.

Every spreadsheet.

Every vendor agreement.

Every process doc.

All under a microscope.

And there was no me.

No one to explain why Vendor 6A’s lead time shrank by 72 hours only if you bribed the scheduler with Girl Scout cookies.

No one to decode why payroll routed through three different approval layers.

No one to tell them the “legacy architecture” was just duct tape holding my IP together.

Investors aren’t idiots.

They started highlighting things. Literally—yellow highlighter on every missing process doc, every incomplete integration, every contract that referenced tools Vyron no longer had access to.

In the boardroom, I imagine the air smelled like panic and sugar-free Red Bull.

Meanwhile, I was at home baking banana bread.

That’s what I remember most about that week—the calm. The hum of my KitchenAid mixer. The sunlight pouring across my kitchen table. The quiet satisfaction of knowing that while they scrambled, I was in control.

Kenzie must have felt it too—the ground shifting under her designer heels.

Because suddenly, my GitHub snippets were getting pings from Vyron IP addresses. My old Medium posts were climbing in views. Even my LLC’s website, untouched for months, logged six new hits from Palo Alto.

Still, I said nothing.

No cryptic tweets.

No “told you so” texts.

Just silence.

Because the quiet ones aren’t harmless.

We’re architects.

And Kenzie was about to find out what happens when you try to burn down the woman who designed the foundation.

Part Four

It was a Thursday, one week before Vyron’s big investor pitch, when my phone buzzed with an unknown Bay Area number. Normally, I let those go to voicemail, but something about the timing made me answer.

“Hi, is this Samantha Ray?” the voice asked. Male, tight, formal.

“This is she.”

“This is Alan Brewster, outside counsel for Vyron. I was hoping—informally—to ask if you might be open to consulting on a few time-sensitive vendor matters.”

Translation: We are in trouble, and no one inside has a clue how your systems work.

I let the silence drag until I heard his nervous swallow. Then I said, calm as stone, “I’m not available for anything informal, Mr. Brewster.”

He tried to recover. “I understand. We just… have some gaps.”

Gaps. Cute word for “the entire backend is falling apart.”

I thanked him for the call and hung up. Then I poured myself a glass of scotch, the good bottle I’d been saving for a goodbye-forever kind of moment.

It was time.

From the back of my filing cabinet, I pulled out a manila folder. Inside was one crisp sheet of paper on my LLC letterhead. Dated. Notarized.

Formal Notification of Clause Activation – 12.7B

It read:

Due to my termination without cause, review, or formal documentation, this letter serves as official notice that exclusive licensing rights to the following tools, platforms, and backend integrations have been revoked in accordance with Clause 12.7B of the signed agreement between Vyron, Inc. and Ray’s Integrated Systems, LLC. Access is no longer authorized as of the timestamp of this letter’s receipt.

No drama. No threats. Just legal fact.

I placed it in a certified envelope addressed to every board member and the CEO himself. No emails. No digital copies. Paper. Tangible. A mirror they couldn’t delete.

The courier picked it up the next morning. By noon, it would be sitting on their glass conference table, waiting to detonate.

Not a bomb.

A mirror.

I didn’t need to wait long.

That afternoon, my inbox pinged with a new subject line:

Let’s Talk Acquisition. Your Terms.

I leaned back, sipping scotch, a calm smile spreading across my face.

Kenzie had thought she humiliated me with a hoodie and a juice card.

But all she’d really done was light the fuse on a clause she never bothered to read.

And in less than a week, with Monolith Capital in the room, that fuse was going to blow.

Part Five

The boardroom was all glass and hubris, twenty-seven stories above the bay. A table long enough to host a medieval feast gleamed under recessed lighting. Investors from Monolith Capital sat lined up, pens poised, folders stacked.

It was Vyron’s big day. The $50 million Series B pitch.

And Kenzie?

She was dressed like she was about to host a TED Talk on “disruptive empathy.” Cream blazer, designer heels, oversized water bottle with motivational timestamps: Crush it at 10 a.m., You’re basically Oprah at noon.

She clicked through slides with animations—animations—like she thought investors cared about PowerPoint transitions.

“Thank you for joining us,” she purred. “At Vyron, we don’t just build platforms. We architect trust.”

One Monolith associate actually raised an eyebrow, which for investors is the equivalent of shouting are you kidding me?

Kenzie barreled on. Graphs, pie charts, buzzwords stacked like a Jenga tower: “scalable empathy,” “culture-forward architecture,” “emotional throughput.”

Noticeably missing? Anything about the product.

And that’s when Gregory Watts, Monolith’s lead investor, slowly opened his folder.

Inside was my certified letter.

I was there, by the way.

Gregory had asked me to sit in, said he wanted “technical continuity” in the room. The board had been too desperate to argue.

When Kenzie saw me in the lobby, her Botoxed forehead twitched so hard it could’ve powered a lightbulb. But she smiled through her teeth, pretending I was invisible.

Now, she was mid-sentence when her phone lit up on the table: twelve missed calls from legal, two voicemails, and a group chat blowing up with red exclamation points.

Her voice cracked, just slightly. “We believe our culture is our moat—”

Gregory held up a hand. Calm. Surgical.

“Before we go further, I’d like to clarify something.”

Kenzie froze. “Of course,” she said, an octave too high.

Gregory tapped the termination memo in his folder. “This document states that Samantha Ray was terminated for negativity and cultural misalignment. Was this termination reviewed by counsel?”

Kenzie blinked. “It was a leadership call. A culture call.”

Gregory nodded once. “I see.”

Then he held up the next page. My letter. Clause 12.7B.

The room went still.

