My Sister Got Me Fired, Then My Family Demanded Money When I Found Success. What They Got Instead…

Part 1

The message on my phone felt like a physical shove.

Miss Hall, please come to my office immediately.

For someone who prided herself on being the steady, reliable person people could count on, being summoned felt like a small blaring alarm: something had gone wrong.

My name is Isa Hall, and for five years I’d been a senior account manager at Morgan & Pierce. I’d taken calls at midnight, smoothed client meltdowns, and babysat impossible timelines until everything landed gently where it was supposed to. I showed up early, kept promises, and let other people—my family—be dramatic on their own time. I had a master’s in business administration and a carefully built reputation. I did not expect my sister to weaponize “concern” and hand me an envelope of lies.

Fernando’s office smelled faintly of expensive cologne and coffee gone cold. He looked at me with that expression managers wear when they’re about to say something impossible: chin tilted with faux compassion, jaw clenched like the words hurt him too.

“Sit down, Isa.”

I sat.

He slid a printout across the desk. My name was bolded in the header of the email. The paper felt heavier than it should have.

“This morning we received a call,” he said, “from a woman who identified herself as your sister. She alleged you have a substance abuse problem, that you attend client meetings intoxicated, and that you… steal company property.” He grimaced. “Given the severity of those claims, and the potential liability with certain clients, the board has decided to terminate your employment effective immediately.”

The letters on the page blurred, then snapped back into focus.

“I—what?” It was not the polished, professional response I would have written for a client. It was raw, startled. “Fernando, I’ve never—no one has ever—there’s no record of anything like this because it has never happened.”

“I know,” he said. “Your performance reviews are stellar. There are no complaints on file. But with Riverside and Halpern under our roof, we can’t risk—” He trailed off, folding his hands. “The decision’s been made.”

My throat burned. “So a voice on the phone, with no evidence, outweighs five years of work?”

He looked away. “You can talk to HR about severance,” he said. “They’ve been instructed to offer you two weeks.”

Security appeared forty minutes later, two men I’d chatted with over coffee, suddenly formal. They walked me to HR while people at their desks pretended not to watch. My colleagues’ faces were a mix of curiosity and that particular kind of sympathy reserved for someone whose life is falling apart in real time. No one asked what happened. That would come later, in hushed conversations that would start with, “Did you hear…?”

HR slid a thin folder across another glossy desk. Forms. Signatures. A list of “company property” to be surrendered. I turned in my badge and my laptop. The only thing I took out of Morgan & Pierce was a cardboard box containing a mug, a plant, and a framed photo of a team I was no longer part of.

I called my sister from the parking garage, the concrete echoing my footsteps.

She answered on the second ring, her voice bright and sing-song. “Sis! What’s up? Did you finally spice up your life?”

“I got fired, Victoria,” I said. My voice sounded far away, even to me. “Someone called and told them I was an addict. That I stole from the company. They said it was you.”

She laughed. Actually laughed. “Oh my God, are you serious? That was a prank. You didn’t… they didn’t actually—”

“They did.”

Silence. Then, “Okay, wow, they’re more uptight than I thought. Isa, you take everything so seriously. It was just a joke.”

The words hit harder than Fernando’s had. There’s a peculiar kind of betrayal in someone laughing at the size of the grenade they casually lobbed into your life.

“Why would you do that?” I asked.

“Because you’re boring,” she said. “You’re always working. You missed Mom’s birthday because of a ‘client dinner.’ You missed Quinn’s show. I was trying to—wake you up a little.”

“I liked that job.” My voice shook. “It paid my bills. It helped you, when you ‘forgot’ your car note last month. It helped Quinn when his credit cards maxed. I have been waking up at five in the morning for years to keep us all afloat, and you thought it was a good idea to call my boss and accuse me of theft?”

She sighed, the dramatic kind. “You’re being so intense. Mom’s going to tell you the same thing. Chill.”

Mom did call, twenty minutes later. Not with concern. With annoyance.

“You have got to learn to take a joke,” she said. “You know how your sister is.”

“Unstable?” I suggested.

“Creative,” Mom corrected sharply. “Maybe this is the universe telling you to try something new. Victoria’s friend needs help at her boutique. Wouldn’t it be nice to work together? Something less… stressful.”

There it was, the lifelong script. Victoria as the blazing center of our family solar system, everyone else orbiting, adjusting, putting in the work to keep her shining. Me as the stabilizer, the one who covered overdrafts and car repairs and spontaneous “investments” in Quinn’s next sure thing.

But this time, the script snagged on something.

The anger that surged up in me wasn’t small. It was hot and clear.

