Director Promoted My Coworker Who Stole My Ideas; Two Quarters Later, Everything Changed…

Part One

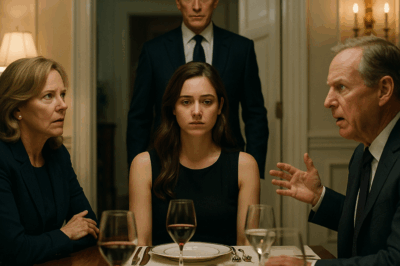

Women just don’t think strategically, Director Hamilton said, his voice echoing through the conference room. He shook Tyler Mason’s hand with the kind of theatrical warmth that fills PowerPoint slides and press releases. Tyler smiled like he’d been handed a trophy. Around the table, people clapped. I sat there frozen and watched my male coworker bask in the glory of presenting my merchandising strategy as his own.

The strategy had increased our regional sales by twenty percent in the quarter, the numbers right there in the dashboards. I had spent months developing the plan—segmenting customers by purchase behavior, building price elasticity models, designing micro-merchandising experiments in three test markets, and iterating until the lift stabilized. Everything in Tyler’s pitch—from the segmentation names to the analysis method and the pilot results—was my work. I had written the slides, coded the models, and personally walked the stores in one of the test markets to see how shelf placement affected conversion rates.

But when applause landed on Tyler’s shoulders, the applause did not reach me.

My name is Simone Briggs. I’m thirty-one and for the last four years I’ve worked as a merchandising analyst at Gravora Group, one of the larger retail chains in the Southeast. I graduated from Auburn with honors and a degree in business analytics. I took pride in numbers—they had always made sense to me when people muddled through feelings. Data was honest, even when the people controlling it were not.

When Tyler joined the team eighteen months ago, I was assigned to help him get up to speed. He had a shiny MBA and a resume that translated in an executive’s eyes to instant credibility. He was charming and sociable in the way that closed rooms like. At first, I respected him. He asked questions that seemed curious and eager. I showed him how I built a customer segmentation model, the way I filtered out noise and found the signal. I explained how pricing experiments could be interpreted, which stores were better labs for product mixes and which were noise.

I was naive.

Three weeks before the board presentation, Tyler approached me. “Let’s collaborate,” he said, smiling that easy smile. “You do the deep analytics. I can present. We’ll make a real impact.” He framed it as mentorship: I’d get visibility and he’d polish my public speaking. It sounded reasonable—beneath the surface, I saw a chance to demonstrate cross-functional leadership. I shared everything: SQL queries, annotated slides, the Python scripts that moved data into usable features. We rehearsed together. I gave him the exact speaking notes he used.

On the day he delivered the deck to Director Hamilton and ten other senior leaders, he spoke with practiced theatricality. He walked the room through the segmentation and the pilot. When questions came, he answered with the kind of calm that comes from rehearsal and rehearsed lying. When he referenced the methodology, he used phrasing I’d invented. When he described the pilot markets, he used anecdotes I had collected on store visits. He credited me once, in an offhand way—“Simone helped with the analysis”—and then moved on.

Afterward, Director Hamilton stood and announced Tyler’s promotion to senior merchandising manager. He said Tyler was “the kind of leader who would drive the department” and that Tyler would “now spearhead holiday initiatives and present to the board.” The promotion included a thirty-thousand-dollar raise, stock options, and a slot on the execution team that led directly toward the executive track.

The room clapped. Tyler smiled. I sat there, clenching my jaw until my hands shook. That cold, hollow feeling in my chest was not just disappointment: it was betrayal. It had the shape of a pattern I had been trying to deny—the way my ideas existed, unacknowledged, until it was expedient for someone else to claim them.

The humiliation was not public in the way leaders fear. There would be no scandal. Instead, there was a slow, grinding injustice: people who lacked ownership would reap the benefits; those who owned the work would remain invisible.

I left the room with a professional smile on my face because in corporate life, outrage is career poison if you wield it at the wrong time. There are politics and optics, and I knew them. I had climbed the ladder by playing smart and keeping my head down. But in the parking lot, seated in my car with the dashboard lights steady, I opened my laptop and drafted a resignation letter. Not in a blaze of pride or drama—instead, with the clinical humility of someone who had recognized a toxic vessel and refused to pour clean water into it.

