The Day My Family Cut Me Off – And I Cut Them Off For Good

**Original Post:**

I’m Susanna, 32. For years, I’ve been the financial backbone of my family, ever since I landed my first consulting job. I quietly paid their bills, funded their dreams, and ignored the one-sided nature of our relationship. Then came that text message on a Tuesday morning. The words were cold and cutting: “We need space from you. Please don’t reach out anymore at all.” My fingers trembled as I read it, my throat tightening.

I grew up in a middle-class suburb of Chicago, in a house that looked perfect from the outside but was constantly teetering on financial collapse. From an early age, I showed a talent for numbers, organizing my allowance into neat categories while other kids blew theirs on candy. By 12, I understood our family budget better than my parents did.

My father, Paul, cycled through business ventures like seasons – a landscaping company that folded in winter, a restaurant supply store that couldn’t compete, a consulting firm with no clients. Each failure drained our savings, but never his optimism. “This one will be different, Susie Q,” he would say, ruffling my hair while I worried about the stack of bills on the kitchen counter.

My mother, Donna, compensated for our financial instability by pretending it didn’t exist. She bought name-brand everything, hosted dinner parties we couldn’t afford, and maintained memberships at clubs where she rubbed elbows with women whose husbands actually made the money mine pretended to. “Appearances matter,” she’d say, sliding another credit card bill into a drawer where she thought no one would find it.

Meanwhile, my three younger siblings lived in the bubble our parents created. James, two years younger, grew up believing money magically appeared. Amanda, four years my junior, inherited our mother’s taste for luxury. Tyler, the baby, at six years younger, grew up the most spoiled, his gaming addiction starting early with our parents buying whatever would keep him quiet.

I took a different path. At 16, I worked after school at the local grocery store. During college, I juggled three part-time jobs while maintaining a 3.9 GPA in finance. No spring break trips, no sorority, no typical college experience. Just work, study, and occasional calls from home when bills came due.

My first job after graduation at Anderson Financial Consulting changed everything. A starting salary of $70,000 felt like winning the lottery. Within a month, I paid off my student loans. Within two, I started helping at home. First, it was just catching up the mortgage when my parents fell three months behind. Then paying for James’s car insurance after his accident. Then funding Amanda’s influencer career startup costs. Then covering Tyler’s community college tuition, which he promptly wasted by dropping out. The pattern became clear, but I ignored it.

—

## The Financial Demands Escalated

Phone calls from family always started with small talk, but inevitably led to money. My mother’s tactics were the most sophisticated, building up to financial requests with subtle guilt trips. “Your father’s blood pressure is through the roof with these bills,” she’d say. Or, “We’re so proud of you making all that money in the big city. Remember where you came from, though?”

My father’s pride made direct asks impossible. Instead, he’d mention problems only money could solve. “The heating system is making that noise again. Probably nothing, but the repair guy wants $2,000 to look at it. Crazy world we live in.”

James never developed such subtlety. His calls were transactional and always urgent. “Sis, I’m in a bind. Need $1,500 by Friday or they’ll repossess the car. You know I’m good for it once this job interview pans out.”

Amanda’s requests came wrapped in promises of future fame. “Just $3,000 for this influencer marketing course and then the sponsorships will roll in. I’ll pay you back double.”

Tyler rarely called at all, preferring to have our parents make his requests. When he did reach out, it was usually late at night. “My rent’s due tomorrow. Landlord’s being a jerk about it. Can you transfer $2,000? I’ll get a job next month. Promise?”

The only voice of reason was Uncle Rick, my father’s older brother. He saw through the charade and pulled me aside at Thanksgiving three years ago. “They’re using you, Susanna,” he said, his voice low. “You know that, right?” I nodded but defended them anyway. “They’re family. They’d do the same for me.” Uncle Rick’s eyebrows rose. “Would they, though? When’s the last time any of them asked about your life without wanting something?” I couldn’t answer. That silence spoke volumes.

Still, I continued the pattern. My apartment remained small and functional while I paid for my parents’ roof repairs. My car was practical and aging while I made James’s luxury car payments. My vacations were weekends in nearby states while I funded Amanda’s Instagram-worthy trips to Bali and Greece. Deep down, I knew Uncle Rick was right. But admitting it meant facing a painful truth: perhaps my family’s love was conditional, based on what I could provide.

