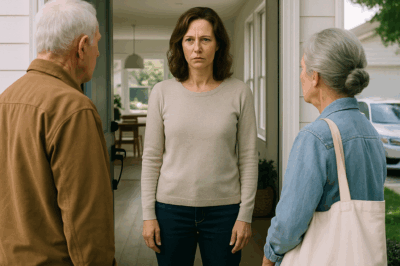

“We’re not your bank anymore,” Mom snapped, her voice sharp with smugness. Minutes later, my phone buzzed — a text from my trust manager: “Approve their $15,000 monthly allowances?” I typed one word: Denied. And just like that, their confident smiles vanished, replaced by the shock of realizing the money they counted on was gone.

Part One

The oak paneling in the study always smelled faintly of lemon oil and old paper. Afternoon sunlight poured through the tall windows, cutting across the leather spines on the shelves, and making the portraits of stern ancestors look as though they were leaning in to listen. It felt like the sort of setting a family in our position would create — respectful, curated, designed to remind you there were stories longer than your own.

We were unusually all together. Michael in his London-cut suit, Rachel fussing with a phone full of appointment reminders, Dad smoothing a hand across the table as though trying to flatten the tension with a practiced gesture. Mom had called this meeting “essential,” the word trembling with equal parts theatrical severity and control. There was the soft clink of fine china on the sideboard as the house manager moved trays and refilled things that had been half-empty for hours and years: tea, polite concern, the illusion of domestic normality.

I sat at the far end of the long table in jeans and a sweater, everything deliberately low-key. Nonprofit director, twenty-eight, unconventional. It made some of them uncomfortable. My salary — public, modest, proof of intention — was a detail they loved to quote when lecturing me about “taking life seriously.” The irony is that the way I had lived didn’t stem from immaturity. It was strategic, chosen, and part of an arrangement no one at that table could have expected.

Dad started the meeting the way he always began anything important: slow, deliberate, as though time itself needed the authority of his voice. “Before we start,” he said, “this is about fiscal discipline. We need to secure the future of the family and ensure we’re not squandering assets.”

Mom nodded and laid out spreadsheets with the solemnity of a public unveiling. “Distribution patterns are unsustainable,” she said. “Support has ballooned for many members of this family. We need accountability.”

There was an immediate blame vector glancing to me, the family’s outlier. Michael leaned in, professional instinct on his face. “Your nonprofit is admirable in theory,” he said, “but living on that salary at your age? You can’t expect perpetual family support.” Rachel, with her watch that cost more than most annual nonprofit budgets, chimed in with the trendy word: enabling. “It’s enabling behavior,” she said. “If people actually had to manage their own money, they might develop careers that support their adult lives.”

I picked at my salad while their words accumulated, each one like cold rain in a face I’d come to know intimately. They didn’t see the thing Mom didn’t know I had: the years of study, the certifications, the legal work to untangle a trust that had been lying dormant in the family’s estate planning for decades. They didn’t know I had been quietly training, quietly taking courses, discreetly getting credentials that looked ridiculous on a coffee-stained résumé but mattered enormously in the right legal filings.

Mom raised her chin. “Effective immediately,” she declared, “no more discretionary support. No rent subsidies, no car repair allowances. No more funding non-emergencies.” That knock of finality that had once belonged to Dad landed in the room as if the family had been rehearsing it for years.

Then my phone buzzed. I checked it discreetly: Whitman Trust Management. A short, administrative-looking text: Monthly allowance approvals pending: Michael Thompson $15,000; Rachel Thompson $12,000; Eleanor Thompson $8,000; Charles Thompson $18,000. Approve?

I set the phone face down on the table, the light catching its screen and doubling the weight of the moment. There was always a little thrill in the private agency of a device you controlled, the sense that you could alter the room by twenty characters on glass. They expected me to be cowed. They expected my nod. They had no idea how wrong they were.

“I have something to say,” I said, and the room turned. I typed one word — Denied — and watched as my family’s expressions tilted from confident to curious to a dawning, slow panic. Denied. I placed the phone back on the table and fixed my eyes on Dad’s face. “It appears there has been a misunderstanding about our family finances,” I said.

The door opened then and the impossible elegance of the interruption walked in: a woman in a tailored suit carrying a leather briefcase, a professional with a badge from the trust company. “Miss Thompson, I’m Patricia Williams from Whitman Trust Management,” she said, smiling faintly, apologetic for the timing but precise in her purpose. “I’m here to have Miss Emily Thompson sign some urgent quarterly trust documents.”

Everyone stared at me like someone who’d been asked to step into a play they didn’t know the lines to. Dad sputtered: “That’s absurd. I handle the family trust.” Patricia blinked, a professional pause that read, I do this every day. “There’s a misunderstanding,” she said. “The trust designates the youngest child as the successor trustee at the age of twenty-five. Ms. Thompson reached twenty-five three years ago. She has been the trustee.”

The room, which had smelled so confidently of cedar and legacy just minutes earlier, changed in a breath. Mom’s face drained. Michael laughed once, an incredulous, brittle sound, and Rachel’s phone slipped from her hand. Papers came out of the briefcase like butterflies. Patricia produced certified copies of the trust documents, legal text embossed and dry with the gravity of a notary stamp. The trust — the Thompson Family Trust established by our grandfather — was valued at nearly twenty-four million dollars and had been set up with a very specific clause: the youngest child becomes the sole trustee at twenty-five with discretionary power to manage distributions.

“You mean you’ve been controlling all the monthly allowances,” my mother whispered, not quite asking.

“Yes,” Patricia said quietly. “Ms. Thompson has been the primary trustee for three years. She has been responsible for monthly distributions, asset management, and the trust’s charitable allocations.”

My father’s hand trembled as he skimmed the contract. For thirty years he had believed the family finances were a particular kind of private throne that grew with his presence. He scanned the sentences and his temple pulsed. When he looked up, the air between us felt new and dangerous. “This is impossible. I built this company,” he said. “I ran our investments. How could she—?”

“Grandfather built an estate,” I said, keeping my voice low, the sound of a wooden mallet in a silence that had been waiting to be nailed. “And he made provisions that the youngest child — me — would become trustee at twenty-five.”

Around the table, the dominoes of entitlement began to fall. Michael’s phone went from a polite buzz to an urgent ring. Rachel’s card declined at lunch because, I explained when the banker called mid-meeting, I had placed a temporary hold on the auto-transfers pending an approval review. “All the automatic transfers are suspended,” the Whitman account manager’s voice said through the phone speaker. “We need the trustee’s authorization.”