“I just lost my income because your daughter thinks sabotaging my career is a prank,” I said. “Maybe the universe is telling me something else.”

“What’s that supposed to mean?” Mom asked, wounded.

“It means don’t call me about jobs at boutiques,” I said. “It means I’m going to figure this out without you. I’ll call you when I can.”

I hung up before she could start crying.

For a day and a half, I let myself be wrecked.

I sat on my couch in my small, overpriced apartment; I watched old episodes of shows I didn’t care about; I ate crackers for dinner; I stared at the ceiling at 3 a.m., doing the math of my savings versus my rent versus my student loans. I let myself feel the humiliation, the fear, the faint, sick suspicion that Morgan & Pierce had been looking for any excuse to trim senior salaries.

And then, because panic is not a sustainable strategy, I opened my laptop.

I updated my resume. I wrote a polite but truthful email to a headhunter I’d met at a conference: “…unexpectedly available, strong in client retention, particularly in legacy accounts like Riverside…”

Riverside. They were the crown jewel of my old firm, an industrial giant with a temperamental CEO and a habit of changing agencies every few years in a flourish of press releases. I’d spent three years learning their moods, anticipating their needs, keeping them happy enough to renew.

Within a week, I had three preliminary interviews. Two were with companies using words like “synergy” and “family culture” as wallpaper over fluorescent despair. The third was Stuart & Associates, a mid-sized firm with sharp edges and sharper people.

Larry Ford, their managing partner, wore a navy suit and the kind of smile that knew how much it was worth. He’d read my resume, background highlighted.

“Why us?” he asked, pen poised.

“Because you poached Halpern from Morgan & Pierce,” I said. “Because you understand legacy clients. Because I’m not looking for a consolation job. I’m looking for a place where the fact that I care too much is an asset, not something my family mocks.”

His eyes flicked up. “Family?”

“My sister called my old firm and told them I was stealing,” I said. “As a joke. They believed her. I’m not telling you this for sympathy. I’m telling you because my loyalty is a choice. The next place I land, I will build something that belongs to me as much as to them.”

He leaned back, studying me. “Tell me what you did when Riverside threatened to walk last year.”

I did. I laid out my strategy, the timeline, the preemptive analysis I’d done of their competitors. I watched his posture change as I talked about retention numbers.

Two days later, the offer came. The salary was nearly double what I’d been making. The bonus structure was real, not some vague promise in a handbook. There was a signing bonus.

I took it.

When I walked into Stuart & Associates on my first day, past a reception desk that did not yet know my story, I felt something I hadn’t felt in a long time: potential that wasn’t tied up in keeping other people afloat.

That should have been the end. But families have an apprentice-level understanding of heat-seeking, and mine could smell new money like blood in the water.

A week after I announced my new job on LinkedIn, the family group chat lit up like a pinball machine.

Mom: My brilliant girl!!! So proud of you. God provides.

Dad: Congrats, kiddo. We always knew you’d land on your feet.

Victoria: Guess the universe DID have a plan lol. Drinks on you now!

Quinn: Damn, big sis. That salary… 👀

I smiled at my phone, just a fraction. Then they started circling.

Mom: Kitchen cabinets are falling apart, you know. Your father’s been putting it off for years. Would be nice to redo before the holidays…

Victoria (private text): Babe, my gallery commission is delayed and rent is a beast this month. Can you float me 2k? Just for a week. Promise.

Quinn: The bank is threatening to tow my car. Can you help? Just this once.

The resentful part of me wanted to fire back: Just like you “helped” me with my career?

The bookkeeper in me, the one who had been quietly tracking every dollar I’d ever lent them, opened the notebook I kept in the back of my closet. A spiral-bound ledger of every bailout, every “small” loan, every “I’ll pay you back when I get my bonus.”

It wasn’t just about the money. It was about the story all those little withdrawals told:

– $600 for Victoria’s “emergency” vet bill that turned out to be a weekend trip.

– $1,200 for Quinn’s “business investment” that became a sports betting app deposit.

– $300 here, $500 there, for utility bills my parents “forgot” to pay while never missing a single dinner out.

The anger sharpened into something cooler. Calculated.

I opened my laptop, created a folder called FAMILY. Into it went screenshots of bank transfers, texts asking for money, emails from my parents with subject lines like “Do you have a minute? It’s important.”

Not because I needed revenge.

Because I knew my family. If I said, “You’ve taken advantage,” they’d say, “We’re family, we help each other.” If I said, “I can’t keep lending,” they’d call me selfish. If I simply stopped, they’d paint me as cruel and ungrateful, rewriting history in their favor.

