The Tax Tango: Trump’s Tariff Tightrope and the Republican Dilemma

The political landscape is a battlefield, and the weapons of choice are often taxes, tariffs, and trade deals. In a recent discussion, two Republican pundits found themselves grappling with a particularly thorny issue: President Trump’s unexpected consideration of raising taxes on the wealthiest Americans. The mere suggestion sent ripples of unease through the GOP, traditionally staunch defenders against any form of income tax increase.

A Republican Identity Crisis?

The core DNA of the Republican party, as one pundit put it, is an unwavering opposition to raising income taxes. For generations, the GOP has championed the idea that lower taxes incentivize economic growth and benefit everyone. This stance was famously encapsulated in President Reagan’s mantra: “Read my lips: No new taxes.” The prospect of Trump, a Republican president, even contemplating a tax hike for those earning over $2.5 million sent shockwaves through the party faithful. It felt like a betrayal of core principles, a potential schism in the ranks.

The Art of the Deal…or the Art of the Troll?

Some observers speculated that Trump’s tax proposal was nothing more than a strategic maneuver, a classic example of “the art of the deal.” By floating the idea, he could potentially disarm Democratic attacks and portray himself as a champion of fiscal responsibility. Others saw a more Machiavellian motive: a calculated attempt to troll his political opponents and sow discord within the Republican party. However, the implications of such a move could be far-reaching, potentially fracturing the fragile unity of the GOP and jeopardizing the passage of crucial legislation.

The Math Doesn’t Add Up: Tariffs and Trade Deals

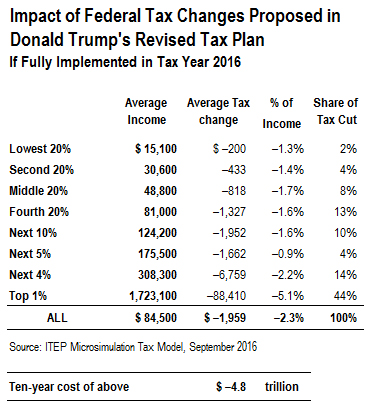

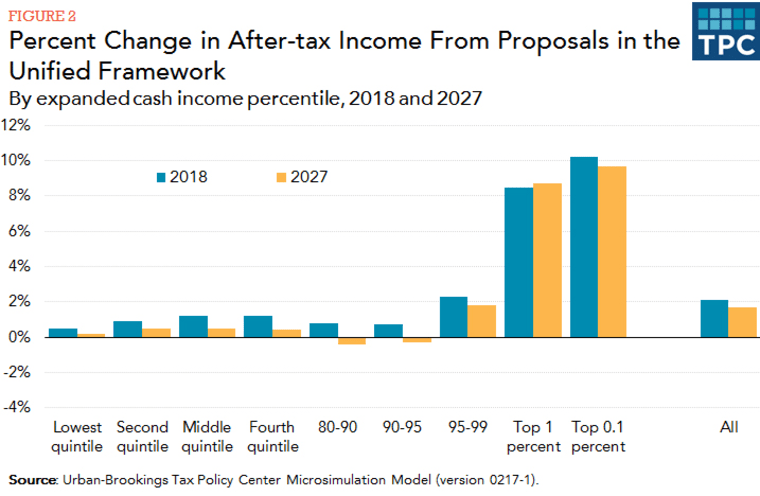

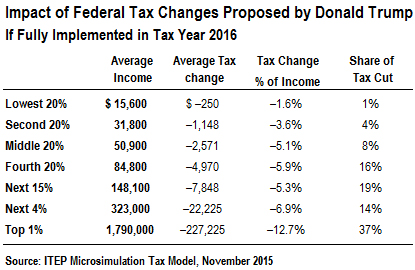

The discussion also delved into the complex relationship between tariffs, trade deals, and the federal budget. The Trump administration has consistently touted tariffs as a means of generating revenue and leveling the playing field for American workers. However, critics argue that tariffs are ultimately a regressive tax, disproportionately impacting low- and middle-income families. Moreover, the pursuit of trade deals, while potentially beneficial in the long run, could paradoxically reduce tariff revenue, further complicating the budget picture. The idea that tariffs are a sustainable solution to the nation’s financial woes is, according to some, “a little rich” considering the massive trillion-dollar deficit.

The Swamp Dwellers and the Crypto Grifters: A Conspiracy Theory?

The conversation took a darker turn with the introduction of a conspiracy theory: that Trump and his billionaire backers are intentionally engineering a recession to capitalize on distressed assets. The idea is that by deliberately destabilizing the economy, the wealthy elite could swoop in and acquire stocks, homes, and commercial buildings at fire-sale prices, further consolidating their wealth and power. While such a scenario might seem far-fetched, it reflects a deep-seated distrust of the political establishment and a growing sense of economic inequality. The presence of wealthy individuals at Trump’s inauguration and the influx of crypto money into his fundraising efforts only serve to fuel these suspicions.

The Heartland vs. Wall Street: A Divided America

At the heart of the debate lies a fundamental conflict between the interests of Wall Street and the needs of the American heartland. While Wall Street executives may be eager for trade deals that boost corporate profits, the average American family is more concerned about the rising cost of living and the erosion of economic security. The elimination of programs like USAID and the potential defunding of social safety nets like Section 8 raise serious questions about the administration’s commitment to supporting vulnerable populations. Are we “robbing Peter to pay Paul,” sacrificing the well-being of the many to benefit the few? The answer, it seems, depends on whom you ask.