The calm, curated center of the room split just slightly and panic flowed like water into the break. The numbers — fifteen thousand, twelve thousand, eighteen — were not small. The amount each sibling had been living on was not an accident; it had been planned into their contract with life, an expectation encoded in the way they booked vacations and leased cars and dreamed of expansions of their lifestyles.

Dad called his banker and accountant in a flurry I’d never seen him in. “Stop this,” he barked into the line. “This must be a mistake.” There was nothing the banker could do; the legal directive was clear. The trust required discretionary approval. And the discretionary approval had a face: mine.

I could have said it then and there: I’ve been the trustee, I’ve made distributions, I’ve paid for the house’s upkeep, staff payroll, and taxes. I have been behind the scenes keeping a quiet engine going while you all talked about fiscal discipline. But that was the shock on their faces: the people who thought they’d been excluded suddenly found their assumed riches lying in the hands of someone they’d scolded.

Patricia had numbers, a presentation, everything professional and deadly in its competence. “The trust has performed well under the current asset strategy,” she said. “We’ve had eighteen percent annual returns the last three years. Distributions have been sustainable with the portfolio but oversight and more formalized policies are recommended.”

“Distributions have been sustainable” — those words were the quiet engine that had kept their lives humming. “You’ve been making payments to them from trust income,” Michael snapped when he found his voice. “Why did you let them think I was in control? Why would you do this and not tell us?”

My reply was simple. “Because you threatened to cut financial support and lecture me about needed discipline.” The line between indignation and practicality narrowed like a noose. In truth, I had invested those years in learning trust law and building credentials. I had watched the portfolio and designed a model for charitable giving that would create an enduring structure beyond the immediate tastes of any single generation. My nonprofit work was not a social media affectation; it was a strategic element of preserving the family’s legacy in a way grandfather would have liked.

The room vibrated with outrage. “You can’t reassign our allowances without consulting us,” Mom said, standing suddenly small and petulant. “This family is entitled to what it has always had.” Her voice held the brittle edge of someone who had been unperturbed by money and suddenly needed it like oxygen.

I took the breath I’d practiced in moments like this and put my cards on the table. “From today forward, distributions will be restructured. Monthly allowances will be reduced and tied to documented needs and quarterly reviews. There will be required financial counseling for beneficiaries. Some property expenses will be covered only if beneficiaries demonstrate appreciation and responsible stewardship of the assets.” The words landed with the clinical finality of legalese.

They called it outrageous. They called it punishment. In the quiet of the briefcase, Patricia placed documents in front of me, the official forms — items that would be filed and logged and stamped into legal reality. I signed. Then I made another call to the private banking liaison and authorized the suspension of transfers. The sound of their card transactions failing echoed in the room like someone dropping a tray in a fine restaurant.

At some point in the meeting, the house manager came into the study with a face of thin horror. “Domestic payroll is scheduled for tomorrow,” she said, “and the funds are flagged.” The reality of the house’s life — gardeners, chefs, housekeepers who’d sustained the fabric of our days — now hung by a thread in the decisions I’d just made. Patricia and I discussed contingency plans: temporary holds, staffing support for the transition period. It would be rough; the staff would need time and notice. But notice is what we gave.

Rachel cried for reasons that had been years in the making: not just the loss of a monthly allowance, but the shock of being dependent, of always measuring success with receipts and not with the messy, hard work of meaning. Michael’s face had the color drained from it as vendors began to call about pending invoices that would not clear. Dad tried to assert the old order and found that legality was not so easily pushed back into a useful theatricality.

I remember the look Mom gave me when I told them I was redirecting five million dollars from expected family distributions into a charitable foundation under the trust’s auspices. It would become a permanent avenue for projects I cared about — transit scholarships, clinics in underserved neighborhoods, seed funding for community leaders. “You can’t do that to the family,” she said. “That money was for us.”

“That money was never just for us,” I replied. “It was my grandfather’s attempt at making our name stand for something other than inherited comfort. I’m just enacting what he asked of the trust’s successor.” The legalese sat like a coat on my shoulders: I’d been trained, licensed, and appointed. I had the authority.

We negotiated quickly because we had to: who got how much for now, which payments would be paused, how property taxes would be covered. I tied some allowances to mandatory financial counseling, which, in the room’s unanimous opinion, was insulting and punitive but also practical. If you had money to blow, you might not want to face where it had gone and why. If you wanted allowances to continue, you had to show you could steward the money.

By the time the meeting ended the oak table had witnesses to a family’s unmasking. “One more thing,” I said. “We will re-evaluate in ninety days. If the family demonstrates sincere change in behavior— budget plans, attendance in counseling, clear goals — distributions can increase. If not, we will proceed with the restructure.”

They left with wilted faces, their confident smiles replaced by something strange and raw: shock, humiliation, a specific kind of anger you get when a crutch is taken away. As I stood by the window and watched them leave, the group illusions fell like a breath from a held lung. That day the house felt like a place where old roles were being rewritten.

I went upstairs, sat by my desk in my own quiet corner of the house, and called the nonprofit director to explain delays in grant matching. I made a list of emergency measures to support staff payroll for the organization. I set up transitional funds to ensure that the household employees would not be left destitute instantly — this was not cruelty; it was a rebalancing.

The first week after the meeting rippled outward. Vendors called, friends texted; social media churned with speculation — the family’s private matters suddenly a publicized scandal in the neighborhood. Some of them plotted revenge. Michael threatened lawsuits. Rachel pleaded with me to at least extend a grace period. Dad burned bright, making statements about betrayal. Mom, quietly, called and said she was hurt. She wanted things back the way they were.

I removed myself from social feeds. I wrote memos, made phone calls, and slept poorly. There were moments of doubt. Had I been too punitive? Had I slammed a door that should have been cracked wide for renegotiation? But the truth that steadied me was grandfather’s clause: he wanted the youngest product of his lineage to be the person who would decide whether the family’s wealth would serve the family or the world. In the end, I had merely taken him at his word.

Part Two

The shock among my siblings turned to scheming. Lawyers surfaced like party guests who’d stayed too long. Michael met privately with counsel and business partners, saying his life had been “derailed.” Rachel posted carefully curated photos of herself and the kids at the park and tried, through a series of glossy filters, to appear unaffected. Dad oscillated between fury and an odd, tender nostalgia when he approached me alone on the porch and said, “Did you always want to be the one in charge?”