Paper doesn’t argue.

So I let my practical side take the lead. I drafted four letters.

Each began the same way.

Dear [Name],

This is not a letter I enjoy writing. But I need to put into words some realities I’ve been glossing over for years.

For my parents, I listed dates and amounts: the times I’d covered their second mortgage payment, the “temporary” bridge for Dad’s business that had never been repaid. I attached statements. I highlighted that the last time they’d asked for money, they’d been on a cruise two weeks later.

For Quinn, I listed his “emergencies” and the deposits I’d found to online betting companies around those dates. I wrote, gently, that I loved him, that I was worried, that continuing to bail him out was helping his addiction, not him. I ended with a paragraph about Gamblers Anonymous and the number of a counselor my friend had recommended.

For Victoria, I printed the email I’d received from Fernando: …call from your sister, accusing you of substance abuse… termination effective immediately. I attached the screenshot of her laughing text. Then, beneath it, the list of times I’d paid for her car note, her credit card, her studio rent.

At the end of each letter, I wrote some version of the same thing:

Going forward, I will not be lending money to family members. Any help I offer will be through formal work or mutually agreed-on arrangements, not bailouts. I’m doing this because I love you, and because I refuse to be an accomplice to our worst habits any longer.

I printed them, signed them, and mailed them certified mail. I wanted proof of delivery. Proof that the truth had landed.

Then I went back to work.

At Stuart & Associates, I spent my days immersing myself in clients and strategy decks and nervous boardrooms. At night, my phone lit up with notifications from the Postal Service. Delivered. Signed for.

Victoria’s letter landed first. I imagined it in her hands, opened with the theatrical flourish she brought to everything.

Her reply was a barrage of texts.

Are you insane?

You’re going to DOCUMENT this?

What if someone SEES?

You’re making me look like a monster.

I didn’t respond immediately. When I did, I kept it simple.

Isa: Everything in that letter is true. If you disagree with any of it, show me where.

Her typing bubble appeared, disappeared, reappeared.

Victoria: You’re punishing me for a joke.

Isa: I’m holding you accountable for the fallout.

She didn’t reply to that.

My parents’ letter landed two days later. Mom called within ten minutes.

“What is this?” she demanded, voice low and tight. I could hear the clink of a wine glass in the background. “These… attachments. These numbers. Are you really keeping track?”

“Yes.”

“For how long?”

“Years.”

“Oh my God, Isa,” she breathed. “We raised you to be generous. To be family-oriented. And you… what, kept a ledger?”

“You raised me to be responsible,” I said. “And when you needed someone responsible, you called me. I answered. But this isn’t just about generosity. It’s about the fact that you took thousands of dollars from me while telling me I was selfish when I tried to set boundaries.”

“How dare you.”

“I’m not asking you to pay it all back,” I said. “I’m telling you it can’t keep happening. If you want a new kitchen, talk to a financial planner. Don’t call your daughter like she’s a credit card.”

Dad’s response came a week later. A short email.

You’re right. We need to look at our spending. I’m not proud of what those statements show. Let’s talk when your mom has cooled off.

Quinn’s texts surprised me the most.

Got your letter.

You really kept track of all that, huh?

I’m not mad. I’m… embarrassed.

I think I have a problem.

Isa: I think you do too.

Quinn: Will you help me find someone?

I sent him the number to the counselor.

In the midst of all this, my life at work settled into something almost comfortable. Larry noticed the Riverside account’s numbers ticking upward. At a partner’s meeting, someone joked that stealing me from Morgan & Pierce had been the best ROI of the year.

When Larry later told me they were considering me for a fast track to partner—not ten years from now, but in five—I thought, briefly, about calling my mother to tell her. Then I remembered her last message, full of accusation, and decided to wait.

Success did what it always does: it amplified everything.

To the people who valued me, it was a validation. To my family, it was a resource.

Mom: We’re so proud of you. We always said you were the smart one. You should spoil yourself. And us a little too. We sacrificed a lot, you know.

Victoria: Wow, partner track? You’re like… rich now. Remember when we used to plan owning a café together? We could still do something like that. You invest, I run it.

Quinn: I’m three weeks clean. Just saying. 🙂 (Also car insurance is due, but I’m not asking, just kidding, unless you’re offering.)

I stared at the flood of messages.

The old me would have gone into triage mode—assessing, prioritizing, sending money with a knot in my stomach and a justification in my head.

The new me opened my business plan.