Last year, the financial demands intensified, becoming near-weekly emergencies. In February, James called me at work, panicked. “They’re taking my car, Susanna, right now! There’s a guy with a tow truck outside!” I could hear the rumble of a diesel engine. “James, we talked about this. You promised to make the payments.” “I know, but that job fell through and then I had some unexpected expenses.” Those expenses, I later discovered, included a weekend in Vegas. Nevertheless, I transferred $4,000. Two days later, James posted photos of himself with a new gaming system.

March brought Amanda’s latest business venture: beauty products. “It’s only $10,000 to become a distributor,” she explained over lunch. “The products sell themselves!” I recognized the pyramid scheme immediately, but Amanda wouldn’t hear it. “You just don’t believe in me,” she accused, tears welling in her expertly made-up eyes. I gave her $5,000, half of what she asked for. She took it without thanks and didn’t speak to me for three weeks.

April was Tyler’s gaming equipment emergency. His computer couldn’t handle the latest releases, and he needed $3,000 for upgrades. When I suggested he get a job, my mother intervened. “He’s going through a tough time right now. This gaming thing could become a career.” My observation that successful streamers worked incredibly hard was met with frosty silence, followed by my father calling to express disappointment in my lack of support.

May brought home repairs. $6,000 for a leaking roof became $10, then $15, then $20,000. Each time, I received calls about “unexpected issues.” During a visit home in June, I noticed my mother had a new living room set and my father was sporting an expensive watch. “We’re not children, Susanna,” my mother became defensive when I asked. “We don’t need to justify every penny to you.”

That Sunday, I offered to help everyone create financial plans. “I’m happy to help, but I think we need a long-term solution.” The temperature in the room dropped 10 degrees. “Are you saying you won’t help us anymore?” my mother finally asked. “Not at all,” I backpedaled. “I just thought it might be good for everyone to have more control over their finances.” “We’re doing just fine,” my father said, firmly ending the discussion.

Later, I overheard Amanda and my mother in the pantry. “She’s becoming so controlling,” Amanda whispered. “It’s like because she has money, she thinks she can tell us all what to do.” “She’s always been that way,” my mother replied. “Miss Perfect with her budgets and her savings accounts. She doesn’t understand that not everyone thinks about money all the time like she does.” I stood frozen, their words cutting deeper than they could know.

—

## The Ultimate Betrayal

The true breaking point came in December. I received a call from a collection agency about a loan in default—one I had never taken out. My parents had applied for a $30,000 loan six months earlier, using my information as a guarantor without my knowledge or consent. They had made no payments on it.

When confronted, they acted as though it was a simple misunderstanding. “We thought you knew,” my father said dismissively. “We mentioned needing a loan for the house repairs and you said you’d help. This was just easier than transferring money back and forth.”

“You forged my signature!” I said, my voice shaking. “That’s fraud!”

“Don’t be so dramatic,” my mother interjected. “We’re family. It’s not like we’re strangers using your information.”

That night, I lay awake. A lifetime of patterns suddenly crystal clear. The collection call wasn’t a mistake; it was the inevitable escalation of years of financial exploitation disguised as family need.

The text arrived at 9:17 on a Tuesday morning. I was in my office when my phone buzzed with a notification from our family group chat. “We need space from you. Please don’t reach out anymore at all.” The message came from my mother’s number, but was clearly meant to represent the entire family. No emojis, no explanation. Just 13 words that effectively excommunicated me.

I stared at my phone, certain I had misread it. My hands began to shake. “Susanna, are you okay?” My assistant, Marissa, stood in my doorway. “You look like you’ve seen a ghost.”

“I’m fine,” I managed, though my voice sounded distant. “Just need a minute.”

When she left, I called my mother immediately. Voicemail. My father. Voicemail. James. Voicemail. Amanda. Voicemail. Tyler didn’t even have voicemail set up. It was a complete communication blackout. My heart raced, my palms sweated. Was this about the loan confrontation?

Finally, I called Uncle Rick. He answered on the second ring. “Susanna,” he said, his voice gentle but troubled. “I was about to call you.”