“I wanted to do what was right for the trust,” I told him. He looked at me like a man looking at a map he no longer knew how to read. “Your grandfather made provisions,” I reminded him gently. “It’s not personal. It’s fiduciary.”

It was, of course, personal. Money tastes like contempt and love both, depending on which side of the table you sit. What followed were weeks of legal inquiries, the trust company fielding calls, and Whitman Trust Management professionally confirming the documents. The foundation filing took longer because a charitable vehicle requires careful planning: board selection, mission statements, tax-exempt status. I wanted it to be strong, not a public relations stunt. We selected trustees that included community leaders and a small advisory committee of financial experts. We committed resources to long-term sustainable programs because I wanted the family name to mean something more than a line in a ledger.

There were formalities to follow. I set up a budget policy requiring quarterly reports from beneficiaries, a digital portal where each beneficiary would submit a simple accounting of needs and goals. I contracted financial counselors to design classes for our family, knowing they would resist but also that knowledge might be a foothold. I instituted a clause: hostile actions or attempts to undermine the trustee would trigger housing review. That was the line that got them — private squares of entitlement tied to legal consequences. It was a blunt instrument, but it was necessary.

In retaliation, Michael considered litigation. “You can’t just reassign allowances,” his lawyer argued. “This was family tradition” — as though a tradition can be legally enforced against a trustee’s discretion. I sat calmly through the consultations, mindful of precedent and documents. The trust’s language was clear: discretion rested with the trustee. As long as I could demonstrate prudence and fiduciary responsibility, the courts would be unlikely to overturn the trustee’s decisions except under extreme evidentiary burdens. The documents had been notarized; the bank had confirmed account control; legal challenge, in the end, was mostly a matter of money. Michael had money. He also had a lot to lose if the files that had been in my temporary custody came to light — logs of spending, ledgers showing patterned dependence.

What complicated things was that the trust’s assets were not just cash. Some of the portfolio was in family-owned real estate: holiday homes, rental properties, the house where we sat that afternoon. I had to balance the staff’s livelihoods and the properties’ upkeep with the moral imperative of change. The staff could not be let go overnight. So I ordered a phased restructuring: payroll would continue for three months at current levels while a retraining and reemployment program would be offered to the staff. Properties that were revenue-positive would continue to be maintained; those that were losses would be evaluated for potential sale to stabilize the portfolio. The financial counselors were not fury incarnate but practical: they helped negotiate that transition with dignity.

Outside the house, the neighborhood felt charged. People whispered about how “the heiress” had turned the family upside down. The press called several times; I declined interviews. I wanted this to be quiet work, not a spectacle to create reputation capital for the foundation. The donors we sought wanted authenticity, not drama.

Internally, the family dynamic strained in ways we could not have predicted. Michael stopped attending family dinners. Rachel’s marriage frayed under the stress. Dad retreated into a private corner of his life, speaking to his own lawyer with the weary resignation of a man whose expectation of control had been quietly dismantled. Mom, bless her, had the hardest time because she’d always seen money as the answer to every problem. Without the automatic flow, she had to face insecurity she had never named. Slowly, in her own time, she began attending the financial counseling sessions. That was perhaps the first sign things might not disintegrate completely.

The foundation launched with a modest event. I chose to keep the initial grantees local and personal — community clinics, an arts program for underserved youth, and a vehicle to support the small startups the nonprofit community needed to sustain. The garden outside the house, which had always been a private luxury, became the site of a summer scholarship fair. People came. They had questions. They thanked us. The family attended, some reluctantly, some curious. That day, the portraits on the wall seemed less like sentries and more like witnesses.

The legal phase petered out when Michael’s counsel realized that contesting the trust would cost more than he might recover and likely ruin his public image. He negotiated a settlement: his allowances would be reduced but reinstated with conditions after six months of counseling and proof of financial plans. Rachel agreed to enroll in budgeting sessions and to work with a coach to create a business plan to monetize her interested skill sets. Dad remained stubborn for months, but we had long conversations on the porch, and slowly he began to see the generational possibility in what I’d done.

Months later, the most surprising thing happened: a family meeting where none of the old theater was in force. We sat with the bank managers and the nonprofit’s advisory council and people actually listened to one another. Michael spoke — halting at first — about the fear that had driven him: the fear of not being enough, that his brother’s and sister’s choices, their different temperaments, had always made him unsure of where his place was. His confession was not an excuse. It was an attempt to be human in front of those he had injured. Rachel admitted she’d felt entitled and scared. Mom apologized without pretense. Dad, in a rare moment of softness, said, “I misread the future.”

Forgiveness, when it came, was not instantaneous. It was practical: a reentry program for regained allowances, targeted financial training, shared volunteering days at the foundation to teach stewardship instead of dependence. The foundation required transparency; beneficiaries had to be involved in showing how funds were used. It was not 100% reconciliation; it was a reorganization of family life, one that kept dignity but enforced accountability.

What I took from that time — lessons that steadied me when I lost sleep for worry — was this: wealth without stewardship becomes ruinous. And stewardship without compassion becomes cruel. My design for the trust’s future had to merge both: strictness in the rules that prevented old patterns from repeating, and generosity to help the family evolve. We had to learn how to be recipients of wealth in a way that honored past sacrifice and future possibility.

Over the next year the foundation grew slowly, deliberately. We measured impact rather than photographs. We developed a grant program for local community leaders who had ideas but lacked startup capital. We funded a clinic with a sliding scale for those without insurance. The trust’s portfolio continued to perform well because the investment staff ran it prudently. The family’s fortunes stabilized; allowances were restored on probationary terms; staff positions were maintained through reassignments and retraining. The house that had been the scene of so much drama remained ours but now had new uses: meetings, volunteer drives, study halls.

There were stubborn pockets of pain. Michael and I remained less intimate but more honest. He attended therapy and trading sessions on fiscal planning. Rachel pivoted into a small entrepreneurial venture that made her proud. Dad published an essay about family legacy that started a local conversation about what wealth should mean: inheritance or investment in the public good.

Two years later, I sat in the garden — the same sunlight through the same tall windows — but now the laughter came from a different source: children playing in an art class I’d sponsored, volunteers planting seedlings for a community farm, staff who had once worried about payroll now proudly overseeing programming. My mother stopped calling the trust “my money” and started calling it “our responsibility.” That mutational shift was not small.