My long-term goal had never been to die at someone else’s firm. I wanted my own. I wanted Hall Strategies to be a real sign on a real door. Not because I needed my name on something, but because I wanted control. Over my time. Over my money. Over who benefitted from my work.

I built a runway. I saved aggressively. I networked quietly. When I told Larry I eventually wanted to branch out, he didn’t flinch.

“If you’re going to leave, I’d rather be the one who helps you do it,” he said. “So you remember whose name to drop when someone asks, ‘Who believed in you?’”

A year after Victoria’s “prank” cost me my job, I handed in my resignation to Stuart & Associates and opened Hall Strategies LLC in a one-room office with terrible carpet and the best natural light I’d ever seen.

I expected my family to be offended that I’d told them after the fact. They surprised me.

Mom came to see the office. She looked around, touched the plant on the windowsill, traced the cheap glass of the framed Hall Strategies sign.

“I didn’t realize,” she said quietly, “how much you had in you. I always… thought of you as the practical one. The… helper.”

“That’s part of it,” I said. “It’s not all of it.”

She nodded, eyes shiny. “I’m sorry we didn’t… I’m sorry we weren’t proud out loud sooner.”

It was not perfect. It was not complete. But it was something.

My sister’s reaction was different. Less reflective.

“Congrats,” she said, hugging me and smelling, as always, faintly of expensive perfume. “Now you can finally invest in my idea without a boss breathing down your neck.”

I pulled away. “No.”

She blinked. “No?”

“I’m happy to hire you,” I said. “As a contractor. Social media. You’re good at that. I’ll pay fair market rates. We’ll have a contract. Scope, timeline, deliverables. But I’m not bankrolling any business I don’t control.”

“You don’t trust me,” she said, hurt flaring.

“I don’t trust your follow-through,” I said, gently. “Yet.”

She tossed her hair, rolled her eyes, but a few days later, she sent me a polished proposal. We negotiated rates, she signed the contract, and after a few bumpy starts, she delivered.

Payment, earned, not given, hit her account two weeks later.

“That felt… different,” she admitted over coffee. “Not like… charity.”

“Because it wasn’t,” I said.

As for Quinn, he kept going to meetings. He took a job at a boring logistics company and found, to his own surprise, that boring sometimes felt like peace.

He stopped asking for loans.

When he needed help, he called to ask if I’d look over his budget instead.

The money my family had wanted from me—the easy, no-strings-attached wire transfers they’d come to treat as a right—never arrived again.

What they got instead, slow and stubborn, was structure. Contracts. Invitations into my success with conditions, not entitlements.

And to my own genuine astonishment, many of them rose to meet those conditions.

Part 2

Three years after the “prank,” I was sitting in a conference room in midtown, glass walls reflecting back a version of myself I barely recognized from the woman who had walked out of Morgan & Pierce clutching a cardboard box.

Hall Strategies had grown from a one-room experiment into a small, scrappy firm with eight employees and a roster of clients that actually paid their invoices on time. We specialized in what I knew best: helping professional service firms clean up client relationships and craft strategies that didn’t burn their people out.

We had a culture doc. We stuck to it. No emails after 8 p.m. without a damn good reason. No “we’re family” rhetoric. That phrase had lost its shine a long time ago. We were a team. We got paid. We went home.

We also had a second business line I hadn’t planned for: financial education workshops for families and small teams.

It started with a client who asked me how I’d handled my own family dynamic. I told them, in a sanitized way, about the letters. They blinked, then asked if I’d be willing to build a workshop around that. A conversation starter, they called it.

I did.

“Money and Boundaries: How Not to Sink the Boat While Keeping Everyone on Board.”

We ran it for one firm. Then another. Then a nonprofit. People lined up afterward, not to talk marketing, but to talk about their brothers, their parents, their kids.

“Would you… ever do something like this… more broadly?” my friend Mara, who ran a women’s networking group, asked me.

“Like a… program?”

“Like a course,” she said. “Like… something my cousins can take instead of calling me every time they’re short on rent.”

I laughed. “You want me to turn my trauma into curriculum.”

“Yes,” she said, without missing a beat.

So we did.

Hall Strategies split, gently, into two branches: the consulting arm, and a quietly growing coaching and education side. I hired a financial therapist to co-facilitate. We built modules. We recorded videos in my office with the terrible carpet and the great light.

It wasn’t therapy. It wasn’t legal advice. It was practical language and tools for saying things like:

– “I can’t lend you money, but I can sit with you while we call your creditors.”

– “Here’s what I can contribute this year. Anything beyond that is not available.”

– “If you want to participate in my business, here are the roles I have. They’re paid. They also come with accountability.”

