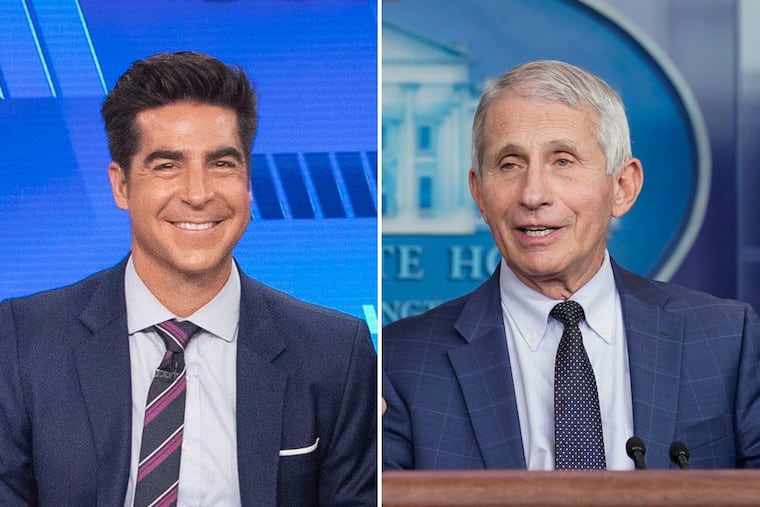

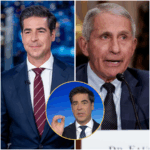

“We’re Taking Over!” — Jesse Watters Leads Fox News’ Multi-Billion Dollar Blitz Against CBS, ABC, and NBC

A Shockwave Through the Media Establishment

It was the kind of headline that sent shivers down the marble halls of New York’s broadcast empires and rippled into the glass towers of Silicon Valley: Fox News is no longer content with being the top cable news network — it wants to control the future of TV advertising itself.

In a move being called “a corporate blitzkrieg” by one ABC ad strategist, Fox is mounting a multi-billion-dollar campaign to wrest advertising dominance from CBS, ABC, and NBC — the so-called “Big Three” that have dictated television’s ad economy for decades. And at the center of it all is a man more often associated with primetime monologues than corporate power plays: Jesse Watters.

The Rise of Watters: From Street Interviews to Media Power Broker

Watters’ career arc is as unconventional as it is meteoric. Starting as Bill O’Reilly’s “ambush interview” guy on The O’Reilly Factor, he transformed into a ratings juggernaut with Jesse Watters Primetime and The Five. His signature mix of confidence, combative humor, and audience rapport didn’t just win viewers — it earned him trust inside Fox’s boardrooms.

Now, insiders say, Watters isn’t just a face on screen; he’s the architect of the network’s advertising offensive. He’s been in the room with CEOs of global brands, making the pitch that Fox is the place to invest — not just for politics-driven engagement, but for mass-market reach that crosses from TV into the fastest-growing digital spaces.

One Fox executive told me:

“Jesse is young, brash, and delivers numbers. Advertisers listen when he talks — and they remember.”

Breaking the Big Three’s Grip

For half a century, CBS, ABC, and NBC controlled prime-time ad spending like an oligopoly. Ad rates for their marquee shows set the market, and everyone else — including cable news — lived in the margins.

Fox is blowing that model up. Using driven audience targeting, high-engagement personalities, and a viral social media strategy, they’re drawing brands that historically would have never shifted dollars away from broadcast titans.

The early wins are coming from advertisers chasing younger demos. Fox’s digital ecosystem — TikTok clips, YouTube channels, and OTT streaming — is now pulling more brand engagement in the 18-34 bracket than some of the legacy networks’ prime-time lineups.

Digital Front Lines: Where the Real War Is Being Fought

This is not just about TV spots during commercial breaks. Watters’ plan leans heavily into hybrid monetization:

Streaming tie-ins: Fox Nation originals bundled with ad buys.

Short-form dominance: vertical videos designed for TikTok, Instagram Reels, and YouTube Shorts.

Interactive campaigns: live polling, in-show social integration, and direct-response ads that convert instantly.

By doing so, Fox is positioning itself not just against CBS, NBC, and ABC — but against YouTube, Netflix, and even Meta for digital ad supremacy.

The Watters Method

Where network sales teams pitch brand safety and heritage, Watters pitches energy and influence. His meetings with advertisers aren’t lectures — they’re performances, much like his show.

An ad agency insider described one pitch session:

“He walked in with real-time engagement charts from his last segment, showed how it outperformed network entertainment programming, and then broke down exactly how that engagement converts to brand recall. It was like watching a quarterback call an audible that leads to a touchdown.”

Legacy Networks Under Pressure

NBC, CBS, and ABC aren’t standing still. Sources inside two of the three say there’s been a flurry of emergency strategy meetings. Some are eyeing partnerships with streamers. Others are re-tooling ad pricing to match Fox’s performance-based models.

But Fox’s momentum is creating a dangerous feedback loop for the Big Three:

Advertisers shift dollars to Fox.

Legacy networks lose the budget to innovate.

Innovation slows, pushing more advertisers away.

A Cultural and Commercial Power Play

This campaign isn’t purely financial — it’s cultural. Fox is selling advertisers not just an audience, but a tribe — loyal, active, and primed for engagement. Watters’ brand of personality-driven content ensures those viewers are not passive channel-surfers but participants.

In a fractured media world, that’s gold.

Will Fox Take It All?

If Fox can sustain its ad-revenue surge, it could permanently reorder the media hierarchy. CBS, ABC, and NBC would no longer be the gatekeepers of prime-time’s most valuable inventory.

And if Watters’ hybrid model succeeds, it could become the industry blueprint — merging old-school broadcast reach with the micro-targeting precision of digital platforms.

