At Family Dinner, I Accidentally Saw My Mother And Sister Using My Fake Signature

Part One

My name’s Veronica. I’m thirty-two, and I never expected a simple family dinner in our Irvine home to feel like walking straight into an ambush. I make my living as a marketing specialist — a job that trains you to spot manipulation in copy, in client presentations, and in the little tells people give off when they’re not telling the whole truth. I could pick apart ads for a living, but nothing in any campaign deck ever prepared me for what I saw the night my grandmother passed away and her inheritance turned the people I loved into strangers who looked like strangers and acted like conspirators.

Pamela — Grandma Pam to anyone who adored her — had been my secret compass since I was a child. While other kids chased Saturday cartoons, I sat across the diner booth from her, legs barely reaching the seat, while she taught me the art of making money make sense. She used to divide a pizza into five metaphors: essentials, savings, help for others, small pleasure, and future plans. “Build security by thinking ahead,” she’d say, fingers annotated with flour from the pastry she loved. She showed me how to track every dollar in a tiny ledger and how compound interest felt like magic when you were twelve and felt powerless in an adult world.

I learned to love thrift as a creative act. At sixteen I opened my first investment account with babysitting cash. At twenty-two I walked into a state university with a gym bag, a scholarship, and two part-time jobs. I spent my twenties building a modest life in Irvine: a marketing internship, a string of promotions, an apartment that became mine after years of saving, a condo paid off slowly and without drama. While Sabrina, my sister, evaporated money like it was perfume — designer bags, impulsive vacations, a luxury SUV that looked a size too big for the neighborhood — Mom and Dad thrived on enabling. They folded themselves into her life like supportive stagehands, offering bailouts with a smile and a shrug.

You have to picture that family dynamic to understand why Pamela’s decision felt like a sun moving behind clouds. When the diagnosis came — a swift, merciless stage-four cancer — I moved in bursts: work calls in the early morning; hospital waiting rooms; chemo schedules typed into a calendar I starred on my phone. Pamela was lucid on most days, and on one quiet evening, with the salt-sour tang of hospital coffee on the table between us, she called Mr. Sutton, the attorney she trusted, to the apartment. She drew a blueprint with measured hands: an irrevocable trust, assets shielded, protections that would ensure her life’s careful thrift didn’t evaporate into a pattern she’d watched my parents repeat for years.

“Trevor and Cheryl enable,” she said, tapping the table. “I’ve watched it for decades. I don’t want animosity at my funeral and a mess afterward. Veronica, you will be responsible, and you will be careful because you are, for reasons I’ve always loved, cautious. You’ll honor this the way I want.”

The trust made me the sole beneficiary, yes, but it also staggered my conscience. Aunt Cheryl witnessed, the notary signed, and Pamela blinked, smiled, and slept. It felt like a private victory: the careful woman who had taught me how to budget had used her last months to safeguard the small dry particle of dignity that finances can be. After the funeral, there was a period of muted family rituals; people send casseroles, they weep at eulogies, they pretend the brittle things were not said five minutes before. Life does not absolve itself.

Then the text came.

Family dinner. Friday. Important. Dad signed it off with a formality that felt wrong on its face. We never scheduled family dinners like a board meeting. My instinct lit up like a warning beacon. That week I drove through Irvine’s neighborhood with the knowledge of what could happen pulsing in my chest: opportunists rearrange, the entitled assume, and the enabling make arrangements as if they were acts of love.

It was worse than I expected.

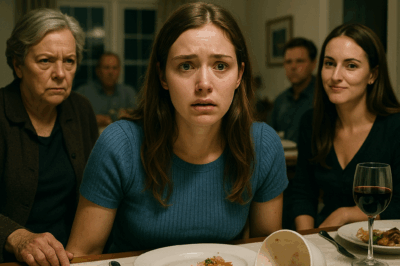

Sabrina’s new SUV shone under the streetlight when I pulled into the drive. Mom, all too bright with lasagna as a decoy, ushered me in with the practiced hands of someone who has hosted too many apologies behind food. Dad offered a clipped nod — I read him like a client who’s prepping for a negotiation. In the living room, I noticed a stack of documents on the side table before anyone could redirect me with small talk and bread bowls. A heading I knew too well — trust fund paperwork — and, beneath it, a signature that I recognized by myself the way you can recognize handwriting that has traced your childhood: my name, but crabbed and wrong, obviously forged.

