Trump’s Tariff Scandal: Insider Conspiracy or Billionaire Power Play?

Wall Street wins. Main Street loses. Again.

It started with a tweet—but it may end with a congressional investigation that could rock the very foundations of American democracy.

When Donald Trump recently teased a new wave of tariffs on foreign imports, Wall Street panicked. Markets dipped. Investors scrambled. Then—just days later—he walked it back. Stocks soared again.

The result? A handful of well-connected insiders made a killing. And now, all eyes are on Trump.

Was this just another case of market-savvy Trumpism—or something far more sinister?

The Trump Tariff Time Bomb: Planned or Opportunistic?

On the surface, Trump’s tariff maneuver seemed like standard political theater. Talk tough. Shake the markets. Then ease off and claim victory.

But here’s where it gets murky: according to several watchdog groups and political insiders, the timing of the tariff flip-flop wasn’t just convenient—it may have been orchestrated. Multiple reports suggest a select few investors with close ties to Trump quietly positioned themselves to profit before the public even knew what was happening.

We’re talking about millions—maybe billions—in potential gains, raked in during a narrow window of market chaos that Trump himself triggered.

Was the System Rigged From the Start?

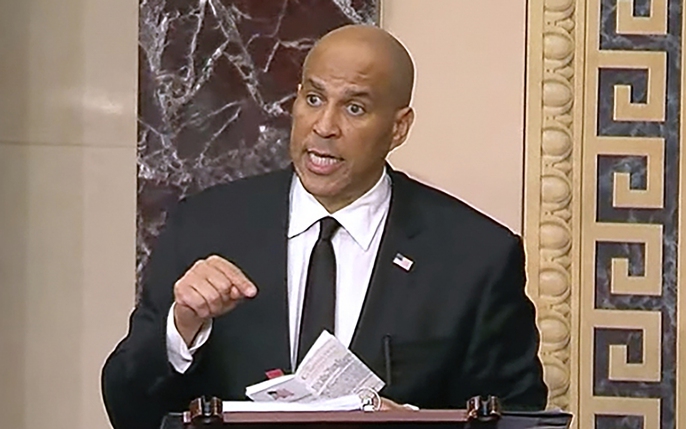

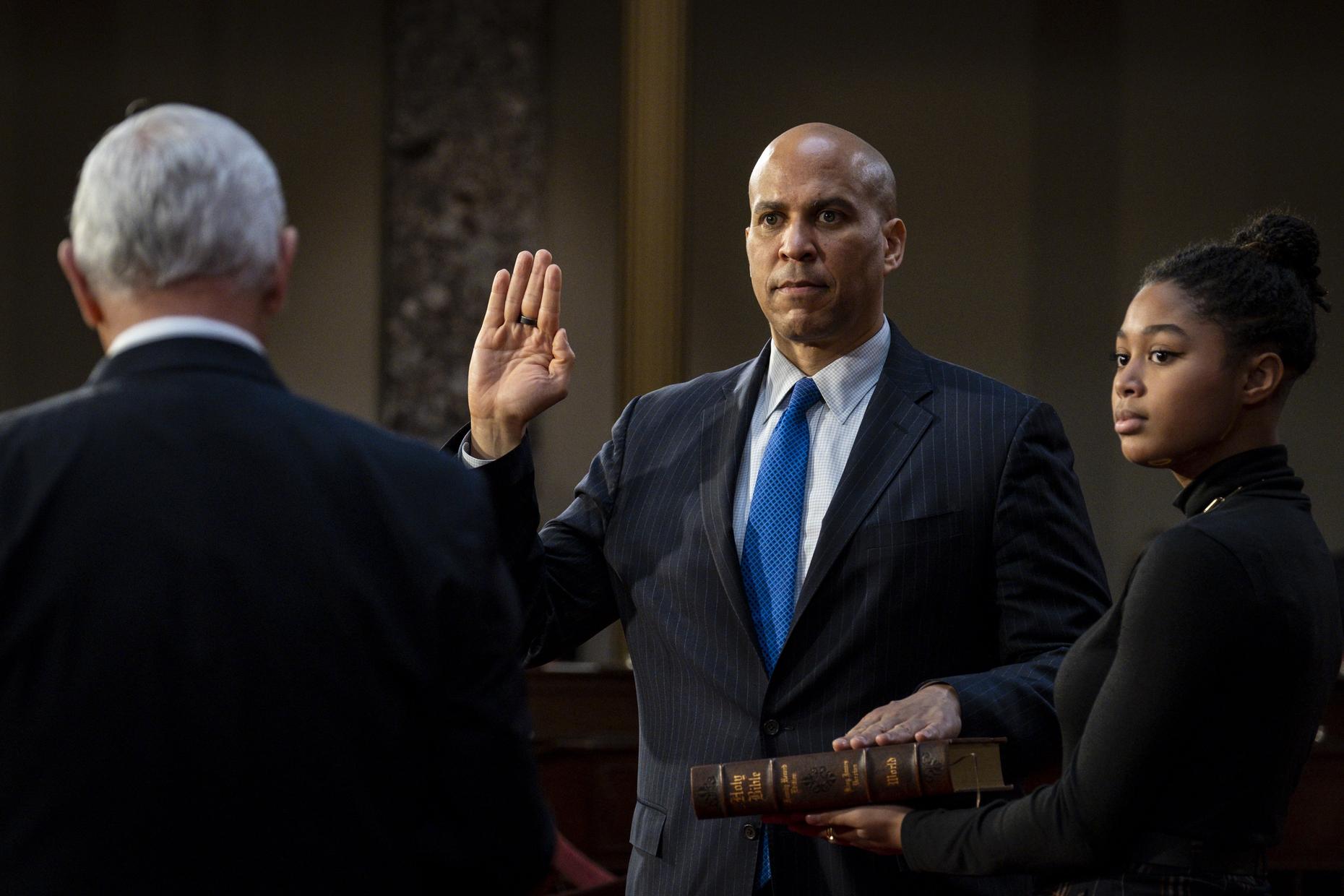

Senator Cory Booker didn’t mince words. In a blistering statement, he accused the former president of weaponizing the stock market for political and financial gain:

“This wasn’t leadership—it was manipulation,” Booker declared. “When the president plays God with the market and only his friends get the playbook, that’s not capitalism. That’s corruption.”