It felt… good. Useful. Like alchemizing something ugly into something that could help other people avoid the same bruises.

Naturally, that was around the time my family’s next ask arrived.

“Hall Strategies is doing so well,” Mom said over Sunday dinner, gesturing with her fork. “We were thinking…”

“Always a dangerous phrase,” I muttered.

She shot me a look. “We were thinking,” she repeated, “about the house. Your father and I aren’t getting any younger. It needs work. Roof, insulation, all that. If we fix it up now, it’ll have more value later. It’s an investment. We thought maybe you’d want to… partner.”

Dad cleared his throat. “We could put your name on the deed,” he said.

I took a bite of roast chicken to buy myself a second.

“How much are we talking?”

“Eighty thousand,” Mom said. Like she was saying “eight.”

I almost choked.

“Mom, that’s…”

“Less than you made last year,” she said quickly. “We read the magazine. The one where they featured your firm.”

Ah. There it was. They had seen the local business journal profile. Me at my desk, smiling, headline touting “Local Woman Entrepreneur Builds Growing Consulting Firm.” The article had mentioned revenue.

“It’s not eighty thousand sitting in a pile,” I said. “It’s salaries. Taxes. Operating costs. Retained earnings.”

“You could take a loan,” she said.

“I already have a business loan,” I said. “I’m not taking out another one to put granite in your kitchen.”

Her face tightened. “It’s not about granite, Isa. It’s about security. It’s about legacy. Don’t you want something to inherit?”

“I’d rather inherit healthy parents than a leveraged house,” I said.

Dad winced.

“Look,” I continued, forcing my tone to stay even. “I am not writing a check for eighty grand. That’s a boundary. Full stop. If you want me involved in any house stuff, it’ll be as an investor. That means contracts, share of equity, say in decisions. It also means I get paid back first when the house sells.”

Mom bristled. “We’re your parents.”

“And I’m your daughter, not your retirement plan,” I said.

The air went sharp.

Victoria cleared her throat. “Okay, we are not turning Sunday dinner into Shark Tank,” she said.

“Easy for you to say,” Mom shot back. “You don’t have eighty thousand to say no to.”

Victoria blinked. For once, she didn’t have a comeback.

Quinn, surprisingly, did.

“Mom,” he said, putting his fork down. “They’re right.”

She stared at him. “Excuse me?”

“You’re asking Isa to solve a problem you and Dad created,” he said. “You took out the second mortgage. You refinanced for the addition. You put the vacations on the card. That’s not on her. She already helped more than she should have.”

“You’re just saying that because you want to look good in front of her,” Mom snapped.

“Or maybe I’m saying it because I’ve spent the last two years sitting in a church basement admitting I used other people’s money to feed my addiction,” he said, voice calm. “Maybe I’m allergic to magical thinking now.”

Silence.

I wanted to hug him. I also wanted to cry.

“I’m not saying I won’t ever help,” I said quietly. “I’m saying I won’t help like this. How about this: I’ll pay for a financial planner for you and Dad. Three sessions. I’ll even sit in, if you want. We’ll do it like we do with our clients: look at the whole picture, make a plan.”

Dad’s shoulders sagged. “That’s… fair,” he said.

Mom opened her mouth. Closed it. For once, she seemed to recognize she was outnumbered by reality.

“Fine,” she said, stabbing a carrot. “But you’re bringing dessert next week.”

It wasn’t a hug. It was something.

A month later, I sat in a conference room with my parents and a planner named Denise who had the patience of a saint and the backbone of a drill sergeant.

“Your spending is outpacing your income,” Denise said, pointing at the spreadsheet projected on the wall. “You can’t refinance your way out of this. You have to change behavior.”

“Can’t we just…” Mom started.

“No,” Denise said, with a gentle firmness that reminded me of myself on my better days. “You can’t. Here’s what you can do.”

She laid out options. Downsizing. Selling one of the cars. Cutting memberships.

Mom looked like she’d swallowed chalk. Dad looked relieved.

Afterward, on the drive home, he said quietly, “I should have done that ten years ago.”

“You’re doing it now,” I said. “That counts.”

Meanwhile, Hall Strategies chugged along. We signed our first out-of-state client. We hired our first full-time assistant. We upgraded the carpet.

Victoria kept working on campaigns. She was late a few times. We had awkward feedback conversations. She got better.

“I like invoices,” she said one afternoon, grinning at her laptop. “They’re like little stories that end with money.”

Quinn came to one of our workshops, sitting in the back, arms crossed, listening to a woman talk about debt as a symptom, not a moral failing. He took notes. He didn’t ask me for money.