The Price of “Winning”: Who Pays the Tariff Tax?

The ultimate question is who will bear the brunt of these economic policies? The pundit’s analysis suggests that everyday Americans are essentially paying for the “wins” of large corporations and wealthy landowners. The 10% tariff on imported goods acts as a baseline tax increase, impacting consumers across the board. While beef cattle owners may be celebrating new export opportunities, the average family is grappling with higher prices at the grocery store. It’s a classic case of trickle-down economics, but with a twist: the benefits flow upward, while the costs are borne by those least able to afford them.

News

EXCLUSIVE, THIS JUST HAPPENED: Ana Navarro HUMILIATES MAGA Pundits After Their INSULTING Remarks on Racism – Accuses Them of Belittling People of Color LIVE! In a jaw-dropping on-air moment, Ana Navarro completely dismantled MAGA pundits after they made shocking, belittling remarks about racism, claiming it doesn’t exist. The fiery exchange left the pundits speechless as Navarro called out their blatant disregard for the struggles faced by people of color, exposing their ignorance live on air. The explosive confrontation has ignited a firestorm, with viewers stunned by the audacity of the MAGA pundits’ comments. How will this impact their credibility and the broader political discourse? The fallout from this intense clash is already making waves

Biden’s Election Post-Mortem: A Minefield of Race, Loyalty, and What-Ifs The post-election autopsy continues, and former Vice President Joe Biden’s…

EXCLUSIVE, THIS JUST HAPPENED: Scott Jennings Gets a VERBAL BEATDOWN That Leaves Him Stunned and on Repeat – The Shocking Moment You Won’t Believe! In a fiery live TV exchange, Scott Jennings was completely obliterated during a heated debate, with his opponent delivering a brutal verbal beatdown that left him scrambling for words. The intensity of the moment had Jennings stuck on repeat, struggling to respond as his argument was shattered. What was said that left him speechless and unable to recover? The dramatic fallout from this unforgettable on-air clash will leave you in shock

The Murky Waters of Trump’s Trade Rhetoric: A Deal or No Deal Charade? The discourse surrounding international trade, particularly under…

EXCLUSIVE, THIS JUST HAPPENED: MAGA Pundit’s DISGUSTING Comment ERUPTS the Panel in Heated Debate – The Moment That Left Everyone Speechless! In a jaw-dropping live exchange, a MAGA pundit’s disgusting comment ignited a fiery debate that shattered the panel’s composure. The intense confrontation escalated quickly, with the pundit’s controversial words leaving everyone in the studio stunned. What exactly was said that caused such an explosive reaction, and how did the rest of the panel respond? The shocking details behind this heated moment will leave you questioning everything

The Specter of Deportation: A Nation Grappling with its Conscience The echoes of heated debate reverberate across the American landscape…

EXCLUSIVE, THIS JUST HAPPENED: Scott Jennings Gets VICIOUSLY SHAMED to His FACE in Heated Debate – The Moment That Left Him Speechless! In a fiery on-air clash, Scott Jennings was publicly shamed by his opponent during a heated debate, leaving him stunned and scrambling for a response. The intense exchange escalated quickly, with harsh words exchanged that completely caught Jennings off guard. What was said that led to this dramatic moment, and how did Jennings react to being humiliated live on air? The explosive details behind this confrontation will leave you speechless

The Shifting Sands of Justice: Retribution, Remembrance, and the Specter of Division A recent panel discussion has unearthed a troubling…

EXCLUSIVE, THIS JUST HAPPENED: Republican SHUTS DOWN Eric Swalwell – Plays SHOCKING Video That Makes Him RUIN His Pants LIVE on Air! In a jaw-dropping moment that stunned viewers, a Republican congressman completely shut down Eric Swalwell during a heated debate, playing a shocking video that left the Democratic representative visibly rattled. The intense moment took an unexpected turn as Swalwell’s reaction was so dramatic, it left him struggling to regain composure live on air. What was in the video that caused such a shocking response, and how will this public humiliation affect Swalwell’s political future? The fallout from this explosive exchange is already making waves across social media and the political world

The “Defund the Police” Debacle: A Political Reckoning? In a scathing critique that’s igniting political circles, Representative Andy Biggs has…

EXCLUSIVE, THIS JUST HAPPENED: This CNN Panel Gets DESTROYED by Scott Jennings – The Moment That Left Everyone Speechless! In a jaw-dropping on-air moment, Scott Jennings completely dismantled the CNN panel, one by one, leaving them scrambling to defend their points. What started as a typical debate turned into an intense confrontation as Jennings’ powerful rebuttals exposed flaws in every argument. The panel, visibly rattled, struggled to respond, leaving the studio in stunned silence. What did Jennings reveal that turned the tide so dramatically? The explosive details behind this unforgettable moment will leave you questioning everything

CNN Panel Left Stunned as Scott Jennings Dismantles Their Arguments CNN’s Political Panel was left reeling after an intense…

End of content

No more pages to load