The implications are chilling. If true, it would mean that Trump not only influenced markets—but did so with a wink and nod to his inner circle, allowing them to buy low and sell high while everyday Americans watched their 401(k)s get whipped around like a ragdoll.

And here’s the kicker: Trump posted a cryptic “buy the dip” message on Truth Social right before the market reversed. Coincidence? Or coded signal?

The Anatomy of a Power Move

Let’s break down the sequence:

Monday: Trump warns of harsh new tariffs on Chinese steel and electronics.

Tuesday: Dow Jones plummets 800 points. Panic ensues.

Wednesday morning: A handful of mysterious high-volume trades flood in, targeting industries directly affected by the tariffs.

Wednesday night: Trump backtracks in an interview, calling the tariffs “negotiation leverage.”

Thursday: Markets rebound dramatically. Stocks tied to those early trades surge. Insiders profit.

And guess what? The identities behind some of those trades remain a mystery, shielded behind hedge funds and dark money.

Checks and Balances—Shattered?

This isn’t just about stocks and speculation. It’s about the breakdown of government integrity.

The Trump years were marked by a relentless erosion of institutional norms—career experts replaced by loyalists, watchdogs sidelined, agencies hollowed out. Now, critics argue, the very system meant to prevent corruption is no longer functional.

“Loyalty, not legality, was the standard,” said one former White House ethics advisor. “That’s how you get a government that serves itself, not the people.”

And Congress? Silent. Passive. Paralyzed by partisanship. Many Republicans either shrugged or outright defended Trump’s actions, calling them “strategic moves” or “market savvy.”

But where does savvy end and sabotage begin?