“What’s going on? I just got a text telling me not to contact anyone in the family and now no one will answer their phones.”

A heavy sigh came through the line. “I’m at your parents’ house right now. There was a family meeting last night that neither of us was invited to.”

“A family meeting about what?”

“About you, primarily,” Uncle Rick’s voice was apologetic. “After you confronted them about the loan, they’re claiming you’ve become too controlling about money, that you’re using financial support to manipulate everyone.”

“That’s insane! They committed fraud using my information and I’m the one manipulating them?”

“I know, I know,” Uncle Rick soothed. “It’s completely backwards, but they’ve convinced themselves you’ve changed. That success has made you look down on them. Your mother was particularly upset about you offering financial counseling.”

“But the loan?”

“They’re minimizing that completely, calling it a misunderstanding that you’re blowing out of proportion to punish them.” I sank into my chair. “So this text, this cutting me off completely… that’s their response?”

“It’s worse than that,” Uncle Rick admitted. “They’re planning to ride out this arrangement until, and I quote, ‘She realizes what she’s lost and apologizes.’ They seem to believe you need them more than they need you.”

I closed my eyes. “Do they realize I’ve given them over $175,000 in the past five years?” I asked, the number having recently crystallized during a depressing review of my finances. Uncle Rick’s whistle was low and long. “I knew it was a lot, but not that much. And no, I don’t think they conceptualize it that way.”

—

## Taking Back My Life

After hanging up with Uncle Rick, I canceled my meetings, claiming illness. It wasn’t far from the truth. I felt physically sick. Back in my apartment, I scrolled through old family photos, searching for clues. In each photo, I searched their faces for genuine affection. The evidence was thin at best. Around midnight, I found myself sobbing on my kitchen floor. The ultimate betrayal wasn’t the loan or the text, but the realization that perhaps I had never been loved for myself, only for what I could provide.

The next morning, I arrived at work, puffy and disoriented. I broke down in the women’s restroom. Lisa, a coworker, found me there. “Susanna, can I help?”

I told her everything. “What you’re describing isn’t normal family support. It’s financial abuse,” Lisa said.

The term hit me like cold water. “Abuse seems extreme. They’re not bad people.”

“They just take advantage of your generosity, manipulate your emotions to extract money, cut you off when you set a reasonable boundary.” Lisa shook her head firmly. “If this was a romantic partner treating you this way, would you hesitate to call it abuse?” She had a point.

Lisa gave me the number for Dr. Taylor, a therapist specializing in financial abuse. In her warm, minimalist office, I recounted the same story. “Do you have documentation of how much you’ve provided?” Dr. Taylor asked. I nodded. “Would you be willing to calculate the exact amount before our next session?”

That evening, I pulled out bank statements and spreadsheets. Since graduating college eight years ago, I had given my family $178,642. Nearly all of it labeled as loans that were never repaid. But the accounting exercise revealed something even more disturbing. I pulled up my current credit report and discovered three credit cards I didn’t recognize. My parents and James had opened cards in my name, totaling over $22,000. I dug deeper, finding two cell phone plans for Tyler and Amanda, a furniture store credit line, a lease agreement for James’s apartment that listed me as a co-responsible party. By dawn, I had uncovered over $45,000 in fraudulent debt and financial obligations. This wasn’t just a single loan. This was systematic identity theft perpetrated by my own family.

I called Uncle Rick. “They’re still using my information,” I said, my voice eerily calm. “Credit cards, phone plans, lease agreements, all without my knowledge.”

“I had no idea it went that far,” he said. “I knew about the loan, but not the rest.”

“Did you know they had a family meeting to plan their next financial requests before I confronted them about the loan? Were they already planning what else they could get from me, even while using my identity to secure other funds?” Uncle Rick’s hesitation told me everything. “James mentioned something about you helping with a business venture. And your parents were talking about a timeshare opportunity.”

A strange laugh escaped me. “They were planning to cut me off if I didn’t agree, weren’t they? This whole ‘space’ thing was already their backup plan.”

“I think so,” Uncle Rick admitted. “When you confronted them about the loan, they just accelerated the timeline.”