The final clarity I want to give — the ending the reader asked for — is not melodrama but consequence: accountability brought change. The trust’s directives remained in place. The reduced allowances became conditional pathways to restore funds. The family, chastened and educated, remained intact enough for holidays, for conversation, and for work. The foundation became a living signpost of the choice we had made: sleep on the problem of indifference and it grows; step into stewardship and it becomes a way to make what you have last forever.

There are people who prefer the drama of fierce confrontation and revenge as storybook endings. My ending is quieter: I protected the trust, I protected the employees, and I redirected inherited privilege toward public benefit. I didn’t burn bridges for the sake of spectacle; I built new roads for the family to cross. When the dust settled, we were different: humbler, kinder, more responsible.

In the last scene, I sit in the study late on an autumn evening, the old portraits seeming less judgmental somehow. Dad is quietly in the next room, reading. Michael visits sometimes, soberly grateful in small acts. Rachel calls me to ask for advice about managing a business. Mom brings tea and sits with me without drama; she still sometimes shakes her head at my audacity but admires the results. The staff laugh in the kitchen. The foundation’s staff writes a grant report on the results of a clinic we funded. People come and go, but the house hums with a different kind of life now.

I still get texts from Whitman Trust Management asking me about authorizations. Some months I still push Denied when they ask for requests that lack purpose. Other months I approve, because stewardship is not only about limits; it’s also about trust. I learned that my grandfather was less radical than he sounded; he simply wanted someone who would wield the family’s name as a tool rather than a pillow. I became that person, imperfectly, with my own contradictions.

When asked years later whether I regretted that day at the oak table, the hubris of the decision, I say no. I made a choice to turn the family machine into a vehicle for something larger than ourselves. The ending — clear and sharp — is that the family no longer treated the trust like an entitlement and learned how to steward wealth that could do good. The staff remained employed. The properties were stabilized or thoughtfully sold to preserve the portfolio. The family dinners— once arenas of quiet competition — started to include conversations about impact and purpose. That, to me, was the clearest victory: not the denial of a text message, not the immediate shock, but the slow, tenacious movement toward a legacy that might actually last.

And on the garden table where we once had our crisis meeting, children now plant seeds each spring as part of the foundation’s educational program. They learn to wait. They learn to water. They watch things grow. The trust’s money grows too, but more importantly, so does understanding.

Part Three

Five years after the day I hit Denied, winter came in quietly.

The house didn’t look that different from the outside. Same stone facade, same careful boxwoods, same old oak out front lifting its branches toward a sky that never learned to make up its mind. But inside, the rhythms had changed.

There were color-coded calendars tacked to the kitchen corkboard now—volunteer shifts, foundation events, grant deadlines. The study that had once hosted tense family meetings now doubled as a conference room where nonprofit directors pitched ideas instead of bankers pitching products. The dining room table saw fewer catered dinners and more potlucks.

The trust reports looked different too. There were still lines of numbers, charts, and projections, but alongside “Family Distributions” there were new columns: “Community Health Grants,” “Scholarships Awarded,” “Small Business Seed Capital.”

Our last quarterly review with Whitman Trust Management ended on a simple sentence from Patricia: “Ms. Thompson, you’ve turned a passive estate into a living instrument.”

I slept better at night. Not always, but more often than I used to.

Then Mom collapsed in the grocery store.

I was at the foundation office—an old warehouse we’d renovated on the edge of downtown—when Rachel called. Her number lit up my screen, and for once I didn’t hesitate to answer.

“Em,” she said, breathless and brittle, “it’s Mom. She— she fell. They think it’s her heart. We’re at St. Andrews.”

The room around me muffled. I grabbed my coat and my keys and was in the car before rational thought caught up with my body. The drive to the hospital blurred past in a series of red lights and silent prayers.

When I reached the ER, Rachel sat in a molded plastic chair with her head in her hands, mascara smudged into gray shadows beneath her eyes. Dad stood by the wall, arms crossed, jaw clenched. He looked older than I’d ever seen him—like someone had turned down the contrast on his whole body.

“What happened?” I asked.

“She just… went down,” Rachel said. “One second she was arguing with the cashier about double coupons and the next she was on the floor.”

The image of Mom negotiating ten cents off a box of cereal while sitting on top of a trust worth tens of millions would have been funny on any other day.

“She’s stable,” Dad added quickly. “They’re running tests. There’s talk of a bypass. Or a—what was it, Rach?”

“Stent,” Rachel whispered. “Possibly both.”

The cardiologist’s words later that afternoon were a string of terms anchored to one simple reality: Mom would need surgery, soon, and it would not be cheap. Insurance covered some. Not all.

She was groggy when I first saw her, tubes in her arms, monitors blinking in soft, indifferent colors. Her hair, dyed too dark for her age, was flattened against the pillow. For a moment, I saw not the woman who had snapped at me across an oak table, but the girl she must once have been—scared, ambitious, determined not to go back to the cramped apartment she’d grown up in.

“Emily,” she rasped, when I took her hand.

“I’m here,” I said.

“Doctors… say I’m expensive now,” she joked weakly.

I smiled because she wanted me to.

“Good thing the trust has excellent healthcare priorities,” I replied.

Her eyelids fluttered. “I was so sure I’d die before I ever needed you,” she murmured.

“You’re not going anywhere,” I said. “Not yet.”

Later, when the surgeon stepped into the hall with a clipboard and a practiced frown, the words “out-of-network” and “complication risk” slid between us like unwelcome relatives.

Dad turned to me in the middle of it, instinctively, the way you turn to the person who always made the decisions in the old world. Only the old world was gone.

“What can the trust cover?” he asked, voice rough.

“Anything that falls under medical necessity,” I said. “Within reason. We’ll restructure the next quarter’s allocations to prioritize this.”

He nodded once, swallowing hard. Pride warred with terror across his face.

“Thank you,” he said, and for the first time in a long time it didn’t sound like he believed he was owed it.

The hospital asked for a deposit. The figure was large enough to make Rachel blink and Michael, who had hurried over after a court appearance, swear under his breath.

“I’ll call Whitman,” I said. “We’ll manage it.”

The call was fast. Medical emergency. Yes, authorized. Yes, I understood this meant other distributions would need to adjust.