The sight came in a slow-motion, nausea-inducing moment. I could see my name and the crooked letters that tried to imitate me. I felt my throat grow dry. Instead of collapsing, I did what marketing people often do: I observed and logged. I smiled and let them steer the conversation toward my so-called extra money, toward how “generous” it would be to redirect it. I let them think I hadn’t seen. That little white lie — the one where I stopped the public scene from exploding — was tactical, like sliding a card down to the ace.

They had rehearsed a narrative in the kitchen, perhaps in whispers over the phone. The plan, crudely: forge the signature, push the papers through, and act like good family on the night of sorrow. But we had learned to be cautious; Mr. Sutton had set up red alerts, monitoring suspicious access to the trust accounts. He’d done it the only way the law could often be trusted — by anticipating who in a family might act without honor and by installing technical barriers. There was a $1 trick in the trust too: Pamela had funneled some assets in a way that looked lucrative on paper but was actually wrapped in legal protections. It was not wealth that could be easily stolen, but it could be used as bait to expose who would try.

When I excused myself the first time to the bathroom, I detoured to Dad’s home office down the hall. If you want to eavesdrop in a family, the first stop is always where the papers live. On his desk lay a folder labeled “Sabrina’s Finances” in his neat, utilitarian handwriting. I stepped behind the door, felt my pulse in my throat, and leafed through. There it was: records of bailouts, unpaid loans masked as “family support,” screenshots from Sabrina’s social media with lavish trips that were not matched by bank statements, and an email from her ex Scott referencing overspending. The evidence painted a pattern as clear as a graph. The more I read, the less surprised I was that the forgery existed. The problem was never Sabrina’s spending; it was the enabling that made it an addiction.

In the dining room their faces were the ones you reserve for holidays where you are expected to be polite. Dad cleared his throat like a man at a press conference. “We’ve been thinking about Pamela’s estate,” he said, and they all spoke in that soft, corporate tone people reserve for stirring hurt into logic. “Sabrina’s in a tight spot financially, and since you’re stable, Veronica, it makes sense to redirect some of that inheritance her way.”

They weren’t asking. That was the first thing. The second was the number: $250,000. A round, stupidly precise figure that might have paid a down payment on a new condo or cleared a list of unpaid cards. I leaned in and asked, voice even, to get specifics. They dropped anecdotes: investments that went south, bills that piled, and the gentle, constant rhetoric of “family helps family.” If only family had kept a ledger like mine, we might have been spared this entire night.

I had a plan. See, witnessing a forgery is one thing; proving it and turning what could be gaslit into a document trail is another. Before I’d stormed in, I had called Aunt Cheryl and whispered: be ready. She’d answered my call with the rare kind of quiet solidarity older relatives sometimes reserve for a younger person whose bones look like themselves. Mr. Sutton had been prepped. I had my phone clicking photos of paper in the hall, of signatures, of my parents’ emails. I had texts with friends who would corroborate timelines.

And then — as if on cue — my banking app pinged with a red alert. Unauthorized access attempt detected. Mr. Sutton’s watchful technology had flagged a movement toward the trust. I held my phone up like an exhibit in a courtroom where the jury was my family. “See this?” I said, and the sound of my phone’s alarm beat against the polite clink of silverware as if the room itself realized the farce had been uncovered.

Mom gasped. Sabrina made a move for my phone, but I withdrew it like a lawyer protecting evidence. Dad’s face drained — the man who had always relied on optimism was suddenly old and exposed. They tried the emotional pile-on — “You’re selfish,” “You would deprive your sister,” “Pamela would have wanted us to help” — but I had documents. I had Scott’s email. I had bank screenshots. I had Aunt Cheryl corroborating the trust and Mr. Sutton’s notarized signatures. In a week, they filed suit to contest the trust’s validity, but the legal world isn’t kind to forgeries and the law in California gives weight to the intent and proof present when an irrevocable trust is formed correctly.

The lawsuit they filed was theatrically framed as a noble defense of family rights: claims of undue influence, diminished capacity, faint-hearted pleas that Pamela had been confused. They hired a probate attorney with the smooth suit and the assured talk. Mr. Sutton, however, had been meticulous. Medical records affirmed Pamela’s clarity the day she signed. Aunt Cheryl had been present and would swear it in front of any judge. The timestamps on the paperwork made a clean chronological chain. Under California probate law, an irrevocable trust properly executed is not easily undone. The judge sifted through the affidavits, the evidence, and the emotional pleas and ruled swiftly: the trust stood.