The Stakes

Billions in ad revenue up for grabs.

The survival strategies of legacy networks tested in real time.

The definition of “prime-time dominance” rewritten for the streaming age.

An NBC veteran put it bluntly:

“This is the biggest power shift in TV advertising in 30 years. If Fox wins, they don’t just take market share — they redefine the market.”

Bottom Line

Whether Fox’s blitz ends in total dominance or stalls against entrenched rivals, one thing is undeniable: Jesse Watters has moved from talking head to power player, from reading ad copy to re-writing the playbook.

If the Big Three can’t mount a counteroffensive fast, the phrase “prime-time network” might mean something entirely different in five years — and it could have a Fox logo next to it.

News

🔥WHEN LATE NIGHT’S TITANS COLLIDE — AN UNFORGETTABLE SHOWDOWN ON THE LATE SHOW! Late-night TV shook to its core as Jimmy Fallon, Seth Meyers, John Oliver, Jon Stewart, and Stephen Colbert came together in a moment no one saw coming. This wasn’t just a reunion — it was a full-blown spectacle of power, loyalty, and unspoken tension. Behind the laughter and scripted banter, whispers of off-camera rivalries, secret alliances, and high-stakes decisions rippled through the set. When the cameras rolled, the comedy titans delivered unity. But what really went on behind the scenes? Fans are already speculating about hidden disputes, political jabs, and messages only insiders caught. This is television history with a twist — a night that could change the late-night landscape forever… Full details and shocking behind-the-scenes revelations in the comments 👇

The Night Late Night United: How Five Rivals Turned the Ed Sullivan Theater Into a Cultural Earthquake An Assembly No…

💥 SHOCKING $5 MILLION PRECEDENT THREATENS TO DESTROY THE WNBA — Caitlin Clark Case Could Trigger a Legal Earthquake! A former player just secured a staggering $5 million settlement for discrimination — but the real bombshell? Legal experts now warn that Caitlin Clark’s evidence is even more explosive. Newly surfaced locker room testimony, shocking statistics, and hidden reports paint a picture of a league on the brink of a catastrophic lawsuit. Could this be the scandal that rocks the WNBA to its very core? Full details, damning evidence, and shocking revelations revealed in the comments 👇

Caitlin Clark, the WNBA, and the Civil Rights Time Bomb No One Wants to Talk About The Golden Rookie and…

🔥 EXPLOSIVE FOOTAGE LEAKED: Stephen A. Smith & Patrick Mahomes in Fiery Confrontation — Fans Left Stunned! New video just surfaced showing an unexpectedly intense showdown between sports titan Stephen A. Smith and NFL superstar Patrick Mahomes. What started as a routine discussion erupted into a heated clash that no one saw coming. Fans and analysts are scrambling to make sense of what was said, and social media is in meltdown. Could this footage change everything we thought we knew about Mahomes and Smith? The world is watching…

Patrick Mahomes vs. Stephen A. Smith: Inside the Volcanic Feud Rewriting the NFL’s GOAT Debate The clip that blew up…

💔SHOCKING TEARS ON GMA: Michael Strahan’s Devastating Canc3r Reveal Leaves Studio Shattered — Viewers Gasp in Horror! 😢 What was meant to be a regular broadcast turned into a heart-stopping, tear-filled moment as Michael Strahan made a revelation that no one saw coming. The GMA team visibly crumbled on live television, with emotions running raw and unfiltered. Fans at home were left choked, stunned, and desperate for answers — what exactly did Strahan disclose? How will this affect the beloved morning show? And why did the studio react in such an unprecedented way? This is more than a personal tragedy — it’s a broadcast no one will forget, and the fallout is only just beginning…

Michael Strahan’s Emotional Tribute to Deion Sanders After Courageous Cancer Battle A Friendship Forged in Football, Tested by Life In…

🚨BREAKING: ABC NEWS IN CHAOS — Anchor SUSPENDED After Karoline Leavitt Catches SHOCKING Off-Air Remark! “This Is Who Reports Your News” They thought the cameras were off. Karoline Leavitt knew better. In a jaw-dropping, behind-the-scenes moment now tearing across social media, Leavitt exposed an ABC News anchor saying something viewers were never meant to hear — a comment so shocking it has thrown the network into full-blown crisis mode. Within hours, the clip went viral. ABC had no choice but to pull the anchor from the air pending an “internal review”, while rival networks circle like predators smelling blood. Viewers are outraged, journalists are whispering behind closed doors, and the network’s credibility is under siege like never before. If you thought media scandals were messy before… this one could rewrite the rules of what’s acceptable on-air.

ChatGPT đã nói: When the Mask Slips: Karoline Leavitt, ABC News, and the Screenshot Heard Across America The Spark That…

🚨2 MINUTES AGO: FOX NEWS DECLARES TOTAL WAR ON CBS, NBC & ABC — JEANINE PIRRO LAUNCHES $5 BILLION MEDIA TAKEOVER! The media world is reeling. In a move that feels more like a blockbuster thriller than real life, Jeanine Pirro has unleashed an unprecedented assault on CBS, NBC, and ABC, backed by a staggering $5 billion war chest and the powerhouse presence of Tyrus. Sources whisper of secret strategies, shadow campaigns, and a relentless plan to topple the so-called “mainstream media” from within. Rival networks are reportedly in full-blown panic mode, scrambling to cover holes that no one even knew existed. What hidden truths is Pirro exploiting? Why now? And could this be the moment that reshapes television — forever? The full, shocking story behind this high-stakes media war is just beginning to surface…

Fox News’s Alleged $5 Billion “War” on CBS, NBC, and ABC — Power Grab, Political Theater, or Just Viral Fiction?…

End of content

No more pages to load