Three days later I applied to Sunvil Studios, a disruptive retail chain that had been quietly opening stores and taking market share using nimble analytics and an execution-focused culture. When they invited me for an interview, they did not ask about my previous title. They asked to see my work. I put together a portfolio with the projects that were undeniably mine—white-labeled direct-mail tests, the pricing elasticity model I had architected months before, the consumer segmentation algorithms that had also been used in the pilot. I did not include what had been co-opted by Tyler; I didn’t need to prove anything in that moment. My work, clearly documented, spoke for itself.

Sunvil’s director of merchandising strategy, Margaret Foster, was direct, curious, and, mercifully, eager to understand the mechanics behind the results. She asked about assumptions, about control variables, about how I mitigated causal inference errors in small-sample pilots. When I walked her through the code, she leaned in. “This is what we need,” she said. “We need people who can design experiments and actually read the results. Could you start next month?”

I accepted and, with the resignation letter in hand, gave Director Hamilton two weeks’ notice. He feigned disappointment and said the usual things—“We hope you’ll reconsider”—but the condescension in his voice made my decision easy. My last two weeks at Gravora were illuminating. Without me, Tyler’s work showed cracks. His follow-up presentations had the gloss of leadership but not the depth of insight; they were missing the nuanced segment weighting and the store-level execution plans. People began asking pointed questions in meetings. He hadn’t anticipated that the scaffolding we’d built internally—the scripts, the dashboard layers, the sanity checks—would matter. He tried to rebuild them, using notes and recordings he’d made during our sessions, but it was like reconstructing a house from a photograph.

Coworkers who had been supportive discreetly told me they’d noticed. Bethany Coleman, a senior analyst who always had a kind word and a sharp brain, cornered me near my cubicle before I left. “Simone,” she said quietly, “we saw what happened. We saw you build that model. Don’t let the politics make you doubt your work.” Her words were both balm and fuel.

At Sunvil, the culture was refreshingly different: results over rhetoric, experimentation over committee theater. I was given a team, resources, and, most importantly, the autonomy to build. Over the next eight weeks I dove into work: assessing market opportunities, optimizing inventory assortments, and, most critically, identifying supplier weaknesses that Gravora had taken for granted.

During this period, I stumbled upon a vulnerability that would become the pivot of the story: Bright Hollow Labs, a premium supplier of home goods, had been increasingly frustrated with Gravora’s strategic inconsistency. Their products represented a hefty portion of Gravora’s inventory value in high-margin categories. I was building a supplier partnership strategy at Sunvil—an approach to lock in exclusive products through data-driven merchandising plans—and Bright Hollow was the kind of partner that could shift market share.

I spent long days parsing procurement data, modeling revenue projections for exclusive rollouts, and crafting an outreach plan that demonstrated Sunvil’s superior value proposition: targeted merchandising that maximized visibility and turning rates, coupled with clean performance metrics. When I reached Bright Hollow’s business development director, the conversation was candid. They were tired of having their best-selling lines shuffled into discount bins when Gravora’s buyer panicked about margins. They wanted a stable partner who would market their product boldly and keep it premium, not dilute it into a clearance aisle.

Two months after I left Gravora—two financial quarters later—Sunvil announced an exclusive partnership with Bright Hollow Labs. The press release was clean and the metrics spoke for themselves. We increased Bright Hollow’s product velocity and price realization in our stores by a percentage that made financial analysts perk up. Sunvil’s stock responded positively. Gravora, meanwhile, was scrambling. Losing Bright Hollow’s stable of premium goods meant Gravora would either be pushed into low-margin alternatives or face holes in their holiday catalog. Word reached me through industry contacts: Director Hamilton convened emergency meetings. Tyler was assigned the task of patching the supplier relationship. It was exactly the kind of problem his rehearsed rhetoric could not solve.