That ruling birthed a cascade of consequences that I confess I had not entirely anticipated emotionally. Viewed through my childhood memory, my parents had been wronged by their own indulgence. In their attempt to fix a problem that had never been mine, they had created a legal scandal that would take everything. Creditors smelled the weak link. Sabrina’s debts, which had been papered over with loans and generous gifts, were suddenly visible to people who wanted repayment and had the legal muscle to seize assets. My parents had co-signed, backed, and guaranteed without calculation. Bankruptcy filings followed as the household attempt to reconstitute their lives collided with financial reality.

They suffered. The house we’d all grown up in — the familiar bones of our lives — was sold to meet liens, and the family unit collapsed into legal affidavits and cold letters. Sabrina’s designer watch was reclaimed by a pawn broker, and the shiny SUV disappeared in a repo truck at dawn like a painful metaphor for the things people assume are permanent. A quiet social ostracism followed. People I had known since elementary school found themselves shifting allegiances. Some sympathized with my parents in whispered condolences; others, quietly aware of the bailouts and the years of enabling, drifted away. Cousin Dustin emailed me after months of silence: “I’m done enabling. I’ll help you legally.” Aunt Cheryl took my hand in public, as if to say: We did what we had to.

I did not gloat. I would not claim joy in the fall of my family’s financial empire. What I felt in the months that followed was a complicated mix: grief at what had been lost, relief at the legal vindication of Pamela’s plan, and a bitter clarity about who loved me for my choices and who loved me because it was convenient. I cut off contact with the phones on both ends — the rage-laced texts, the pleas masked as concern, all routed through Mr. Sutton when necessary. Therapy helped me hold my standing without collapsing into the guilt my parents weaponized.

And then I built something.

It seemed only right to honor Pamela by making her lessons live beyond the one family that had failed to hear them. I took a portion of the trust and launched the Pamela Financial Literacy Foundation. It was a small nonprofit at first — workshops at community centers, budgeting classes for teens at Irvine High, webinars about spotting manipulative family dynamics disguised as “help.” We created modules that taught young adults how to set monetary boundaries without burning bridges, how to spot when a family dynamic is exploitative, and how to negotiate money conversations with care and firmness.

People came. Teens on the edge of college came, parents who wanted to model better behavior came, and even some older adults showed up to learn how to protect their savings from predatory relatives. The work felt like a balm. I poured energy into making the curriculum humane — real scenarios, role-playing sessions, templates for tough conversations. We gave micro-grants to students who otherwise had to dip into shaky credit. We published a short guide called Keeping Money Kind that made rounds in local libraries and on campuses. Through the foundation, Pamela’s voice — no longer the private whisper in a diner booth — started to radiate outward.

The foundation also helped me form my chosen family. Jenna, my college friend, became my co-conspirator in all things good. She helped write the grant proposals, tutored me through public speaking nerves, and became the person who knew the exact balance between letting me be furious and letting me be kind. Aunt Cheryl, too, became the family that I could return to without fear of being consumed by enabling cycles. She sat with me at fundraisers, introduced me to donors, and chuckled in a way that said: We did right.

Part Two

People often imagine retribution as something dramatic and cinematic: a reveal at a party, a viral video, a courtroom diatribe that leaves a villain crumpled. In our house, consequences were quieter and longer. They were paper trails and legal maneuvers and the slow bleed of privilege washed away by reality. The bankruptcy filings, the asset liquidations, the loss of social invitations — these were consequences that left scars but also opened space for truth.

Sabrina slid away from our lives at first, punished by debt collectors and the social shame of a lifestyle that had to be unlearned quickly and without the friendliest of teachers. She tried — clumsily and sometimes in ways that showed old habits — to rebuild. Her first attempts at finding sustainable work were rocky. Employers, once enticed by the sheen of her socialite resume, were now sometimes wary of her credit history. The kind of trust required in workplaces for financial responsibility was not always given. She took temp jobs, did retail stints, and swore off the luxury life she had once thought her birthright. Embarrassment does the subtle work of changing a person if, and only if, it is accompanied by a willingness to learn.

My parents moved into a smaller rental. The house that had held our childhood — the one the neighbors used to admire — sold to pay creditors. Trevor, who had always been solid in a way that made mistakes easy to gloss over, took the bankruptcy with a stoic sadness. He worked two jobs for a while — delivering packages and consulting on lawn care he had once disdainfully considered beneath him. Cheryl, whose pearls had once seemed permanent, took provincial daytime work to make ends meet. They learned humility in the slow daily grind most people know well: the little defeats and the small repairs to character.