An hour later, as we sat in a gray waiting room fogged with old coffee and new fear, Michael turned to me.

“So Mom gets a blank check,” he said. His tone wasn’t hostile, exactly—but it was edged.

“It’s not a blank check,” I replied. “It’s a necessary medical expense.”

Rachel winced. “Can we not do this right now?” she whispered.

Michael ignored her. “When I asked for help with tuition last year, I got a spreadsheet and a lecture about appropriate use of funds.”

“You were enrolling in a third degree program you didn’t need and hadn’t finished the last two,” I reminded him. “And you wanted the trust to pay for an apartment in a building that advertises itself with champagne on its homepage.”

He flinched, but he held my gaze.

“And now? Suddenly you can move things around in a heartbeat?”

“Because this is about a heartbeat, Michael,” I said, more sharply than I intended. “Not lifestyle inflation.”

He opened his mouth, then shut it again. His hand drifted unconsciously to his chest, where I knew anxiety had been living rent-free for years.

We sat in silence after that, listening to the muffled beeping and the distant squeak of nurse’s shoes on linoleum.

Mom’s surgery went well. The surgeon emerged hours later, stripped of his mask, with the tired but satisfied expression of a man who had done his job and done it well. “She’s stubborn,” he said. “That helps.”

In the days that followed, the trust bore the brunt of the bills. I adjusted the quarterly plan, fingers flying over my laptop as nurses bustled in and out of Mom’s room.

I cut discretionary distributions by another ten percent for the next two cycles. I suspended a proposed kitchen renovation at one of the vacation homes. I postponed a portfolio rebalancing that would have generated a taxable event. It was like playing chess against three versions of myself: the cautious trustee, the worried daughter, and the woman who had once been told “We’re not your bank anymore” by the very person now hooked up to monitors.

On the third day, when Mom was lucid enough to be properly cranky, she shooed Dad and Rachel out of the room and motioned me closer.

“Sit,” she said. “I hate talking up at people. Makes me feel like I’m giving orders.”

I dragged the chair closer to her bed and sat.

She watched me for a long moment, her eyes tracking every line in my face as if memorizing it.

“I meant it, you know,” she said. “Back then. When I said we weren’t your bank.”

“I know,” I said quietly.

“I thought I was protecting you,” she continued. “Thought if I cut you off, you’d be forced to make something of yourself. I didn’t… I didn’t realize I was saying I loved money more than I loved you.”

I blinked. Of all the apologies I’d quietly written for her in my head, none had been that blunt.

“You loved safety,” I said. “Money was just the tool you trusted the most.”

She snorted, then winced and pressed a hand to her chest.

“Look how that turned out,” she muttered. “Safety’s a myth. One little clot and the whole thing falls apart.”

There was a beat of silence.

“You saved me,” she said. “With that trust. With your… annoying sense of responsibility.”

“I did my job,” I replied.

“You did more than that, Emily.” Her voice softened in a way I almost didn’t recognize. “You grew up in a house where money was used to avoid hard conversations. You turned around and used it to start them.”

My throat tightened.

“Do you… regret anything?” I asked, surprising myself with how much I needed the answer.

“Daily,” she said. “But I regret one thing more than the others.”

She took my hand, her fingers thinner than I remembered, the skin cool and papery.

“I regret that you had to be the adult before I remembered how,” she whispered.

The monitors kept up their steady rhythm. For the first time, the beeping didn’t sound indifferent. It sounded like punctuation.

I squeezed her hand.

“We have… time,” I said. “To figure out how to do this better.”

“You have time,” she corrected. “I have whatever scraps the surgeon left me. Use them well, okay?”

“I’m trying,” I said.

“I know,” she replied. “God help this family if you ever stop.”

When she was finally discharged weeks later, a little weaker, a lot humbler, the trust’s statement for the quarter came in. The medical line item glared from the page, a thick vein of numbers feeding off our carefully planned distributions. But the portfolio had held. The household employees were paid. The foundation’s commitments continued. Nobody lost what truly mattered.

Financially, we had survived the first real storm since I took the helm.

Emotionally… that was more complicated.

The crisis cracked open something fragile we’d been dancing around. Rachel held onto Mom like a lifeline. Dad apologized, awkwardly, for the years he’d let money speak when words would have done better.

Michael… wobbled.

He called me late one night, the faint clink of ice in glass filtering through the line.

“Look,” he said without preamble, “I get that Mom needed the money more than I do. I’m not a monster.”

I leaned against my bedroom window, looking out at the garden bathed in moonlight.

“I didn’t say you were,” I replied.

He sighed. It was the sound of someone wrestling with something knotted and old.

“But I need you to tell me,” he continued. “Am I always going to be the one you say no to?”

The honesty in his voice undid me more than any accusation could have.

“You were the one who asked for the most,” I said. “And for a long time, you were the one least willing to hear no.”

“That’s not an answer,” he said.

“No,” I agreed. “It’s context.”

He was quiet for a moment.

“I’m starting to see a difference between being provided for and being… carried,” he said slowly. “I don’t like realizing how much of my life fit into the second category.”

“That realization is the first step to changing it,” I said.

He huffed out a small, humorless laugh.

“Did Mom’s heart attack scare you?” I asked.

“Yeah,” he admitted. “But not because I thought we’d lose the money. I mean— maybe that too, but mostly because… she’s Mom. And for a second I saw all the ways I’ve used her as a shield instead of a person.”

“We all did,” I said. “In different ways.”

He cleared his throat.

“I found a therapist,” he said, words tumbling over each other. “For financial stuff. And… childhood stuff. There’s a class Whitman recommended for beneficiaries. And a coach.”

“Good,” I said, trying not to sound as relieved as I felt.

“So if I… stick with this,” he said, “if I build something that isn’t propped up by the trust, will you—”

“Will I approve more distributions?” I finished for him, a smile tugging at my mouth.

“I was going to phrase it less like a checklist,” he muttered.

“If you do the work, Michael, I will have a lot fewer reasons to say no,” I said. “That’s the whole point.”

He exhaled, a long, shaky sound.

“Okay,” he said. “I’ll hold you to that.”

“Good,” I replied.

The call ended. I stared at my reflection in the dark window—an older version of the girl who had once sat at a polished oak table and been told she was cut off.

I thought of Grandfather’s clauses. Of how he’d built a trapdoor into the trust that none of us had seen coming. Of the way he’d entrusted the baby of the family, the one everybody underestimated, with the hardest job of all.