“This,” he said, “revokes all licensing rights to your core backend systems as of the date of Ms. Ray’s termination. Meaning the infrastructure you are pitching to us—your integrations, your vendor stack, your operational platform—is not legally yours to operate.”

Kenzie made a sound between a gasp and a squeak.

Gregory’s tone never rose. “You don’t own your product. You don’t own your data pipe. What you are showing us is, effectively, vaporware.”

Silence slammed down like a gavel.

The CTO buried his face in his hands.

The VP of Sales walked to the window like he was considering a long drop into startup oblivion.

The CEO—Kenzie’s father—went pale, fumbling for his water glass, missing completely.

And Kenzie?

She tried. Oh, she tried. “This is just a technicality. Samantha was toxic for morale, she—”

Gregory cut her off. “No. This is ownership. And you no longer have it.”

I didn’t gloat. Didn’t smirk.

I just sat in the back, neutral as stone, watching the weight of one forgotten clause crush an entire $50 million fantasy.

Kenzie had fired me with a hoodie and a juice card.

Now she was watching her father’s empire implode under a paragraph she never bothered to read.

And all I did was bake banana bread and wait.

Part Six

The silence in the glass boardroom wasn’t passive. It was final.

Gregory slid my letter back into his folder like a judge returning a guilty verdict. “Congratulations,” he said softly. “You just lost your company.”

Then he stood, buttoned his jacket, and walked out. No raised voice, no theatrics. Just calm, precise execution—the way serious money ends a conversation.

The investors followed. Chairs scraped, papers shuffled, but no one said goodbye. In less than sixty seconds, $50 million in funding evaporated like smoke.

The board turned on Kenzie instantly.

One director slammed his pen down hard enough to crack the table. “Why the hell didn’t legal flag this clause?”

The General Counsel, face pale, pointed directly at me. “She wrote it herself. We rubber-stamped it. It’s enforceable.”

The CFO muttered, “She warned us,” and put his head in his hands.

Kenzie flailed. “We can fix this! We’ll just—just renegotiate the license with Samantha’s LLC!”

Everyone turned to look at me.

I stood slowly, hoodie folded under one arm like a trophy. My voice was calm, even kind.

“I don’t negotiate with people who hand me a $50 gift card and call it severance.”

Kenzie’s face twisted. “You were negative! Toxic for culture! I had to fire you!”

I tilted my head. “And in doing so, you fired your infrastructure. Actions have consequences. Even pastel blazers can’t cover that up.”

I dropped the hoodie into the trash can on my way out.

Didn’t even look back.

The fallout was swift.

Monolith Capital pulled out officially within 24 hours. News of the collapsed deal leaked to TechCrunch by the end of the week. Headlines blared:

“Vyron Implodes After Losing Rights to Core Platform.”

“$50M Deal Torpedoed by Overlooked Licensing Clause.”

Investors fled. Vendors cut ties. Within a month, Vyron laid off half its staff.

Kenzie vanished from LinkedIn, her TEDx audition reel quietly deleted. The CEO—her father—resigned “to spend more time with family.” Translation: he’d been forced out.

Vyron’s office plants, the succulents she’d handed out as “emotional recalibrations,” ended up wilting in the dumpster behind the building.

And me?

I didn’t rage-post. I didn’t subtweet.

I simply renamed my LLC, launched the platform under my own banner, and signed two clients within the first quarter—one of them, deliciously, a former Vyron customer.

Sometimes revenge isn’t fire. It’s silence. It’s absence. It’s watching a company collapse under the weight of its own arrogance while you drink coffee and plan your next move.

Months later, my attorney Shelley raised a glass of wine across the bar table. “So, Sam. Any regrets?”

I smiled, calm and steady. “Only that I didn’t activate Clause 12.7B sooner.”

Checkmate.

THE END

News

Dad Demanded: ‘Where’s the $200K?’ I Froze—Then My Sister Turned Pale… CH2

Part I: Savannah always smelled like memory to me—magnolia and salt, fried batter and something warm I could never name….

He Took His Mistress to a 5-Star Hotel — But Froze When His Wife Walked In as the NEW Owner… CH2

Part One The Cortez name was once spoken with reverence. When Adrien Cortez walked into a room, people straightened their…

She shaved my daughter’s head at a family party and laughed, calling it a “prank.” CH2

She shaved my daughter’s head at a family party and laughed, calling it a “prank.” They all thought I was…

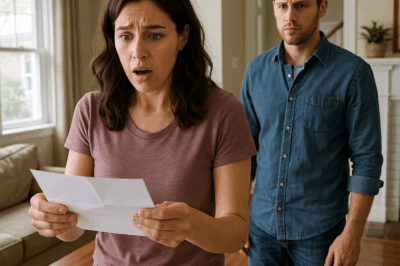

My Wife Got Home, Saw An Envelope On The Table, Opened It, And Saw That… CH2

Part One Samantha arrived home just as the sun was folding itself into the horizon. The neighborhood was quiet, children’s…

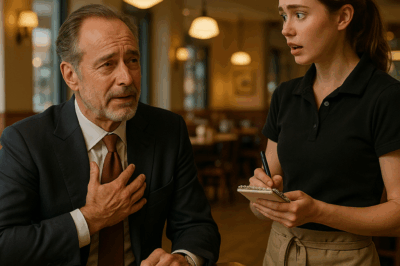

“I Only Have One Month to Live—Will You Travel With Me” the Millionaire Asked the Waitress… CH2

Part One Emily Parker thought she knew her routine by heart. Wake up in her Williamsburg apartment before dawn, walk…

My Husband Wants His Parents to Move In, Tells Me to Leave or Divorce… CH2

Part One The moment Robert told me to “go back to my parents’ house,” it felt like the floor had…

End of content

No more pages to load