Beyond the professional satisfaction of seeing an idea I created produce real commercial upside, there was something quietly satisfying about watching the market impose consequences for the choices Gravora had made—promotions for optics over competence, politics over product. I had no joy in another person’s downfall; this was merely the market catching up. Two quarters later, the numbers were public: Gravora’s sales dipped in key regions, stock analysts raised questions, and senior leaders were left asking how a previously strong merchandising pipeline could falter so quickly.

I’ll tell you what it taught me: ownership matters. When you own a process, you own the nuance; you own the friction and the decisions that make the outcome resilient to change. The man who had taken my work had lacked the ownership, and the difference between stealing a deck and owning its execution became glaringly obvious when the rubber met the road.

Part Two

The months that followed were a mix of steady wins and quiet sorting. At Sunvil, I built a small team for supplier development and a playbook for exclusive brand partnerships. We were not just chasing deals; we were designing the retail narrative for products that deserved premium shelving and considered marketing. The Bright Hollow partnership was the most visible example: we co-created seasonal exclusives, used local influencers in targeted test markets, and provided Bright Hollow with granular performance dashboards that removed guesswork.

Our results were immediate. The initial quarter with Bright Hollow exceeded projections by nearly twenty percent. The company took notice. Internal celebrations were modest—no champagne jabber on the trading floor—just the satisfaction of an experiment that worked. My team grew, and I pushed for policies I believed in: fair procurement terms for suppliers, transparent performance targets, and incentives that prioritized long-term partnerships over short-term discounts.

Meanwhile, Gravora’s woes deepened. Without Bright Hollow as a cornerstone supplier, their assortment lost some of its edge. Grand plans for holiday exclusives were scuttled or compromised with less attractive alternatives. At a leadership level, the questions turned to accountability. Director Hamilton convened an internal review. Tyler, who by then had been digging deep to reproduce my segmentation approach and failing to match the nuance, found himself in the kind of sleepless stretch that previously belonged only to the analysts I had been.

I didn’t gloat. There was no exultation in watching colleagues panic. I focused on the work, on building systems that could be taught and scaled. But the industry is small and result-driven; word travels. Suppliers reached out with curiosity. Investors who once commented on Gravora’s shiny rebrand called Margaret Foster and me to ask why Sunvil was gaining traction. I began to get invites to speak at panels about supplier relationships and evidence-based merchandising. I said yes to a few, not to collect trophies, but to make a larger point: that mercantile success is sustained when relationships are mutual and strategic decisions are based on evidence.

Within Gravora, the reassignment of responsibilities revealed structural problems that promotion alone could not solve. Directors who prized style over substance found themselves without traction because the organization had not institutionalized the analytics that made their shiny presentations work. Tyler, who had worn my voice like a glove, now had to produce that voice from scratch. He worked late nights and attempted to codify my heuristics, but you can fake a formula for a while—never forever.

Then came a decisive week. Bethany, who had been supportive from the start, reached out to say there had been a cascade of resignations from junior analysts at Gravora. Morale had fractured. People were tired of watching credit be misallocated and of their work being subsumed into a male-centric narrative that rewarded a particular kind of presentation skill over the craft of analysis. The net effect of those resignations was that Gravora lost institutional memory—the very thing Tyler desperately needed to compensate for the missing analytical backbone.

A market analyst piece ran quoting industry contacts about Gravora’s challenges in supplier retention. The commentary asked a blunt question: had Gravora prioritized optics at the expense of operational excellence? The board asked hard, public questions. Share prices fluctuated.

For my part, I kept doing the tactical work: refining our contract models to ensure suppliers like Bright Hollow had minimum guarantees on display and a collaborative marketing plan that included shared KPIs. We published case studies demonstrating how co-investment in merchandising lifts conversion—data that became part of the pitch deck for future supplier partners.

The human side of this story is not cruelty; it’s systems. Tyler wasn’t evil in the cartoon sense—he was opportunistic and willing to use other people’s labor to build appearance. Director Hamilton, similarly, was a man of conviction who believed in shaping narratives. But systems that reward optics over outcomes eventually degrade. Two quarters after the theft, the market, suppliers, and internal metrics punished that degradation.