Later that month, a padded envelope arrived from Whitman. Inside was a slim, leather-bound booklet embossed with my grandfather’s initials. A cover letter explained: additional materials related to the trust, discovered while digitizing old files.

I sat at the kitchen table, the same one Mom had once covered in catalogs and takeout menus, and opened it.

On the first page, in my grandfather’s cramped handwriting, were three words:

“FOR THE YOUNGEST.”

He’d written it like a confession. Or a dare.

The letter that followed wasn’t legally binding. It was more like a moral codicil, a note to whatever future child would inherit the impossible job of deciding what to do with the family’s money.

He wrote about his own father—how he’d watched him hoard wealth like a dragon, how neighbors had gone without while their pantry overflowed.

He wrote about shame. And fear. And how money had been used as both a sword and a shield in their house.

“You will be told that you owe your family everything,” he wrote. “You do not. You owe them honesty. You owe them fair dealing. You owe them the courage to say no when yes would be easier. Above all, you owe the world more than you owe any one of us, because the world didn’t get to choose what you were born into. You did nothing to earn this. Your job is not to enjoy it. Your job is to aim it.”

I closed the booklet with a shaky breath.

Aim it.

The next day, at a foundation board meeting, I quoted that line. I didn’t tell them where it came from. I just said, “What we have here is not a trophy. It’s a tool. Let’s aim it.”

The room nodded.

The seed of another thought took root that week, one that I tried not to water but kept thinking about anyway.

What happens when I’m no longer the youngest? When the trust’s absurd little clause picks a new target?

Because in a family, “youngest” isn’t a fixed state. It’s a temporary position.

And the world, unlike a bank account, refuses to stop changing just because you’d like a minute to catch your breath.

Part Four

It happened, as these things often do, on a birthday no one expected to matter.

My niece, Lily—Rachel’s daughter—turned twenty-five on a Sunday in June. The party was small. She’d insisted on that. No rented ballroom, no string quartet, no ice sculpture shaped like our family crest. Just a backyard, a charcoal grill, and a mismatched collection of lawn chairs that testified to the fact that Rachel now cared more about comfort than catalog spreads.

I watched Lily move among her friends and our family, easy and unselfconscious, a plastic cup in one hand and a lopsided paper crown on her head. She hugged Mom, whose hair had grown in thinner and softer since the surgery. She teased Michael about his dad jokes. She took a selfie with Dad, who pretended to object but secretly loved it.

She had my brother’s quick smile and my sister’s stubbornness. She also had something none of us had at twenty-five: a clear-eyed understanding that money was neither magic nor monster. Just a thing that could help or harm depending on who held it.

She’d grown up in the middle of our family’s reformation. She’d watched allowances shrink and then stabilize. She’d seen her parents sit through budgeting workshops and therapy sessions. She’d volunteered at the foundation since she was fourteen, stuffing envelopes and loading vans, then later evaluating grant proposals with a seriousness that impressed even Patricia.

At twenty-two, she’d taken a job at a community development credit union across town, the kind of institution that looked at people banks called “high-risk” and saw potential instead of problems. Her salary was a fraction of what she could have earned walking into any of the firms that would have hired her for her last name alone. She didn’t care.

“I want to sit at tables where people talk about resilience, not just returns,” she’d told me once, stirring cream into her coffee at my kitchen island.

Now, as the sun began to sink and the fairy lights flickered on around the yard, my phone buzzed in my pocket.

WHITMAN TRUST MANAGEMENT, the screen read.

I stepped away from the noise, toward the side of the house where the hydrangeas grew wild and unruly. The air smelled of charcoal, cut grass, and the faint sweetness of the cake cooling on the counter inside.

“Ms. Thompson,” Patricia’s calm voice came through the line. “Sorry to intrude on a Sunday. But one of the trigger clauses in your grandfather’s trust just came into effect.”

My stomach did a small, unpleasant somersault.

“Let me guess,” I said. “The ‘youngest child reaches twenty-five’ time bomb.”

“Precisely,” Patricia replied. “The trust stipulates that upon the twenty-fifth birthday of the youngest descendant in the primary line, the current trustee must either confirm their continued stewardship with a written declaration or initiate a succession process.”

I leaned back against the siding, feeling the rough texture through my shirt.

“And ‘youngest descendant in the primary line’ is… Lily,” I said.

“Yes,” Patricia confirmed. “We can file a simple affirmation if you intend to continue as sole trustee. Or, given the work you’ve done with the foundation and the family’s current stability, you may choose to begin grooming a successor.”

I could hear, beneath her neutral tone, the weight of the choice.

“Does the trust say the successor must be the youngest?” I asked.

“No,” she said. “The clause is… suggestive, not prescriptive, in that regard. Your grandfather liked to create… pressure points, not straightjackets.”

I almost laughed.

“Of course he did,” I muttered.

“We don’t need an answer today,” Patricia added. “But we’ll need one on record within the next six months to stay compliant with the review schedule.”

After I hung up, I stayed outside for a long minute, staring at the way the last of the sunlight caught on the edges of the yard. Children shrieked with laughter near the sprinkler. Someone turned the music up a notch. The house, my grandfather’s monument and my parents’ fortress and my accidental office, glowed like an anchored ship.

“Are you hiding from the party or plotting world domination?” Lily’s voice drifted around the corner.

I turned to see her, barefoot in the grass, crown askew, eyes bright.

“A little of both, probably,” I said.

She came to stand beside me, shoulder bumping mine.

“You okay?” she asked.

“Whitman called,” I said. “About the trust.”

She groaned dramatically. “Please tell me there’s not another clause about someone having to marry into royalty or name their firstborn after Great-Grandpa.”

“Worse,” I said. “It’s about succession.”

Her eyes widened. “Like… who gets to be you when you retire?”

“Something like that,” I replied.

She looked out at the yard for a long moment, chewing on the inside of her cheek—a habit she’d had since childhood.

“Do you want to stop?” she asked finally.

The question startled me.

“No,” I said. “I mean… not yet. I’m tired sometimes. But this isn’t just a job. It’s a… calling. Your great-grandfather gave us a loaded gun and told us to build a garden. I can’t exactly walk away without making sure the safety’s on.”

“That is a deeply weird metaphor,” she said. “But I get it.”

“You turned twenty-five,” I said. “That makes you eligible, in a way, to be… next.”