What surprised me was how some relationships shifted sideways into something better. Cousin Dustin, after a period of awkwardness, became a person who visited to fix things around my condo: a leaky faucet, a balky air conditioner. The awkwardness grew into genuine connection as we traded life stories instead of ledger balances. Aunt Cheryl became the living archive of family truth, the person who recited Pamela’s final words with a tenderness that had no justification other than love. I learned, in the months after the court ruled in Pam’s favor, to extend a measure of empathy without giving away my boundaries.

Sabrina’s path to contrition was not linear. Initially she denied and then negotiated. She blamed bad timing, then addictive behaviors, then social pressure. It took a year of support groups, a job in a small startup doing social media for a local bakery, and therapy before she stopped making excuses. In time she gave a small public apology — a short statement at a community event for the foundation — and then she volunteered at the center handing out pamphlets about budgeting. The crowd members who had known her before looked on with complex expressions. Some forgave because they believed people can change; others continued to hold her accountable. Accountability, I learned, is the scaffolding of healing.

The foundation grew slowly, not in the way foundations on television do, with gala galas and champagne splurges, but in secondhand moments: a student who learned to save a few percent of a part-time paycheck, a mother who wrote to tell us she finally demanded a formal repayment plan from an adult child instead of bailing them out. Those notes mattered more to me than the ownership of anything. Money without mission can be a dull thing. Pamela had always believed the purpose of savings was to preserve dignity — and I felt like we were living that truth.

As for the legal aftermath, there were still snarled tangles. My parents’ bankruptcy discharge blurred into a fog of consequences: credit repair took years; opportunities came less easy. They wrote letters to me in the early months that read like attempts at apology and explanation: “We were trying to help.” But the letters also sounded like the old reasons that had allowed the enabling in the first place. For a while I read them and burned them in the sink and then stopped. After therapy I allowed some of them back into my life under the condition of a new rule: any communication had to be channeled through Aunt Cheryl or Mr. Sutton. Boundaries are not walls, as I had told them during the first arguable night; they are frameworks for functional relationships.

Time, the slow, impartial arbiter, rearranged distances. There were holidays where my table seat was conspicuously blank. There were others where, with awkward grace and small apologies, people showed up. I did not reconcile in a grand gesture. Instead, reconnection happened in coffee meetings where my parents learned to ask about my work and did not assume I would proffer funds; where Sabrina showed up to volunteer for a foundation workshop and, in front of a room, admitted that she had once been the person who thought money was a way to fix feelings. I listened, took her hand, and told her that apology is a beginning; repair is the labor that follows.

As the foundation matured, its projects matured too. We ran a mentorship program pairing young adults with retired financial counselors who volunteered their time. We launched “Money & Boundaries,” a course for college freshmen that taught the difference between family support and family sabotage. We got a small grant from a community bank to build an app for expense-sharing that included legal templates for agreements between family members — a tool I always wished my younger self had. The accomplishments were small and steady and meaningful.

There were darker nights, too. I would sometimes wake in the middle of the night and hear my mother’s voice sing past love — a sound from another life — and wonder if I had been cruel not to open the door to her pleas earlier. Therapy taught me to hold those doubts like weather: passing phenomena, not verdicts. I would write letters I never sent and sit with them until the ache loosened. Jenna sat beside me in those moments like a lighthouse. She reminded me that choosing peace is not the same as choosing cruelty. It is choosing survival.

Over time I learned the geography of forgiveness. It’s not a single destination; it’s a landscape you navigate with maps made of boundaries and tools of accountability. I forgave because I no longer wanted to carry around rancid resentment; I made a point not to forget because forgetting is often what helps people repeat mistakes. I took steps to educate myself and others about manipulative family dynamics: what to watch for, how to set up contractual protections, and how to create contingency plans that are not shameful but practical.

A year and a half after the dinner, the foundation hosted a modest conference on financial empowerment at the local community center. People came — young couples, single parents, retirees who wanted to ensure they were not coerced into gifts they could not afford. I gave a talk about building safety without vengefulness, about how Pamela’s trust was not about punishment but about preserving a dignity that she feared would be preyed upon. Afterward, an elderly man approached me, his hand trembling. “My sister always took advantage of me,” he said. “I finally found a way to say no.” He hugged me that way strangers occasionally do when thanks are long overdue. That moment felt like an exhale that reached into the chamber of everything I’d been building.