As the sun rose on a new day, something crystallized within me. This wasn’t love. This wasn’t family. This was exploitation, pure and simple. And with that clarity came a resolve I had never felt before. “I need to protect myself,” I said.

My first call that morning wasn’t to my family, but to Diane Harrison, my financial advisor. She helped me create a comprehensive plan to disentangle my finances. First priority: stopping all automatic payments and transfers. Next, I called Robert Jensen, an attorney specializing in identity theft. “What your family has done constitutes criminal fraud,” he explained. “You have every right to pursue charges.” The thought of my family facing criminal charges made my stomach turn, but I agreed to secure my identity first.

By evening, I had: 1) canceled all automatic transfers to family. 2) Frozen my credit at all three major bureaus. 3) Reported fraudulent accounts and begun dispute processes. 4) Changed all passwords and security questions. 5) Documented all unauthorized accounts. 6) Set up fraud alerts. 7) Drafted cease and desist letters.

As I worked, my phone remained silent. No calls or texts from family members wondering why their financial lifelines had suddenly been cut. The silence confirmed what I already knew: they were waiting for me to crack. Around 8 p.m., I finally crafted my response to the family text. I considered lengthy explanations, emotional appeals, and detailed accountings. In the end, I opted for simplicity: “Of course. I’ll cancel my direct deposits first thing.” I hit send and felt a weight lift from my shoulders. Seven words that reclaimed my power.

Within minutes, my phone exploded with notifications. My mother called three times. My father texted asking what I meant. James sent a string of messages about a misunderstanding. Amanda wanted to know if I was seriously being this petty. Tyler sent a single text: “What about my phone bill?” I silenced my phone and poured myself a glass of wine, savoring the quiet satisfaction.

When I checked my messages an hour later, Uncle Rick had sent a single text that made me smile: “Proud of you. They’re panicking.” I called him back. “Are you still at their house?”

“I was,” he said, a note of amusement in his voice. “But I left after your text landed. You should have seen their faces, Susanna. Your mother read it aloud and went white as a sheet. Your father started immediately calculating which bills would bounce first.”

“Good,” I said, surprised at how little guilt I felt. “They needed a reality check.”

“That’s putting it mildly. Your mother tried to convince me to tell you that family comes first. I laughed without humor. The irony is apparently lost on her completely. When I pointed out that they were the ones who cut you off first, she said that was ‘different’ and they just needed a ‘break from your financial controlling behavior.’ When I asked how your behavior was controlling, but their expectations weren’t, she asked me to leave.”

“You didn’t have to do that, Uncle Rick.”

“Yes, I did. I packed up my overnight bag and told them I couldn’t support how they were treating you. It was long overdue.” His solidarity brought tears to my eyes. “Susanna, be prepared. This is just the beginning of their reaction. Once they realize you’re serious, things will escalate.”

He was right. Within two hours, the messages shifted from confusion to anger. My father sent a lengthy text about family loyalty. My mother left a tearful voicemail claiming they had only asked for space from my “negativity,” not for financial support to end. James began alternating between threats and pleas. Amanda posted a vague social media message about “toxic family members who only care about money.” Through it all, I maintained my silence.

That night, I slept better than I had in years, waking to dozens more missed calls and messages. Among them was a text from Uncle Rick: “They’re planning to show up at your apartment tonight. Fair warning.”

—

## Confrontation and Consequences

I spent the day preparing, not by crafting arguments, but by centering myself. I cleaned my apartment, bought fresh flowers, ordered my favorite takeout. When the doorbell rang at 7:30 that evening, I was ready.

By midnight, my family was in complete crisis mode. The confrontation at my apartment door had not gone as they expected. My mother arrived first, armed with tears and guilt, followed by my father and James. Amanda and Tyler joined via speakerphone. I allowed them into my living room but set immediate boundaries. “I’ll listen to what you have to say, but I won’t be changing my mind about the financial support.”

My mother’s tears dried up remarkably quickly. “This is about the loan, isn’t it? We were going to pay you back.”

“This is about eight years of one-way financial support, unauthorized accounts in my name, and a family dynamic that values me only for what I can provide,” I replied calmly.

My father tried a different approach. “We raised you, put food on the table, kept a roof over your head. That’s what families do for each other.”