She snorted. “Congratulations to me?”

“I’m serious,” I said. “You grew up watching us make every mistake in the book. You chose work that aligns with what the trust has become. People already listen when you talk about money and justice. You’d be good at it.”

She was quiet long enough that the muffled strains of the birthday song from inside floated out and faded again.

“When I was thirteen,” she said finally, “and you turned off Mom’s shoe budget, I thought you were a sadist.”

“I remember,” I said. “You left a note in my mailbox that said, ‘You’re ruining fashion AND my life.’”

“It was true,” she said. “But then you took me to that community center you funded. You pointed at the roof that didn’t leak because of the trust’s money and said, ‘Pick: twelve more pairs of heels or a roof when it rains.’”

“Did I really say it that bluntly?” I asked.

“You were going through your Dramatic Aunt phase,” she teased. “But it worked. I’ve been thinking in either/or questions ever since.”

She drummed her fingers against her plastic cup.

“I don’t know if I want your job,” she admitted. “I like my job. I like sitting across from people and helping them figure out how to keep their houses or pay off a loan shark. Being trustee seems like… one long moral calculus problem with everyone you love on the board.”

“That’s not an inaccurate description,” I said.

“But,” she continued, “I also know that if some distant cousin swoops in and treats the trust like their personal ATM, I will spontaneously combust.”

“That’s also a valid concern,” I said.

She looked at me then, eyes very clear.

“Do you trust me?” she asked.

“Yes,” I said, without hesitation.

“To be a good trustee someday?” she pressed.

“To be a better one than I was at your age,” I replied. “And probably a better one than I am now, eventually.”

She let out a slow breath.

“Then maybe we should… try,” she said. “A co-pilot thing. You teach me where all the skeletons and spreadsheets are buried. I learn how to say no without setting the curtains on fire. In a couple of years, if we both don’t hate it, you can start handing over the keys.”

I hadn’t realized how tense my shoulders were until they sagged in relief.

“You sure?” I asked.

“No,” she said honestly. “But I’m willing.”

Sometimes, that’s the only kind of certainty you get.

We went back to the party and ate cake. Lily opened presents—books, a secondhand bike she’d had her eye on, a set of noise-canceling headphones from Michael that made her shriek with delight. No one presented her with a crown and a contract, but the weight of what we’d just discussed hummed quietly between us.

A week later, I called Patricia.

“We’ll need to draft a co-trusteeship agreement,” I said. “With me as primary for now, but Lily as successor-in-training.”

Patricia sounded almost… pleased.

“I’ll have the paperwork ready by Friday,” she said. “Your grandfather would approve, I think. He always believed in tension as a teacher. Shared authority carries its own discipline.”

Tension as a teacher. Shared authority as discipline. The man really had been a poet of control.

The first six months of co-trusteeship were… messy.

Lily asked questions I’d never thought to ask at her age. Why were the investment managers all from the same handful of firms? Why wasn’t there a cap on how much any given family member could receive over a five-year period? Why did some of our legacy holdings sit in companies whose values clearly clashed with the foundation’s mission?

“You’re right,” I said more often than I liked.

We divested from a handful of funds that quietly profited off the very predatory lending practices her credit union spent its days combating. We moved part of the portfolio into community development financial institutions. The returns were slightly lower on paper. The returns in sleep-at-night quality were markedly higher.

We overhauled the beneficiary education program. Instead of mandatory but perfunctory lectures, Lily designed interactive workshops. She brought in speakers who weren’t from our world—teachers, nurses, social workers, people whose lives brushed against the sharp edges of inequality every day.

“Trusts don’t exist in a vacuum,” she told the family one Saturday morning as they sipped coffee and tried not to look resentful about being indoors. “They exist in an economy. When we benefit, it’s not neutral. Someone else bears the weight of that structure. Our responsibility is to make sure we’re not adding to that weight.”

Michael shifted in his seat and then raised his hand.

“What are the chances we could have heard this lecture before we were forty?” he asked wryly.

“Blame the boomers,” Lily shot back, jerking her thumb at her mother and grandparents.

“Hey,” Mom said, but she was smiling.

There were conflicts. Of course there were.

When the market dipped hard one year, Rachel panicked. “We’re losing everything,” she cried, staring at the red lines on the quarterly report.

“We’re not,” Lily said calmly. “We’re weathering a correction. We bought on the way down in sectors we believe in, cut discretionary distributions slightly, and adjusted the grant cycle so we’re not overcommitted. That’s not losing. That’s… breathing.”

Mom watched her granddaughter lay out the strategy with charts and patient explanations. She turned to me later and whispered, “She sounds like you.”

“No,” I said, watching Lily explain bond ladders to Michael as if she were teaching a child to ride a bike. “She sounds like who I wanted to be at her age.”

The real test came when a distant cousin—one of those branches of the family tree that only shows up for weddings and wills—filed a petition to challenge the trust’s charitable allocations.

“This money was meant to support the Thompson line,” his lawyer said, sitting across from us in a conference room downtown. “Redirecting such a substantial portion to outside causes violates the spirit of the estate.”

We’d expected this might happen someday. Success breeds scrutiny, and our foundation had become surprisingly successful.

At the hearing, our attorney laid out the documents. The original trust language. The codicils. The letters my grandfather had written. The growth charts that showed the portfolio thriving even with increased charitable giving.

Then Lily testified.

She spoke about legacy. About intent. About the fact that my grandfather had written “aim it” in his own hand decades before any of us understood what that could mean.

“The trust has done more than keep a few of us in nice houses,” she said, her voice steady in the quiet room. “It’s kept clinics open. It’s put kids through college who would never have seen a campus. It’s funded small businesses that have brought jobs to neighborhoods banks literally drew red lines around. If that violates the ‘spirit’ of the estate, maybe the spirit needs exorcising, not indulging.”

The judge, an older woman with bags under her eyes and a wedding ring worn thin, studied her for a long moment.

“Your grandfather wrote this clause,” she said, tapping the paragraph that gave the trustee full discretion over distributions, “when the world looked very different. It seems to me he trusted the youngest generation to know more about what the world needed than he did.” She paused. “Petition denied.”

We won. Quietly. Without headlines. The cousin grumbled and peacocked online for a while, but the legal victory stood.

Afterward, in the hallway outside the courtroom, Lily leaned her head against the cool marble wall and let out a long breath.

“My legs were shaking so hard up there I thought I’d pass out,” she said.