I started to see my family less as a problem to be solved and more as a group of complicated adults trying, slowly, to grow up.

On the second anniversary of Hall Strategies, I threw a small party at the office. There were cupcakes instead of a catered spread. My employees brought their kids. Larry stopped by, raising a plastic cup of sparkling water.

“Look at you,” he said, gesturing at the room. “The girl my firm let go is out here building competition.”

“Friendly competition,” I said.

“Speak for yourself,” he said, laughing. “I’m here to steal your people.”

My parents came. My mother wore a dress she’d found on sale. My father brought a bottle of sparkling cider instead of whatever expensive wine he used to show up with as a status symbol.

“So this is what you’ve been doing with all that money,” Mom said, looking around.

“Some of it,” I said. “Most of it goes to salaries and taxes. Not as glamorous as you think.”

She traced a finger along a framed client testimonial on the wall. “We never… we didn’t know how to be proud of this,” she said. “We only knew how to ask.”

“I noticed,” I said.

She looked at me. “Thank you for not cutting us off forever,” she said. Where her voice would once have held accusation, tonight it held something like humility.

“You changed,” I said.

“We had to,” she said. “You made it so.”

“You changed because you chose to,” I corrected.

“Maybe both,” she admitted.

Later that night, after everyone had gone home and the office was quiet except for the hum of the refrigerator in the staff kitchen, I sat alone at my desk.

My ledger sat in the bottom drawer. I hadn’t opened it in months. Tonight, I did.

I flipped to the last page. There was a list of “Family Debts” I’d scrawled in anger years ago. Dates. Amounts.

I took a pen and, one by one, crossed them out.

Not because they’d been repaid in full. Many hadn’t.

Because I was done carrying them.

They were tuition I’d paid to learn boundaries. Courses in “No” and “Not this way” and “Here’s the contract.”

I closed the notebook and put it back.

Then I opened a new one. On the first page, I wrote:

Hall Family Fund – Contributions

I listed the small ways my family had started to give back—not in grand gestures, but in the work of changing. Quinn paying his rent on time without help. Mom going six months without a shopping spree she couldn’t afford. Dad bringing over a toolbox to fix a cabinet in my kitchen instead of sending me a bill.

They had wanted my money.

What they got instead was a mirror, a budget, and, eventually, a chance.

It turned out to be exactly what we all needed.

Part 3

The first time a cousin asked me for money after all of this, it threw me.

We were at a family reunion on a humid July afternoon, folding chairs sinking slightly into backyard grass. Kids ran in circles with red popsicle mouths. Old uncles argued about the grill.

“Hey, Isa,” my cousin Janelle said, pulling me aside near the garage. “You got a minute?”

I braced automatically.

She twisted her hands. “I hate to ask,” she said. “But I’m short this month. Car died. You know how it is.”

I believed her. Janelle had never been one of the takers. She worked two jobs, took care of her toddler alone. Her eyes held embarrassment, not entitlement.

The old reflex—the one that had me reaching for my wallet before my brain had finished processing—flickered.

I took a breath.

“I can’t lend you money,” I said. “But I can do two things.”

Her shoulders slumped. “Okay,” she said. “Never mind.”

“Wait,” I said. “First, I have a mechanic I trust. He does payment plans. I’ll call him, see if he can take you on. Second, if you want, we can sit down and go over your budget. See if we can find room in there somewhere.”

She stared at me. “You’d do that?”

“Yes.”

She exhaled. “That might… actually be better,” she admitted.

We sat on the porch steps with my laptop balanced between us, her bills stacked neatly. It was almost disturbingly similar to the first session I’d done with my own parents, except this time there was no defensiveness. Just tired, determined practicality.

“You’re not bad with money,” I told her. “You’re underpaid. That’s different.”

We talked about negotiating with her landlord, about consolidating a couple of small debts, about asking her boss for more hours.

At the end, I said, “I’ll cover half the cost of the repair. As a gift. Not as a loan. You cover the other half over time with the mechanic. Deal?”

She blinked fast. “I’ll pay you back,” she said.

“No,” I said. “You won’t. You’ll pass it on when you can.”

Sometimes generosity isn’t saying yes to everything; it’s saying yes in a way that doesn’t invite the whole extended family to knock on your door with their unpaid bills.

Word spread. As it always does.

But this time, when people whispered that Isa was “doing well,” the story came with a caveat.

“She doesn’t give loans,” they’d say. “She helps you make a plan. She’ll pay for a session with a counselor. She’ll hook you up with a workshop. But she doesn’t write checks.”

Some didn’t bother calling. Those weren’t my people.