“Yes, parents are supposed to provide for their children. That’s the commitment you made when you had me. I never made a commitment to support four adults indefinitely.”

James paced the room. “So, you’re just cutting us off completely? What about my lease? What about the car payment due next week?”

“Those are your responsibilities, James. You’re 30 years old. It’s time you learn to support yourself.”

The conversation devolved, cycling through every emotional manipulation tactic. My mother brought up childhood illnesses. My father mentioned college application essays. James reminded me of times he had picked me up from work, conveniently forgetting I had paid for those repairs. Amanda, via speakerphone, said, “I thought you believed in me and my dreams. Was that all lies?”

“I do believe you’re capable of achieving your dreams, Amanda, but not while someone else funds your life. Real success comes from building something yourself.”

Tyler finally spoke up. “What am I supposed to do about my phone? It’s going to get shut off.”

“Get a job, Tyler. Like everyone else in the world.”

The back and forth lasted hours. My father suggested they could take legal action. My mother hinted she would tell extended family I had abandoned them. James bluntly stated he would default on the lease that fraudulently listed me as a co-signer. Through it all, I maintained my position. When they finally left, around 11:30, having secured no commitments from me, the true panic began.

Uncle Rick called around 1:00 in the morning. “They just had an emergency family meeting.” “At this hour?” I was still awake. “Your father is realizing the mortgage payment is due in three days with no way to cover it. Your mother is worried about the minimum payments on those store credit cards. James discovered his car insurance lapsed.” I felt a twinge of worry, quickly suppressed. “Those aren’t my problems anymore.”

The next few days brought financial reality crashing down. Amanda’s Instagram, once filled with brunches and tropical vacations, suddenly featured posts about “simple pleasures.” James, facing actual job hunting, discovered his resume gaps made it challenging. Tyler’s gaming streams abruptly ended when his high-speed internet was disconnected. My parents’ mortgage grace period ended, and credit card minimum payments were missed. The facade of middle-class stability began crumbling.

A week after my financial separation, my mother showed up at my apartment again, alone. Her appearance had changed dramatically. “Susanna, we’re really struggling,” she began, her voice lacking its usual theatrical quality. “The mortgage is past due. James might lose his apartment.”

“I understand this is difficult,” I said evenly. “But these are natural consequences of financial decisions you’ve all made over many years.”

“We’re family,” she said, as if those two words explained everything.

“Family doesn’t commit fraud against each other. Family doesn’t value money over relationship. Family doesn’t cut someone off for setting reasonable boundaries.” Her expression hardened. “So this is punishment. You’re teaching us a lesson.”

“No, Mom. I’m simply allowing you all to experience the reality most adults live with: financial responsibility for their own lives.” She left shortly after, but something had shifted. The desperate panic was evolving into reluctant acceptance.

My father called the next day, his approach more aggressive. “Your mother is devastated. Is that what you wanted? To hurt her?”

“What I wanted was a healthy relationship with my family that wasn’t based on financial exploitation,” I replied, keeping my voice calm.

“Nobody exploited you. We asked for help and you gave it. Nobody forced you.”

“Did I consent to the credit cards opened in my name? The loan using my information as guarantor? The cell phone plans? The lease agreement?” His momentary silence acknowledged what he wouldn’t say aloud. “We were desperate.” “And now you’re experiencing the consequences of that desperation without using me as a safety net. That’s all.”

—

## A New Life

The first week without contact became two, then a month. I channeled my energy into healing, meeting with Dr. Taylor. My family’s attempts to manipulate me back into the financial supporter role failed repeatedly. They were forced to find other solutions.

Uncle Rick reported that James had finally taken a job at a local warehouse. Amanda had begun working as a receptionist. Tyler had taken a retail position and enrolled in community college classes. My parents had downsized, selling their house and moving to an apartment. My father had taken a sales associate position, and my mother had started selling craft projects online. None of these changes came easily or without resentment. I was still cast as the villain in their narrative, but beneath the resentment, grudging respect was growing.

Three months after the cutoff, I had begun building a new social circle. Lisa from work became a close friend, introducing me to her book club. I joined a hiking group. I even began dating again. Michael, a landscape architect, showed me what a balanced relationship could look like.