At Gravora, consequences began to ripple outward. A few months after the Bright Hollow announcement, the company’s board initiated a strategic reassessment. Board members questioned the executive’s judgment and the sustainability of the merchandising pipeline. Tyler’s promotion was no longer an uncontested triumph; it was now the object lesson of how not to build a team.

In an internal memo that eventually leaked, Director Hamilton acknowledged “areas of underinvestment in analytics and supplier relations.” The language was corporate, softened by buzzwords. Still, the memo signaled change. The next quarter the board told management to prioritize technical capability and institutional knowledge. Tyler’s role shifted to implementation while a new head of analytics—someone with academic and practical experience far beyond pageantry—was hired. Tyler stayed on for a while, his role ambiguous. Some months later, he left Gravora for a start-up, his reputation damaged, his career trajectory uncertain.

Tyler’s exit was not the central point to me. The point was verification: if you build for optics and not for durable understanding, the house will not weather storms. I had spent years refining models and testing assumptions. My exit from Gravora had been a loss; my growth at Sunvil was a gain. My willingness to leave rather than accept public invisibility had been a personal boundary that paid off.

There were wins that mattered beyond corporate scorecards. I began mentoring young analysts at Sunvil and in the industry through a fellowship program that David Foster, our VP, helped seed. We created a short curriculum on experimental design, ethical attribution, and negotiation tactics. I also pushed for formal authorship attribution in internal reports—a small but meaningful policy change so that people who produced the analysis were credited in presentations that went to the board. It was not a flurry of righteous acts; it was careful, institutional nudging.

A particularly memorable moment happened at a regional conference when a junior analyst from another company approached me. She had been watching the Gravora-Sunvil saga and said, “I almost left the field when I saw that presentation get stolen. I thought people like you could not make it. But your work convinced me to stay.” Her words were a kind of quiet vindication that had little to do with Tyler’s misfortune and everything to do with the fact that I’d refused to allow someone else to define my career.

I also learned to be more explicit about my ownership. At Sunvil we began formally attaching authorship labels to deliverables: “Concept: Simone Briggs. Analysis: Team Alpha. Execution: Regional Ops.” It was bureaucratic, yes, but useful. When people read those decks, they understood who to engage for follow-ups. It reduced the space for cloak-and-dagger authorial theft.

In time, Gravora stabilized under new leadership. Director Hamilton was reassigned to a different role. He was not vilified in a public way; corporate governance rarely produces dramatic purges. But the culture shifted slowly toward competence. Leadership realized they could not survive on optics alone; they needed the kind of institutional memory that recognized contributors.

My own arc continued. I advanced to a director-level role at Sunvil where I led strategic merchandising and supplier development. We scaled thoughtfully, opening in new markets with playbooks that preserved local relevance. We turned down franchise offers that insisted on homogenization. Instead we chose partnerships that honored a delicate trade: grow while maintaining quality and relationships.

In the quiet moments—late-night retrospectives with my team, drives to visit suppliers, glasses of wine with folks who’d become friends—I reflected on why the theft had hurt so profoundly. It wasn’t merely about the promotion; it was about the invisible labor that women, and particularly women of color, often perform in organizations. We translate the messy world into actionable insight, and yet are asked to be both humble and strategic. The double standard exists: when a woman advocates, she’s “emotional”; when a man advocates, he’s “leadership.” The economics of recognition, then, are not mere niceties—they shape careers.

That realization coaxed me toward advocacy. I started speaking at conferences about attribution in analytics and the ethics of corporate recognition. I worked with HR teams to craft better policies that ensured transparent contribution statements on strategic deliverables. Those policies were small, but they made a difference. The junior analysts who came into our fellowship were taught to document, to circulate, and to ask for written acknowledgment at the right time.

On a personal level, the arc that began in that conference room ended in a small, satisfying way. A few years after the initial theft, I stood in a packed auditorium and delivered a keynote on “Ownership: How to Build and Protect Analytical Value.” The audience was full of practitioners, procurement officers, and a surprising number of men who nodded along with the detail. At the back of the room, a familiar face watched: Bethany, who had been one of the quiet allies at Gravora, sat with her hands folded. Afterward, she stood in line to shake my hand. “You changed the rules,” she told me. “You made the field safer.”