Others did. Cousins, aunts, friends. A few of my clients’ family members. They came with shame and left with spreadsheets.

It was not glamorous work. It was repetitive. Messy. Healing.

My parents watched, bemused.

“You’ve turned us into a business model,” Mom joked one day.

“Into a use case,” I corrected.

She laughed. “You always did like charts.”

Around the same time, Hall Strategies landed its biggest contract yet: a multi-year engagement with a national nonprofit focused on financial literacy for young adults. They didn’t just want marketing. They wanted strategy. Structure. Someone who understood both numbers and people.

When I pitched our “family systems” workshop as part of the package, the board lit up.

“This isn’t just for kids,” one board member said. “This is for us.”

We built a pilot program. “Money & Family: How to Love Each Other Without Going Broke or Losing Your Mind.”

It sold out in a week.

The irony wasn’t lost on me. The thing I’d once thought would destroy me—my sister’s spiteful call, my parents’ demands—had turned into the cornerstone of a business that paid my rent, my employees, my insurance.

Did that make what they did okay? No. But it did make it not the end of the world.

One afternoon, as I was finishing up a Zoom workshop with a group of siblings arguing gently about a joint inheritance, my phone buzzed.

Mom: Family dinner Sunday? Your father is attempting lasagna.

I smiled.

Isa: As long as I’m not paying for the ingredients.

Mom: Already bought. With cash. From our budget. 😇

At dinner, my father proudly announced that they’d paid off one of their smaller credit cards.

“Only three more to go,” he said.

Mom rolled her eyes affectionately. “He carries the statements around like baby pictures,” she said.

Quinn brought a girl. He introduced her as his girlfriend, then, awkwardly, as “someone who’s seen me at my worst and still shows up.” She worked in healthcare. She asked smart questions about my firm. She teased him gently when he reached for a third helping of garlic bread.

For once, I was not bracing for an ask.

Halfway through the meal, Victoria clinked her glass.

“Attention, everyone,” she said, her flair for drama back but darker edges sanded down. “I have an announcement.”

“God, you’re pregnant,” Quinn blurted.

She glared. “No. I got my first real client. Not a friend of a friend paying me in gift cards. A paying client. A restaurant downtown. They liked the campaign I did for Isa.”

“That’s great, honey,” Mom said.

“They want ongoing content,” Victoria said, cheeks flushed. “Monthly retainer. I sent a contract. Like the ones Isa makes me sign. They signed it.”

Pride shone on her face. Not the brittle kind, but something more grounded.

“I’m… earning money,” she said quietly. “Not borrowing it.”

“That’s what that feels like,” I said.

She grinned. “It’s… different.”

Later, when we were clearing dishes together, she bumped her shoulder against mine.

“You know,” she said, “I hated you for those letters.”

“I know,” I said.

“I thought you were trying to… punish me,” she said. “Make me pay. Make me feel small.”

“And now?”

“Now I realize I’d have kept floating,” she said. “On vibes and other people’s money. It sucked. Losing your easy yes. Having to get up early for a job I… wasn’t sure I could do. But…” She shrugged. “I like who I am more now.”

I swallowed past a lump.

“Good,” I said. “I like you more now, too.”

She laughed, swatted my arm. “Rude.”

We both knew it was true, and that it went both ways.

At some point, you stop seeking the version of your family you wish you had and start building relationships with the ones they actually are.

My parents would probably never be minimalist budgeters. They would always have a soft spot for unnecessary kitchen gadgets. Victoria would always be a little extra. Quinn would always have to watch the part of his brain that lit up at risk.

And me? I’d always have to resist the urge to fix everything for everyone.

The difference was that now we all knew it.

We had had the reckonings. We had said the hard things. We had sat on too many couches—therapist’s, financial planner’s, my own—talking through numbers and hurt feelings.

We had broken the old pattern.

One crisp winter morning, I went back to Morgan & Pierce for the first time since they’d escorted me out with my cardboard box. Riverside’s new marketing VP had invited Hall Strategies to pitch on a project, and the meeting, ironically, was being hosted at my old firm’s conference space.

Fernando was still there. Older, a little more tired, but recognizably himself.

“Isa,” he said, as I stepped into the conference room. “You look good.”

“So do you,” I lied politely.

There was an awkward moment where we both pretended not to remember the last time we’d spoken. Then he cleared his throat.

“I heard about… everything,” he said. “About your firm. About… your sister. I wanted to say…” He stopped, swallowed. “We were wrong. In how we handled it. I was wrong.”

“I know,” I said.

He blinked. “You… know?”