A Decade of Doubt: Trump’s Legacy of Questionable Deals

Let’s not forget—this isn’t Trump’s first brush with accusations of self-dealing:

The Emoluments Clause: Lawsuits alleged Trump profited off foreign diplomats staying at his hotels.

Classified Docs at Mar-a-Lago: Why were top-secret files sitting next to the pool bar?

Stock spikes during COVID briefings: Pharmaceuticals Trump touted often saw suspicious market surges immediately after press conferences.

These aren’t isolated incidents—they form a pattern. A pattern where personal gain and public policy blur until they’re indistinguishable.

And once again, it seems, Trump and his allies might have played the American people like pawns on a billion-dollar chessboard.

Inside the Smoke-Filled Room: Who Really Profited?

Sources now claim that several individuals with direct ties to Trump World—including former advisors, campaign donors, and even one ex-cabinet member—were among those who made large, strategic trades just before the tariffs were rolled back.

If that sounds familiar, it’s because it echoes the darkest chapters of American corruption—Enron, Watergate, the 2008 crash. But this time, the manipulation may have come straight from the Oval Office.

Insiders say a congressional investigation is being quietly discussed—but don’t hold your breath. With Republicans holding the line and Democrats lacking spine, true accountability may never arrive.

The Public Reacts: Outrage, Confusion, and Deepening Cynicism

As the story gains traction, social media has erupted in outrage. Hashtags like #TariffGate and #TrumpProfitsNow are trending.

One viral post read:

“Imagine if Obama did this. They’d already be holding impeachment hearings.”

Another added:

“Trump crashed the market so his friends could buy cheap. Then he ‘saved’ it and they cashed in. This isn’t America. It’s a crime scene.”

The American public is sick of being played. And whether you’re a Trump supporter or critic, the gut-punch is the same: trust in the system is eroding—fast.

So What Happens Now?

This scandal raises terrifying questions:

Is the presidency now a profit machine for those in power?

Is Congress truly powerless to stop insider abuse?

And if nothing changes, what message does that send to future presidents?

Trump, of course, denies any wrongdoing. His team calls it “fake news” and accuses the media of “weaponizing economics against a successful businessman.”

But the silence from financial regulators and congressional leaders is deafening.

The Bigger Picture: Democracy for Sale?

What we’re witnessing isn’t just a tariff snafu. It’s a stress test for the soul of American democracy.

When policy becomes a playbook for personal profit—when government officials turn into market manipulators—we’re no longer living in a democracy. We’re living in a kleptocracy with a red, white, and blue disguise.

If we don’t draw a line now, the next scheme will be bigger, bolder, and even harder to trace.

Conclusion: This Isn’t Over

Trump’s tariff flip-flop may have made a few insiders rich. But it’s left the country poorer—in trust, in integrity, and in belief that anyone is truly watching the watchers.

And if no one’s held accountable, the message to the next would-be power abuser is clear:

Cheat big. Lie louder. And if you’re lucky, America will look the other way.

News

🚨🔥 MSNBC MASSACRE: Karoline Leavitt’s SCORCHING Counterstrike HUMILIATES Jen Psaki After Smug Jab—Did a HIDDEN FEUD Spark This VIRAL Media MELTDOWN? In a heart-stopping MSNBC Q&A, Jen Psaki’s snarky swipe at Karoline Leavitt backfires in a spectacular fashion as Leavitt unleashes a blistering, unfiltered retort that leaves Psaki speechless and sends Facebook into an absolute frenzy! #LeavittVsPsaki explodes online, fueling a fiery debate: Was Psaki’s attack a reckless misstep, or a calculated move in a secret vendetta? Did Leavitt’s fearless comeback redefine political warfare, or expose a much darker, hidden media conspiracy?

