“Tesla has reportedly encountered a $1.4 billion gap between its capital expenditure and the valuation of related assets over the last six months of 2024. This discrepancy, highlighted in a report by Financial Times, comes as Tesla’s stock market valuation has plummeted from $1.7 trillion to under $800 billion. According to the report, Tesla’s cash flow statement reveals $6.3 billion spent on property and equipment purchases in the third and fourth quarters of 2024. However…

Tesla, the electric vehicle and clean energy giant, has reportedly encountered a significant $1.4 billion gap between its capital expenditure and the valuation of its related assets over the last six months of 2024. This discrepancy, highlighted by a recent report from the Financial Times, comes amid a dramatic decrease in Tesla’s market valuation, which has plummeted from a peak of $1.7 trillion to under $800 billion.

The Financial Gap

According to Tesla’s cash flow statements, the company spent approximately $6.3 billion on property and equipment purchases in the third and fourth quarters of 2024. However, its balance sheet reflects only a $4.9 billion increase in the gross value of property, plant, and equipment over the same period. This apparent $1.4 billion discrepancy has raised concerns and prompted questions about Tesla’s financial transparency and asset valuation practices.

Cash Reserves and Debt

Despite maintaining substantial cash reserves of $37 billion, Tesla opted to raise an additional $6 billion in new debt in 2024. The rationale behind this borrowing, despite the company’s considerable cash holdings, has sparked curiosity among investors and analysts.

Investment Ambitions

Tesla has ambitious plans to invest heavily in AI infrastructure, robotics, computing, and battery technology, with at least $11 billion earmarked for each of the coming years. The company views these investments as essential to its long-term growth and market competitiveness.

Investor Concerns

The disparity in capital expenditure reporting, combined with the significant market valuation drop, has created apprehension among investors. Analysts are questioning whether Tesla’s rapid expansion and aggressive investment strategy might be contributing to financial opacity or if there are other factors at play.

Conclusion

As Tesla navigates this complex financial landscape, stakeholders are keenly observing how the company addresses these concerns while pursuing its ambitious technological advancements. The resolution of this discrepancy and the outcomes of Tesla’s extensive investment strategy could significantly influence its financial stability and investor confidence moving forward.

News

The family was laughing upstairs while the guest read downstairs. They never knew their temporary guest was an ex-fire investigator who discovered a faulty wire that would have burned the house down, and she alone had the courage to cut the power.

They say marriage is the union of two people in love, but the truth is that, often, more than two…

The wealthy family didn’t know the temporary guest they mocked was secretly recording the abuse and neglect and used the evidence to have the home declared unfit, gaining full temporary guardianship over the property.

They say marriage is the union of two people in love, but the truth is that, often, more than two…

The “temporary guest” was ridiculed by the family. They didn’t know the guest was actually a lawyer who discovered the home was about to be seized due to the family’s neglect, and she bought the house herself just hours before the auction.

They say marriage is the union of two people in love, but the truth is that, often, more than two…

The Temporary Guest Who Became the True Guardian of the Home

They say marriage is the union of two people in love, but the truth is that, often, more than two…

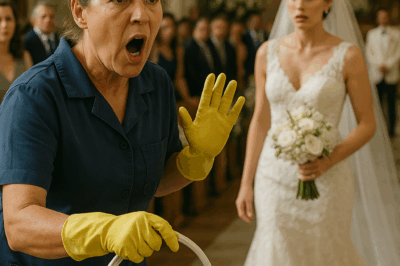

The Cleaning Lady Who Stopped a Wedding: The Day Truth Echoed Through the Church of Santa Clara

Introduction Some stories unfold quietly, hidden behind closed doors, whispered in shadows where no one is supposed to listen. But…

The cleaning lady stopped the wedding, silencing the entire church. She pointed at the groom and revealed she had just cleaned the apartment he shared with the other woman, who was currently pregnant with his child.

Introduction Some stories unfold quietly, hidden behind closed doors, whispered in shadows where no one is supposed to listen. But…

End of content

No more pages to load