“Larry told me,” I said. “Apparently when Riverside followed me, the board suddenly questioned how confident they should be in anonymous phone calls.”

He winced. “We changed our protocols after that,” he said.

“Good,” I said.

He looked at me for a long moment. “Would you ever… consider…” He trailed off, gesturing vaguely at the office.

“Coming back?” I supplied.

He nodded.

“No,” I said, without malice. “But I appreciate the apology.”

He smiled, a little sadly. “You landed on your feet,” he said.

“I built new ones,” I corrected.

Walking out of that building afterward, I felt a strange lightness. Like closing a tab that had been slowing everything else down.

Not long after, I sat down with my accountant to talk about the future.

“You’re in a good position,” she said. “If you keep this trajectory, in ten years you could retire, or you could scale, or you could sell.”

“If I have kids,” I said, “I don’t want them to see money as either a magic well or a weapon.”

“Then you start now,” she said. “With how you treat your own.”

That night, I drafted my will.

I built in provisions for my hypothetical children and nieces and nephews. Education funds, yes. But with guardrails. Conditions to release funds: attending financial literacy courses, completing a certain number of hours of work in the business, or in a nonprofit.

I did not, you’ll notice, write checks for my parents’ future care.

What I did instead was set up a small trust earmarked for their medical needs only, funded modestly, with my brother and sister as co-trustees. It wasn’t enough to solve every problem. It was enough to make sure that when hard things inevitably came, the decisions to help would be made collectively—not on my shoulders alone.

They had asked for money.

What they got, in the end, was something stranger, harder, and ultimately more valuable:

– Access to help if they did their part.

– Contracts instead of verbal promises.

– A daughter, a sister, who loved them enough to stop cushioning every consequence.

Sometimes I still think about the moment in Fernando’s office, the paper sliding across the desk, my sister’s fake-innocent laugh on the phone after.

If you’d paused the scene right there and asked me what I thought would happen next, I’d have told you:

“I’ll crumble.”

“I’ll lose everything.”

“I’ll never trust them again.”

I didn’t crumble. I pivoted.

I lost one job. I found better work.

I lost one version of my family. I helped build a more honest one.

Trust didn’t come back overnight. It might never be as naive as it once was. But it grew back in places that mattered.

Whenever someone at a workshop asks me, “How do you know when to stop helping?” I tell them this:

“When helping keeps someone stuck, it’s no longer help. It’s participation.”

My sister got me fired. My family saw my success as their safety net.

What they got instead of unchecked access to my bank account was a woman who finally realized she was allowed to set terms.

It turned out to be the best deal any of us ever made.

THE END!

Disclaimer: Our stories are inspired by real-life events but are carefully rewritten for entertainment. Any resemblance to actual people or situations is purely coincidental.

News

My Sister Hired Private Investigators to Prove I Was Lying And Accidentally Exposed Her Own Fraud…

My Sister Hired Private Investigators to Prove I Was Lying And Accidentally Exposed Her Own Fraud… My sister hired private…

AT MY SISTER’S CELEBRATIONPARTY, MY OWN BROTHER-IN-LAW POINTED AT ME AND SPAT: “TRASH. GO SERVE!

At My Sister’s Celebration Party, My Own Brother-in-Law Pointed At Me And Spat: “Trash. Go Serve!” My Parents Just Watched….

Brother Crashed My Car And Left Me Injured—Parents Begged Me To Lie. The EMT Had Other Plans…

Brother Crashed My Car And Left Me Injured—Parents Begged Me To Lie. The EMT Had Other Plans… Part 1…

My Sister Slapped My Daughter In Front Of Everyone For Being “Too Messy” My Parents Laughed…

My Sister Slapped My Daughter In Front Of Everyone For Being “Too Messy” My Parents Laughed… Part 1 My…

My Whole Family Skipped My Wedding — And Pretended They “Never Got The Invite.”

My Whole Family Skipped My Wedding — And Pretended They “Never Got The Invite.” Part 1 I stopped telling…

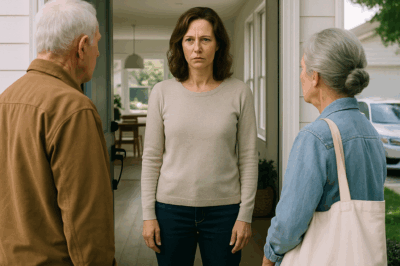

My Dad Threw me Out Over a Secret, 15 years later, They Came to My Door and…

My Dad Threw Me Out Over a Secret, 15 Years Later, They Came to My Door and… Part 1:…

End of content

No more pages to load