Five months after the cutoff, I received my first direct communication from a family member other than Uncle Rick. My mother sent a text: “The credit counselor has been helpful. Thank you for suggesting financial planning back then, even though we weren’t ready to hear it.” It wasn’t an apology, but it was an acknowledgment. I responded, “I’m glad it’s helping.”

Six months to the day after receiving that devastating group text, another message arrived from my mother. This one longer and more reflective: “I’ve been doing a lot of thinking about our relationship. I realize now that we came to depend on you in ways that weren’t fair or healthy. I can’t speak for everyone, but I want you to know that I miss you. Not your financial help, but you, my daughter. If you’re ever open to talking, I would like that. On your terms.”

This message brought tears to my eyes, not from pain, but from the recognition that perhaps healing was possible. After discussing it with Dr. Taylor, I crafted a careful response setting clear conditions: 1) Acknowledgment of the financial exploitation. 2) Concrete steps to address the fraudulent accounts. 3) Commitment to financial independence. 4) Respect for my boundaries. To my surprise, my mother agreed.

Two weeks later, we met for coffee. It was awkward, tense, but also contained glimmers of a potential new relationship. Similar tentative reconnections began with other family members. These weren’t fairy-tale reconciliations. Years of unhealthy patterns couldn’t be undone in months. But they were steps towards something more balanced, more authentic, and ultimately more loving than what had existed before.

The most profound change, however, was within myself. I had discovered a strength I never knew I possessed. I had learned that true generosity comes from choice, not obligation. And most importantly, I had discovered that family who truly loves you wants your well-being, not just your wallet. The journey from financial enabler to empowered individual had been painful, but the freedom on the other side was worth every difficult moment. I now understood that sometimes the greatest love you can show family is allowing them to stand on their own. And the greatest love you can show yourself is believing you deserve better than exploitation disguised as love.

News

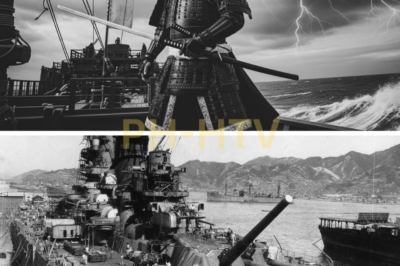

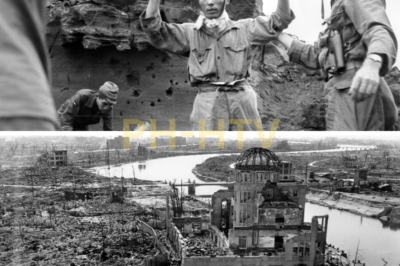

ch2-ha-When the World’s Largest Battleship Went Down: Yamato’s Final Hours

When the World’s Largest Battleship Went Down: Yamato’s Final Hours April 7th, 1945. The East China Sea. The sky was…

ch2-ha-The Sinking of IJN Musashi — How Airpower Crushed the World’s Largest Battleship –

The Sinking of IJN Musashi — How Airpower Crushed the World’s Largest Battleship – October 24th, 1944. The Sibuan Sea…

ch2-ha-How the F6F Hellcat Shocked Japanese Pilots with Lethal Superiority in WWII

How the F6F Hellcat Shocked Japanese Pilots with Lethal Superiority in WWII In the pre-dawn blackness of June 19th, 1944,…

ch2-ha-The Fatal Elevator Jam That Turned Taiho Into a 30,000-Ton Gas Bomb

The Fatal Elevator Jam That Turned Taiho Into a 30,000-Ton Gas Bomb 1430 hours, June 19th, 1944. Deep inside the…

ch2-ha-The Weapon Japan Refused to Build — That Won America the Pacific

The Weapon Japan Refused to Build — That Won America the Pacific The Pacific was an ocean of paradoxes. Japan…

ch2-EVERYONE SAID HIS LOADING METHOD WAS BACKWARDS — BUT ONCE THE SHERMAN FACED FOUR PANZERS, IT CHANGED THE ENTIRE BATTLE.

They Mocked His “Backwards” Loading Method — Until His Sherman Destroyed 4 Panzers in 6 Minutes At 11:23 a.m. on…

End of content

No more pages to load