“You did great,” I said.

“I almost quoted you,” she admitted. “About the gun and the garden. But I figured that might be a bit much for a judge.”

“Yeah,” I said. “Save that for your memoir.”

She laughed, then sobered.

“Do you ever get used to having this much power?” she asked.

I thought about that. About the days my finger hovered over the Approve or Denied button. About the nights I lay awake wondering if I’d done enough, or too much.

“No,” I said. “And I’m not sure you should.”

Years later—because time, like compound interest, does its thing whether you watch it closely or not—I found myself back in the study with Patricia, a sheaf of papers on the oak table between us.

My hair had more gray in it. My knees protested when I climbed stairs. The foundation had a staff of twenty. The trust’s value had grown, but so had the list of people who’d benefited from it beyond our family.

We were signing the documents that would make Lily the primary trustee.

“You know you can keep the title as long as you like,” Patricia said gently. “Co-trusteeship is working. There’s no rush.”

“There is,” I said. “I’ve seen what happens when people hold on too long just because they’re afraid of what comes next. I don’t want to become the thing I fought.”

In the next room, I could hear Lily talking to Dad and Mom. She’d brought charts. They asked questions. The tension that used to crackle around the word “money” had mellowed into something closer to curiosity.

I picked up the pen. My hand shook a little. I signed.

“Congratulations,” Patricia said. “You’ve just demoted yourself.”

“Oh, thank God,” I replied.

That night, we had dinner—just family. No board members, no advisors, no donors. Mom made lasagna, stubbornly ignoring our offers to help. Dad opened a bottle of wine he’d been “saving for a special occasion” for so long that we’d all forgotten it existed.

Lily stood up at the end of the meal, cleared her throat, and raised her glass.

“To Aunt Emily,” she said. “Who turned ‘We’re not your bank anymore’ into ‘We are stewards, not owners.’ Who taught us that Denied isn’t cruelty when Approve would be cowardice. And who trusted me enough to let go before she had to.”

My eyes stung.

Mom clinked her glass against mine.

“I was wrong,” she said quietly. “About a lot of things. Especially that day in the study.”

“I know,” I said.

“If I could go back,” she continued, “I’d say something different.”

“What?” I asked.

She thought about it.

“I’d say, ‘We’re not your bank anymore, Emily. We’re your family. Maybe it’s time you became ours, too.’”

I laughed, a wet, helpless sound.

“It took us a while,” I said. “But I think we got there.”

Much later, after the dishes were done and the house had emptied, my phone buzzed on the nightstand.

A notification from Whitman lit up the screen.

REQUEST: Increase quarterly discretionary distributions for Rachel Thompson by 20% to support expansion of her small business.

The text had gone to both trustees now. Lily was listed as “Primary – Pending Approval,” me as “Senior Co-Trustee (Advisory).”

I watched, amused, as the little “Lily is typing…” indicator popped up in our shared decision thread.

Her response appeared: APPROVED – CONDITIONAL. SUBJECT TO RECEIPTS AND SUBMISSION OF 18-MONTH BUSINESS PLAN.

A second later, she added a note: “Also subject to Mom agreeing not to use funds on weird crystal-infused water dispensers for the shop.”

I snorted.

Then another notification.

REQUEST: Extend temporary housing support for former household gardener during his transition to new job.

Lily’s reply: APPROVED. HE KEPT THE ROSES ALIVE THROUGH THREE GENERATIONS OF OUR DRAMA. WE OWE HIM.

I lay back against my pillow, phone on my chest, heart strangely light.

There would be more requests. More hard calls. More nights when Lily stared at the ceiling wondering if she’d done the right thing. More months when the market did something stupid and we had to scramble to adjust.

But the machine my grandfather built, the one my parents had used like a private vault, had become something else.

Not a bank.

Not a throne.

A tool.

A legacy aimed outward.

People like tidy endings. They like stories where the villain sees the error of their ways overnight, where the heroine makes one bold move and everything falls into place.

My story doesn’t end like that.

It ends with a text tone and a quiet house and the knowledge that the work goes on after you put the pen down.

It ends with my mother asleep down the hall, her once-smug voice now softened by gratitude. With my brother raising his kids on a budget he actually understands. With my sister running a small, thriving business instead of living on autopilot. With staff who stayed, not because they were trapped, but because they were valued.

It ends with my niece holding the weight I once carried and not flinching.

And sometimes, when my phone buzzes, I still see the first message that started it all in my mind’s eye.

Approve their $15,000 monthly allowances?

I remember the stunned faces around that table. The way their smiles collapsed when they realized I’d said Denied. The way it felt to pull the plug on a story that had been running without question for decades.

If I had to live it again, I would still press the same button.

Not out of spite.

Out of love.

Because we were never meant to be each other’s banks.

We were meant to be something harder, and better.

Family.

THE END!

Disclaimer: Our stories are inspired by real-life events but are carefully rewritten for entertainment. Any resemblance to actual people or situations is purely coincidental.

News

My Sister Hired Private Investigators to Prove I Was Lying And Accidentally Exposed Her Own Fraud…

My Sister Hired Private Investigators to Prove I Was Lying And Accidentally Exposed Her Own Fraud… My sister hired private…

AT MY SISTER’S CELEBRATIONPARTY, MY OWN BROTHER-IN-LAW POINTED AT ME AND SPAT: “TRASH. GO SERVE!

At My Sister’s Celebration Party, My Own Brother-in-Law Pointed At Me And Spat: “Trash. Go Serve!” My Parents Just Watched….

Brother Crashed My Car And Left Me Injured—Parents Begged Me To Lie. The EMT Had Other Plans…

Brother Crashed My Car And Left Me Injured—Parents Begged Me To Lie. The EMT Had Other Plans… Part 1…

My Sister Slapped My Daughter In Front Of Everyone For Being “Too Messy” My Parents Laughed…

My Sister Slapped My Daughter In Front Of Everyone For Being “Too Messy” My Parents Laughed… Part 1 My…

My Whole Family Skipped My Wedding — And Pretended They “Never Got The Invite.”

My Whole Family Skipped My Wedding — And Pretended They “Never Got The Invite.” Part 1 I stopped telling…

My Dad Threw me Out Over a Secret, 15 years later, They Came to My Door and…

My Dad Threw Me Out Over a Secret, 15 Years Later, They Came to My Door and… Part 1:…

End of content

No more pages to load