I didn’t feel triumphant; I felt grateful. I had been dragged into an ugly corporate lesson and managed to pull something better out of it: a career, yes, but also a practice that improved the industry.

Two quarters after the promotion that had attempted to erase me, everything had changed, but not because of some cinematic reveal. It changed because of steady, daily choices: suppliers that wanted partners instead of price takers; executives who learned to value on-the-ground analytics; teams that set up proper attribution; and yes, a woman who declined to accept erasure and instead found a place where her work could be seen and rewarded.

If there’s a clear ending here—if the story deserves a single finishing line—it is simply this: stolen ideas can flourish when they find soil, and the markets, like gravity, will eventually reveal the sturdier roots. Tyler’s promotion was a fast, transient headline; the durable shift was in the architecture of how work got credited and how teams were built. That architecture is the real victory.

Years later, walking through Sunvil Studios’ bright offices, passing by walls with photos of supplier partners and the names of analysts credited beneath major wins, I’m reminded of a quiet truth: the best revenge is not retribution. It’s creating a system that rewards real work, not spin. It’s building teams where authorship matters, where junior analysts are trained and then thanked in public, and where the people who do the hard work of turning data into insight are invited to the table—every single time.

At my last annual review, I looked Director Foster in the eye and asked a question that had once seemed dangerous: “What will we do to scale this model so it doesn’t get hollowed out when someone with a louder voice arrives?” She smiled and said, “We will codify it. We will train leaders to seek credit where it’s due.” We put it into policy and practice.

So while the conference room where I lost a chance still exists in my memory—a cramped rectangle of fluorescent light and misplaced power—its hold on me had waned. The real rooms I remember now are the warm, loud kitchen with analysts leaning over laptops; the supplier’s barn where a farmer shows me a new heirloom variety; the auditorium where a thousand people listen to a talk about ethics in analytics. Those rooms hum with the sound of people doing the work properly—and being recognized for it.

And for anyone still in that mid-meeting silence, who watched a credit slide past you as if it were an inevitability, know this: when your work is sound and you do not trade integrity for the illusion of rapid validation, the market has a way of catching up. Two quarters later, everything changed—not because of spectacle or spite, but because method and integrity finally met their reward.

END!

Disclaimer: Our stories are inspired by real-life events but are carefully rewritten for entertainment. Any resemblance to actual people or situations is purely coincidental.

News

My daughter told me to run when my husband left for a business trip. CH2

My daughter told me to run when my husband left for a business trip. Part One The Miller House…

After I became a widow, I never told my son about the second house in spain. glad i kept quiet… CH2

After I became a widow, I never told my son about the second house in Spain. glad i kept quiet……

My Fiancé’s Rich Parents Rejected Me At Dinner — Until My Father Arrived… CH2

My Fiancé’s Rich Parents Rejected Me At Dinner — Until My Father Arrived… Part One The grandfather clock in…

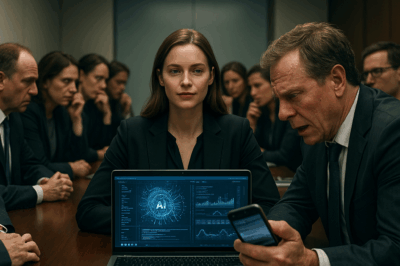

My Backstabbing CEO Stole My $4 Billion AI — Until It Mysteriously Started Exposing His Secret Plan. CH2

My Backstabbing CEO Stole My $4 Billion AI — Until It Mysteriously Started Exposing His Secret Plan Part One…

My Stepfather Called Me a Maid in My Own Home — So I Made Him Greet Me Every Morning at the Office. CH2

My Stepfather Called Me a Maid in My Own Home — So I Made Him Greet Me Every Morning at…

At The Family Dinner, My Parents Slapped Me In The Face Just Because The Soup Had No Salt. CH2

At The Family Dinner, My Parents Slapped Me In The Face Just Because The Soup Had No Salt Part…

End of content

No more pages to load