Sabrina showed up at that event, not in a designer dress but in a t-shirt that said “Community Helps.” She distributed pamphlets and apologized in ways that were not loud. It is easy to perform humility; it is harder to show up in small, consistent acts. She did. Her presence did not erase past hurt, but it meant she was trying to learn how to be part of a different story.

My parents returned one afternoon, older and quieter. Dad’s hair had gone whiter from all that worry. Mom apologized with an honesty that was new. “We were wrong,” she said, “and we didn’t understand the damage we were doing.” The apology was simple and late and honest. I did not cancel the loss; I accepted the apology as one of the many small repairs that get you through a lifetime.

Now, when I walk the familiar Irvine streets with Jenna or sit in the community center before a workshop and watch the crowd arrive, I remember Pamela’s small lessons — her pizza slices and her thrift — and realize how deftly they shaped my life. Pamela had not merely left money; she had left a system for rescue. She’d used the law and the trust like a kindly, stubborn guardian. She had expected me to be quiet and sensible; she had never expected me to become a defender in a way that courtroom rules and nonprofit filings demanded.

The end of this story is not a dramatic scene with a closing bell. There are no sudden reconciliations that erase decades of behavior. What exists instead is a set of steady, human outcomes. The trust stood. The family, for a while, fractured and then recalibrated. Sabrina learned, slowly, how to push against impulses that had once felt like identity. My parents lost a house but gained a clarity they had not had before. Pamela’s legacy lives on through the foundation, helping others avoid the same kinds of petty tragedies where love is conflated with permission to exploit.

Ethics are not something you can sign onto in an evening and expect to sit comfortably with for the rest of your life. They are choices repeated daily. My choice was to protect what Pamela and I knew to be sacred: the right to a life that is not hollowed out by those who love you. In protecting it, I lost some things and gained others. I missed dinners with the parents who had raised me and watched their private descent with an ache that time would not immediately soothe. I gained an audience that listened and in that listening found a life mission.

On Sunday afternoons, when the sky is clear over Irvine and the lemon trees in the neighbor’s yard bloom, I call Aunt Cheryl and Jenna to arrange the workshops for the coming month. We talk about the small victories: the student who saved three hundred dollars, the woman who finally set a repayment schedule with her son, the elder who kept his deed because he had documents in place. The victories are small, and they accumulate.

If I had to capture the moral of all this in one sentence — and I know people want morals — it would be this: protect yourself with kindness, and teach others to do the same. When your family betrays you, it breaks you open — but the light that seeps in can grow something better if you let it. This is the life Pamela left me: practical tools, a legal safety net, and the courage to refuse to be a puppet.

And some nights, when I am alone and the house is quiet, I pull out the old ledger I’d kept since I was twelve. The pages are yellowing, and the handwriting is still the same — small, precise, hopeful. I trace the columns with a finger and think of a woman who taught me to budget not only money but dignity. In the end, that was the inheritance I protected.

END!

Disclaimer: Our stories are inspired by real-life events but are carefully rewritten for entertainment. Any resemblance to actual people or situations is purely coincidental.

News

Sister Swapped My Daughter’s Medication Before Her Recital to “Teach Her Humility” CH2

Sister Swapped My Daughter’s Medication Before Her Recital to “Teach Her Humility” Part One The moment your child collapses…

My Husband Slipped Sleeping Pills in My Tea—When I Pretended to Sleep, What I Saw Next Shook Me. CH2

My Husband Slipped Sleeping Pills in My Tea—When I Pretended to Sleep, What I Saw Next Shook Me Part…

At Family Party, My Mom Gave Me A Painful Slap – While My Sister Got An iPhone 17 Pro Max. Then I.. CH2

At Family Party, My Mom Gave Me A Painful Slap — While My Sister Got An iPhone 17 Pro Max….

At Family Dinner, My Mom Threw The Bowl At My Face Because I Refused To Pour Wine For My Sister. CH2

At Family Dinner, My Mom Threw The Bowl At My Face Because I Refused To Pour Wine For My Sister…

My Husband Danced With His Mistress at Our Wedding Anniversary, by Morning, He Was Homeless. CH2

My Husband Danced With His Mistress at Our Wedding Anniversary, by Morning, He Was Homeless Part One My name…

During the latest taping of The Five, the audience got a hilarious surprise when the atmosphere suddenly grew tense over something seemingly trivial.

During the latest taping of The Five, the audience got a hilarious surprise when the atmosphere suddenly grew tense over…

End of content

No more pages to load