MSNBC Meltdown: Jen Psaki Mocked Her Replacement — And Got Publicly Humiliated by Karoline Leavitt Subhead: A smug joke, a…

🚨💔 FOX NEWS HEARTBREAK UNRAVELED! Dana Perino & Jeanine Pirro’s SHOCKING Surprise Ambush on Kat Timpf IGNITES TEARS and a MYSTERIOUS Sisterhood SECRET! In a soul-crushing Fox News moment, Dana Perino and Jeanine Pirro burst into Kat Timpf’s world with an emotional surprise visit, unleashing a wave of raw emotion and a tear-soaked embrace that leaves fans sobbing nationwide! #TimpfSisterhood explodes across Facebook, with whispers of a hidden, darker truth behind their unbreakable bond fueling wild speculation. Was this a heartfelt act of love, or a calculated move concealing a sinister network agenda?

“She’s Back From the Shadows”—Kat Timpf’s Shocking Comeback Sparks Online Frenzy After Dana Perino and Judge Jeanine Pirro Crash Into…

LATE-NIGHT APOCALYPSE UNLEASHED: Karoline Leavitt’s BRUTAL AMBUSH DESTROYS Stephen Colbert—Her SHOCKING Exposé Triggers CHAOS and a CHILLING Blackout! In an electrifying Late Show moment, Karoline Leavitt takes the stage and transforms a seemingly playful interview into a fiery battlefield, obliterating Stephen Colbert with razor-sharp facts and a searing takedown of his “hypocritical spin.” The crowd goes silent, and producer chaos ensues, leading to a sudden blackout! #LeavittVsColbert ignites an online inferno, as fans and critics scramble to process: Was Leavitt’s explosive move a courageous stand against media corruption, or a well-orchestrated, Trump-backed plot to fuel a cultural war? Whispers of a dark conspiracy surrounding the blackout add fuel to the frenzy!

AMERICA UNFILTERED: THE NIGHT KAROLINE LEAVITT CRACKED COLBERT’S STAGE IN HALF!!! “If you want comedy, Steven, go ahead. But…

POLITICAL BETRAYAL EXPLODES! Marjorie Taylor Greene’s SHOCKING PUBLIC ATTACK DEVASTATES Karoline Leavitt—What DARK SECRET Fueled This EPIC Showdown? In a jaw-dropping clash that’s rocking the political world, Marjorie Taylor Greene turns on Karoline Leavitt with a vicious, blistering public attack that leaves the room in stunned silence and sends shockwaves through the media! #GreeneVsLeavitt ignites a massive Facebook firestorm, with fans divided: Was Greene’s brutal criticism a righteous betrayal, or a cold, calculated strike masking a sinister, hidden agenda? Whispers of a shocking rift between them threaten to unravel everything.

Marjorie Taylor Greene’s MAGA Meltdown: Has the Queen of Chaos Just Declared War on Trump? There’s blood in the water,…

FOX NEWS SHOCKER: Kat Timpf’s JOYOUS Baby Reveal After Cancer Triumph HIDES a CHILLING SECRET—What DARK FORCE Threatens Her Newfound Bliss? Kat Timpf’s heartwarming baby photo, shared with love by Tyrus and Greg Gutfeld, floods social media with joy and celebration—but lurking beneath the surface is a chilling whisper of a hidden struggle that casts a shadow over her victory. #TimpfBaby sparks a frenzy online, as fans are left torn: Is this a genuine moment of triumph, or a fragile mask hiding a devastating truth?

Kat Timpf Unleashes Baby Bombshell: America Meets ‘Lila Bean’ — and the Internet Explodes!!! In a media world soaked in…

Kat Timpf’s Defiant TV Comeback SHOCKS Fans: A Mother’s Unbreakable Spirit MASKS a Chilling Doubt Amid Her Battle with Cancer! 😚 Kat Timpf, a fierce mother who defied death’s grip in her battle with breast cancer, stuns the world by returning to Fox News mid-treatment, just as Greg Gutfeld launches his new show. Her superhuman strength leaves fans in awe, but a lingering fear grows: Can she truly balance motherhood, career, and survival without cracks showing? A chilling doubt haunts her triumphant comeback.

Now it is confirmed, Kat Timpf will star alongside Greg Gutfeld and Jamie Lissow in a new Fox News show…

End of content

No more pages to load